Our debt-exhausted economic system has reached a point of terminal instability. This article provides a brief overview of the causal factors leading up to this condition. The article is followed by an in-depth video presentation featuring predictions and advice from a team of economic, financial and legal experts.When Richard Nixon closed the gold window in August 1971, fully severing the US dollar from its gold standard, the Federal Reserve and other world central banks found themselves liberated. No longer was their ability to provide liquidity constrained by the physical limitations of the gold supply.

The Fed started intervening more and more during times of slowing growth to goose the economy back to vigor. Cheered and further egged on by politicians happy for easy solutions and desperate to avoid having to make tough calls, central banks have been increasingly willing to provide liquidity in good times and bad.

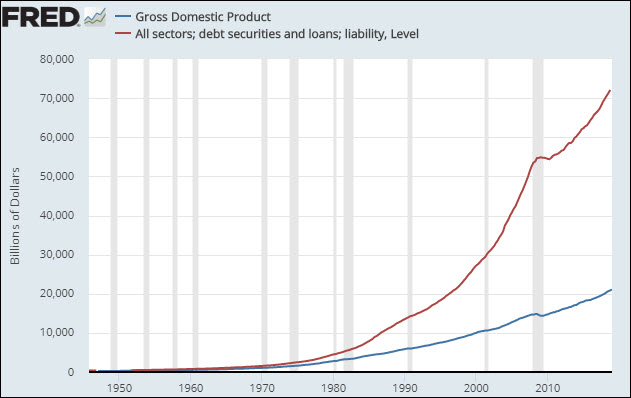

Akin to removing the limit on a teenager’s credit card, with access to so much cheap money, the US went on a debt bender. One that has lasted for nearly half a century:

<img class=“aligncenter” src=“https://peakprosperity.com/wp-content/uploads/2021/09/fredgraph-4.png” alt="“Federal Reserve Economic Data chart of total outstanding US debt” width=“1168” height=“470” />

Here we stand today with the national debt at over $22 trillion, total US debt outstanding of $70 trillion (shown in the above chart), and unfunded national liabilities of over $200 trillion. And we add to this every year with an annual deficit now exceeding $1 trillion.

This gigantic accretion of debt will never be repaid. And as the pile grows higher, the burden of servicing it – even at today’s historically low interest rates – is placing an increasingly heavy drag on economic growth.

An Economic Dead End

To date, the central banks have gotten away with their easy money policies because they could. The day of reckoning could always be pushed further out via a fresh round of liquidity. But, as Brien Lundin says in the video below, the reckoning is "no longer simply inevitable, it is imminent. We are reaching the End of the Road."The Fed and its central banking brethren are now hostage to rock-bottom interest rates. They can’t raise them, lest they asphyxiate the remaining shreds of GDP growth around the world. Especially now, when so much of the global economy is fast sliding into recession. Rate hikes at this point would simply crash the system.

So we can expect more unnatural and desperate measures from here. Fed rate cuts while the stock market is at all-time highs and employment at all-time lows? Sure. Negative interest rates on high yield (i.e. junk) bonds? It’s already happening in Europe.

But we shouldn’t expect these to work. The system has reached a point of debt exhaustion where each new $trillion stimulates much more weakly than the previous one, and causes the system to become exponentially more unstable.

Yet politically, there’s no appetite for anything other than “More liquidity!” to keep the status quo alive for as long as possible.

We’re already seeing the cracks appear. Gold, which serves as a mirror (or at least is supposed to when not intentionally suppressed) to reflect fiat currency devaluation, has decisively broken above its six-year ceiling price of $1,350/oz (trading as high as $1,450/oz last night).

Investment Advice For An Uncertain Future

Just this week, Ray Dalio issued a warning to the world about this impending crisis, advising investors that:"I think (investments) that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant."So what does all this mean? What repercussions can we expect as we arrive at the End of the Road? What prudent investments fit Dalio's criteria?

To address these important questions, Peak Prosperity partnered with Jefferson Financial and Benchmark Financial Services to assemble a team of economic, financial and legal experts to explain the unfolding situation and predict what to expect from here. The result is the 90-minute video presentation below.

Featured faculty for this video include Ted Siedle, national pension expert and recipient of the two largest-ever whistleblower settlements from the SEC and CFTC, Chris Martenson PhD, economic analyst and co-founder of PeakProsperity.com, and Brien Lundin, publisher of GoldNewsletter.com and producer of the world’s longest-running investment conference.

(Links to the resources mentioned in the video can be found here for New Harbor, Peak Prosperity, BenchmarkAlert.com, Gold Newsletter, and the New Orleans Investment Conference.)

This is a companion discussion topic for the original entry at https://peakprosperity.com/weve-arrived-at-the-end-of-the-road/

If the debts are claims, and they are, it's not terribly difficult to work out that they are only useful as claims on the output of GDP. Future money buys us future things. Goods and services. If there's one unit of future claims and one unit of future "stuff" then all is well.

But what happens when there are 10 future claims and only 1 (one) unit of stuff?

There's an imbalance to be sorted out simply via destruction of the claims. Whether that's by an inflationary outcome or a deflationary burn is the only open question.

But AI would be able to dispassionately conclude that one way or the other the claims were worthless today. They can be discounted today and one does not have to wait for some bonfire of the vanities to rage along and take your portfolio up in smoke at the same time as everyone else's.

I have another chart, I can't seem to locate right now (and I've got to head out in five minutes for a range session), which shows that if you subtract US federal deficit spending that US GDP would have been negative ever since 2010.

If or when the US government ever decides it cannot keep running larger and larger deficits, then GDP will contract.

(It's simple math that Steve Keen showed us a while back. A 3% deficit this year needs to be 3%+ something next year or else GDP will take a hit).

I think too that AI, or a mathematically competent grade-schooler, could easily work out that one cannot run larger and larger deficits forever. So there's a reckoning at some point, the difficulty being that moment comes with the largest ever pile of federal debt on the books, and a falling economy, which is a bad mix.

If the debts are claims, and they are, it's not terribly difficult to work out that they are only useful as claims on the output of GDP. Future money buys us future things. Goods and services. If there's one unit of future claims and one unit of future "stuff" then all is well.

But what happens when there are 10 future claims and only 1 (one) unit of stuff?

There's an imbalance to be sorted out simply via destruction of the claims. Whether that's by an inflationary outcome or a deflationary burn is the only open question.

But AI would be able to dispassionately conclude that one way or the other the claims were worthless today. They can be discounted today and one does not have to wait for some bonfire of the vanities to rage along and take your portfolio up in smoke at the same time as everyone else's.

I have another chart, I can't seem to locate right now (and I've got to head out in five minutes for a range session), which shows that if you subtract US federal deficit spending that US GDP would have been negative ever since 2010.

If or when the US government ever decides it cannot keep running larger and larger deficits, then GDP will contract.

(It's simple math that Steve Keen showed us a while back. A 3% deficit this year needs to be 3%+ something next year or else GDP will take a hit).

I think too that AI, or a mathematically competent grade-schooler, could easily work out that one cannot run larger and larger deficits forever. So there's a reckoning at some point, the difficulty being that moment comes with the largest ever pile of federal debt on the books, and a falling economy, which is a bad mix.