Modern investing offers the promise that investors who "do their homework" and use data more intelligently than the herd can gain a valuable edge. But what if the underlying data available to the investing public is fundamentally flawed?

The federal government agencies that issue headline data and the mainstream media that reprints the data without skeptical analysis would have us believe that these indicators -- the unemployment rate and the consumer price index (CPI), for example -- accurately reflect economic realities.

The other indicator that is implicitly or explicitly assumed to reflect the economy’s health is, of course, the stock market, generally represented by the S&P 500 index.

That the government indicators and the stock market are both suspect is now a given.

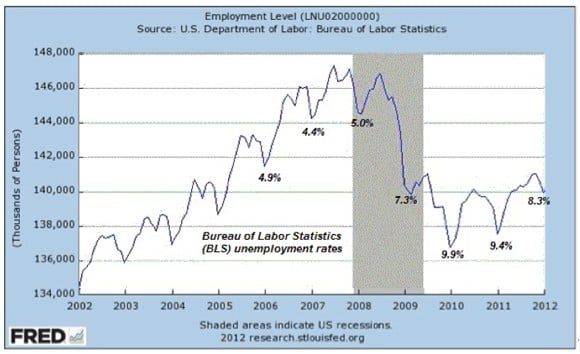

The chart below, one of many possible examples, proves this suspicion is well-founded. This is a chart of a broad measure of employment in the U.S. published by the U.S. Department of Labor, Bureau of Labor Statistics (BLS). As we can see, when 140 million people had jobs in 2009, the official unemployment rate was 7.3%.

Yet when 140 million people had jobs in early 2012, the unemployment rate was 8.3%. How can the rate change when the number of jobs remain constant? The reason is that the unemployment rate is based not just on the number of jobs but on the number of people who are ready, willing and able to work—the labor force. The unemployment rate is based on the labor force minus the number of employed equals the number of people counted as unemployed. The government games the unemployment rate by keeping the labor force number artificially low. Despite the working-age population rising by 9.4 million people since 2008, the official labor force has been 154 million since 2008. Where did the government put all those millions new workers? In the “not in the labor force” category, which rose by roughly 8 million since early 2009. In other words, dropping millions of people from the labor force artificially lowers the unemployment rate.

It doesn’t take any fancy analysis to conclude that if the true labor force were counted, then the unemployment rate would be much higher -- and that is, of course, politically unacceptable.

Part II: The Three Key Indicators to Watch, we answer the question, What's an investor to do? What investment-actionable indicators of financial and economic reality can we rely on?The "good" news is that the options of potential outcomes for the macroeconomic picture are narrowing, making the future a little easier to predict and plan for. The sobering truth is that the narrowing choices ahead of us each involve a magnitude of pain we'd rather avoid. Now more than ever, investors need reliable compass points by which to navigate.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/what-data-can-we-trust-2/