Improbably, the global economy has returned to growth over the past four years despite the ravages of a deflationary debt collapse, a punishing oil shock, ongoing constraint from debt and deleveraging, and stagnant global wages.

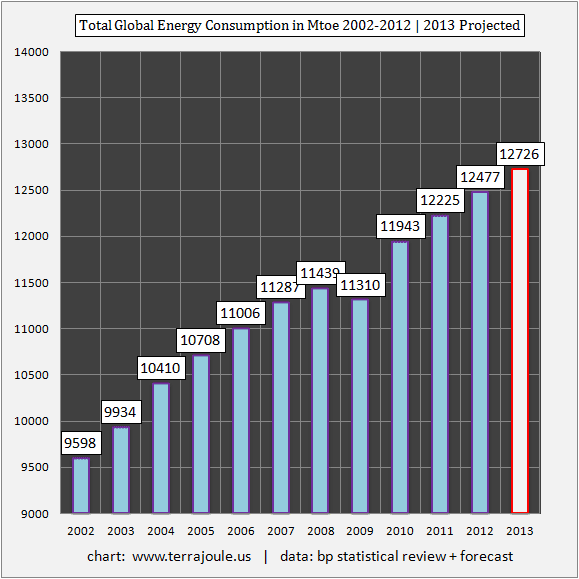

The proof of this growth comes from the best indicator of all: the growth of global energy consumption. Halted in 2009, as global trade collapsed from the second half of 2008 into the first half of the following year, the global demand for energy inputs quickly returned to its long-term trend in 2010, growing at approximately 2% per year.

Ecological economics holds that human economies are subordinate to the availability of natural capital. Technology therefore does not create natural resources, nor does human innovation. Instead, technology and innovation mediate the utilization of existing natural resources. In other words, an improvement in the techniques of longwall coal mining (late 1700s), deepwater offshore oil drilling (late 1900s), and horizontal natural gas fracking (early 2000s) are all impressive. But these innovations only matter when the prize of dense energy deposits are actually on offer. No dense energy deposits = no value to innovation.

We are therefore obligated to acknowledge that when few natural resources exist or are too expensive to extract, very little economic activity is possible. Conversely, we are equally obligated to admit that when resources are available for consumption, then growth will likely result. And lo and behold, that is precisely the explanation for the world’s return to growth since the collapse of 2008: Despite the punishing repricing of oil from $25 earlier in the decade to $100, there was enough energy from other sources to get the global economy back to some kind of growth.

Of course, this is not the smooth and well-lubricated growth that many in the West had become accustomed to in the post-war era. The nature of today’s growth is highly asymmetric between East and West, and highly imbalanced between rich and poor. Today’s growth is also quite lumpy, or highly clustered, as certain domains and regions are benefiting while other populations are living in very stagnant conditions. We’ll get to these details shortly.

But first, let’s look at the longer-term chart of global energy consumption from all sources – oil, natural gas, coal, nuclear, solar, wind, hydro, and biomass – denominated in Mtoe (million tonnes oil equivalent):

This chart is bad news for the many observers on all sides of the macroeconomic equation who are trying to puzzle out the post-crisis era. The fact is, there is enough energy to fund traditional, industrial economic growth in the phase after Peak Oil. Yes, the end of cheap oil did indeed shock the system, and along with the previous credit bubble, it has cast a pall on the potential rate of global growth. But many of the forecasts about the absolute end of growth have yet to come true. This is important because while the global economic system was highly sensitive to an oil shock coming into 2007, it is actually less sensitive now to an oil shock. Those who, ten years ago, correctly predicted the tail risk that oil presented to the system should declare victory. Equally, forecasting a repeat of that experience is probably unwise.

The Oil Crash is Now Behind Us

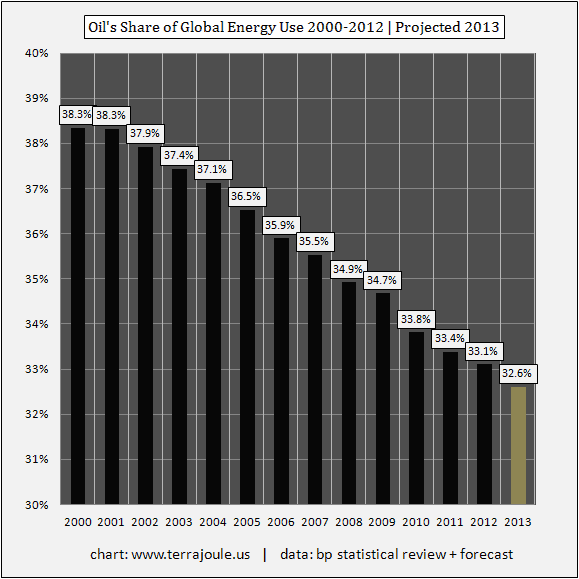

Why? Simply put, whereas oil used to be the key commodity on which a fast, just-in-time, high-functioning global economy depended all too much, now a combination of coal, natural gas, and other inputs to the power grid have taken nearly all of the market share over the past decade. It is axiomatic, therefore, that if the global supply of oil has only increased from 74 mbpd (million barrels per day) in 2004 to 76 mbpd here at the end of 2013, but total energy consumption globally from all sources has risen over 20% in the same period, then nearly all the growth in the global economy is being funded by other forms of energy.

So you can abandon the idea there will be a future oil crash – because we already had it. The world has been busily starting to wean itself off oil for nearly ten years now. Oil use in Europe and the United States peaked in 2004-2005. The decline of oil consumption only accelerated after 2008, and in the OECD, it's still declining. Will $125 or $150 oil crash the economies of Japan, the United States, or Europe at this point? Perhaps not. There is hardly any growth to crash in the OECD. It is as if the OECD economies are effectively bunkered, with no growth in wages, jobs, or construction, and nearly all progress is confined to asset prices, mainly the stock market. Perversely, this stagnation is the new strength.

Meanwhile, in the Non-OECD, where growth is actually taking place, the big drive that has taken world energy use higher since 2008 – from 11310 Mtoe in 2009 to this year’s projected 12726 Mtoe – continues to be funded by natural gas, various inputs to the power grid, and the world’s still fastest growing energy source: coal. Yes that's right, coal, which grew 2.5% last year. Again, ecological economics informs us that there must be energy inputs to fund economic growth. Well, the world has plenty of energy inputs in the form of natural gas and coal. There is no Peak Natural Gas and there is no Peak Coal. No crash is coming in either of these resources in the foreseeable future, either.

To give a better sense of the decline of oil and the rise of other energy inputs, consider that in almost every European country now, bicycle sales now outnumber automobile sales. Life After the Oil Crash, indeed! In the United States, oil demand has fallen to levels last seen over thirty years ago. The 5 mbpd of new demand in Asia, built over the past decade, has been supplied more from demand declines in the West than new global production. The real oil crash, now, the oil crash that matters most, is the decline of oil’s share in the total energy mix. A decade ago, oil provided nearly 39% of total global energy supply. Oil’s now down to 33%, and heading to 32% either this year, 2013, or by next year:

We would not say that the global economy is currently at high risk of losing its access to coal. So we should no longer be overly concerned that the global economy is going to lose its access to oil. It has already lost its access to cheap oil. And now coal, not oil, is in position to take the lead as the number one energy source, globally. But there is little room for complacency in this regard. Because there is little good news in this lower tail risk from oil and its lower-level threat to the global economy. Rather, the global economy is growing increasingly imbalanced.

The Grand Asymmetry

We can think of reflationary policy from Europe, the U.S., and especially Japan as an attempt to counter the West’s loss of access to cheap oil. Is that policy working? Not really.

The primary beneficiaries of this policy have largely been corporations, which derive most of their growth from the 5 billion people in the developing world but are located in the OECD. These corporations are sited in London, New York, Tokyo; the cash from worldwide operations rolls in, but they have little need for expensive, high-wage Western workers. Accordingly, stock markets in the West, composed of these corporations, continue to soar, while investment and growth in the OECD stagnates.

It’s bad enough that Western corporations do not hire domestic workers, do not raise wages, and have maintained capex (capital expenditures) at low levels for years. The huge cash piles stored in corporations represents their conversion, in some sense, to global utilities. Energy companies, technology companies, and infrastructure companies now operate at a very high level of efficiency. So high, and with the aid of information technology, that their need to invest in new capital equipment and especially human labor has fallen to very low levels. How low? A Standard-and-Poor's report on global capex released just this summer showed that investment is, unsurprisingly, far lower in the post-2008 period than before. Recent commentary from the folks at FT Alphaville lays some color on this data point, because at current rates, U.S. capex has only recovered to the previous trough levels of prior recessions. Worse, whatever meager recovery in capex has taken place from the lows of 2009 is now stalling again. From the S&P Global Corporate Capital Expenditure Survey, July 2013:

The global capex cycle appears to be stalling even before it has fully got under way. In real terms, capex growth for our sample of nonfinancial companies slowed in 2012 to 6% from 8% in 2011. Current estimates suggest that capex growth will fall by 2% in 2013. Early indications for 2014 are even more pessimistic, with an expected decline in real terms of 5%.... Worldwide, capex growth has become increasingly reliant on investment in the energy and materials sectors. Together, these sectors account for 62% of capex in the past decade. This reliance creates risks. If the global commodity "super cycle" is fading, global capex will struggle to grow meaningfully in the near term. Sharp cutbacks in the materials sector are a key factor in the projected slowdown in capex for 2013 and 2014.

Notice that the total volume of global capex is increasingly reliant on investment in the very capital-intensive energy and materials sector. This is highly revealing. In the aftermath of oil’s repricing and the repricing of many other natural resources, the global natural resources sector now requires significantly more investment to extract the same units of oil, copper, iron ore, coal, natural gas, and potash, and requires more expensive technology and more human labor. This is the sector holding up the average spend of global capex, so we can conclude that beneath that average, the capex in typical post-war industries like media, finance, real estate, and even infrastructure is not only low, but historically low. The very poor level of employment growth confirms exactly this conclusion. Most poignant of all, this is a wildly strong confirmation of ecological economics, showing that a larger and larger proportion of total investment needs to be devoted now to natural resource extraction, leaving less investment to other areas. The net energy available to society is in decline.

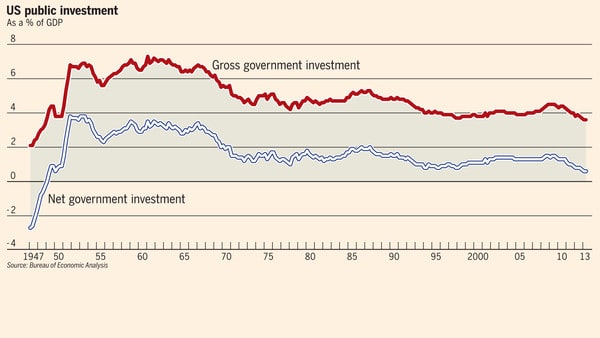

But it’s not just the private sector that has stopped investing. Public sector levels of investment have been dropping as well. In fact, according to yet another dump of recent data, U.S. government investment in public infrastructure is at the lowest levels since WWII. The Financial Times covered this on November 3rd and produced a rather stunning chart. The Financial Times writes, “Public investment picked up at the start of Mr. Obama’s term – temporarily rising to its highest level since the early 1990s – because of his fiscal stimulus. But that has been more than reversed by subsequent cuts. The biggest falls are in infrastructure, especially construction of schools and highways by states and municipalities.”

Conclusion (to Part I)

When neither the private nor public sector is willing to invest in the future, it seems appropriate to ask, what happened to the future? Have corporations along with governments figured out that a return to slow growth does not necessary equal a return to normal growth? Why invest in new infrastructure, new workforces, new office space, equipment, highways, or even rail, when the demand necessary to provide a return on this investment may never materialize?

Many sectors in Western economies remain in oversupply or overcapacity. There is a surplus of labor and a surplus of office and industrial real estate, as well as airports, highways, and suburbs that are succumbing to a permanent decrease in throughput and traffic. Perhaps the private sector is not so unwise. Collectively, through its failure to invest, it is making a de facto forecast: No normal recovery is coming.

In Part II: Why Social & Environmental Imbalances Are Becoming the Biggest Risks, we explore how the misguided policies being pursued worldwide to return to the growth we've been accustomed to are resulting in a volatile mix of imbalances in both wealth and resource availability.

As we move further into a future defined by less per capita – not more, as we've become accustomed to – dangerous rifts in our social fabric (both within and among countries) threaten to define the days ahead.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/what-happened-to-the-future/