Originally published at: https://peakprosperity.com/weak-employment-and-housing-yet-a-massive-stock-market-advance-volatility-crush-what-gives/

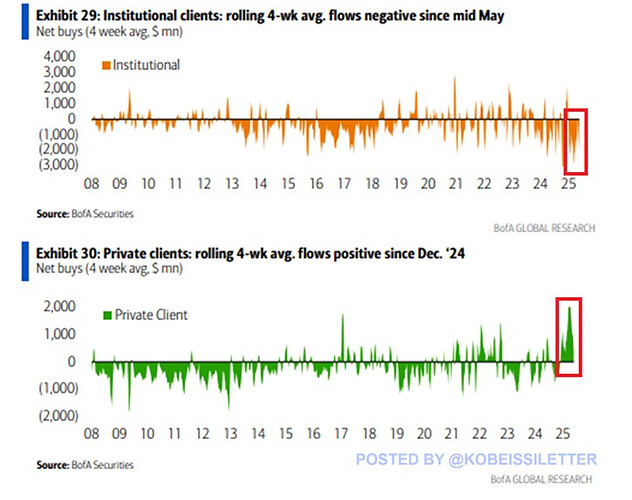

Paul Kiker (Kiker Wealth Management) and I kicked off this Finance U podcast by discussing the record-breaking smash of market volatility, which happened despite plenty of reasons to be uncertain about the economic direction. This volatility crush, the largest in history, seems at odds with the weakening job market, housing market, Trump tariff fickleness, and other mixed economic signals.

We talked about how the job numbers have been downgraded every month in 2025 (4/4) and have been revised downwards for 22 out of the past 28 months. Further, a massive discrepancy has opened up between the establishment survey and household survey data raising questions about what’s going on. Again, this should be a source of uncertainty, but markets have never been more certain as the volatility crush seemingly indicates.

But does it? Is it possible that the central banks are actively intervening in stock, bond and commodity markets? Well, the place where highly leveraged paper products on each of those markets are traded, the Chicago Mercantile Exchange or CME, has a Central Bank Preferred Buyer Incentive Program. This tells us that Central Banks are such heavy buyers and sellers of CME products that they get special high-volume pricing. On things like stock equity futures, gold & silver contracts, bond options, and even agricultural contracts.

(Source)

Now, why would foreign central banks need volume pricing on silver contracts when none of them report holding any silver on their books? Or ag contracts? And why is the GAO specifically forbidden from inquiring into any and all foreign transactions conducted between the US Federal Reserve and other central banks as well as the IMF? Is it possible the Fed has a point of view about what the “right” price is for stocks, bonds, corn, or silver and hides its market-moving actions through foreign cut-outs? These are the sorts of legitimate questions that arise with a lack of basic transparency and accountability.

The conversation then shifted to precious metals, where we noted the significant moves in silver and platinum, and how gold has now surpassed the Euro as a global reserve asset. This shift indicates a growing distrust in fiat currencies and a move towards tangible assets.

We also touched on the concerning trend of increasing consumer debt and delinquencies, particularly in credit cards and student loans, which are showing signs of stress. This, coupled with a stagnant or declining housing market in various regions, paints a picture of an economy at a potential turning point.

(Source)

Paul and I expressed our concerns about the market’s mispricing of risk, especially with the backdrop of high valuations and the possibility of a dollar devaluation. We discussed the implications of ongoing fiscal irresponsibility and the potential for a significant economic adjustment in the near future.

Lastly, we highlighted the importance of being agile in investment strategies, moving away from passive investing which might not serve investors well in the coming years. The discussion was a stark reminder of the need for investors to adapt to the changing economic environment, focusing on reality rather than narrative.

If you’re feeling the need to reassess your financial strategy in light of these insights, consider reaching out to Paul and his team at Peak Financial Investing. And remember, we’ll both be at the Peak Prosperity Summit in New Hampshire this September, where we can delve deeper into these topics. Until next time, stay informed and proactive with your investments.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.