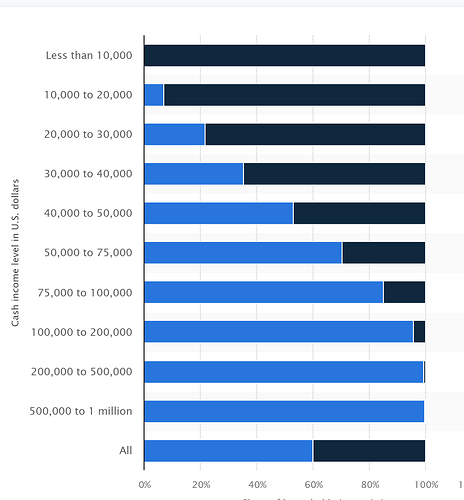

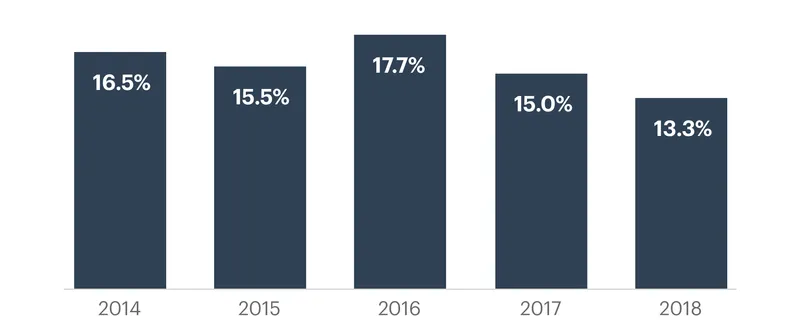

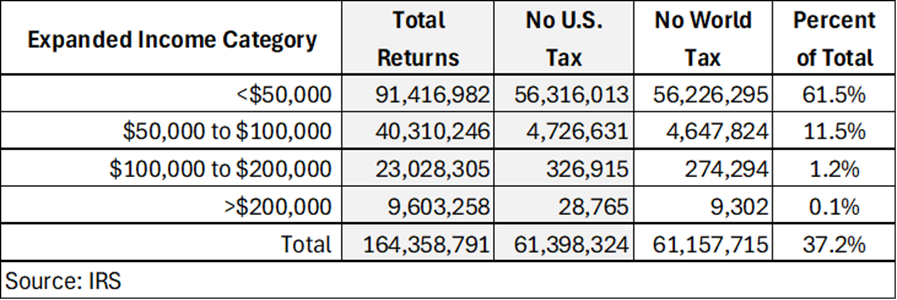

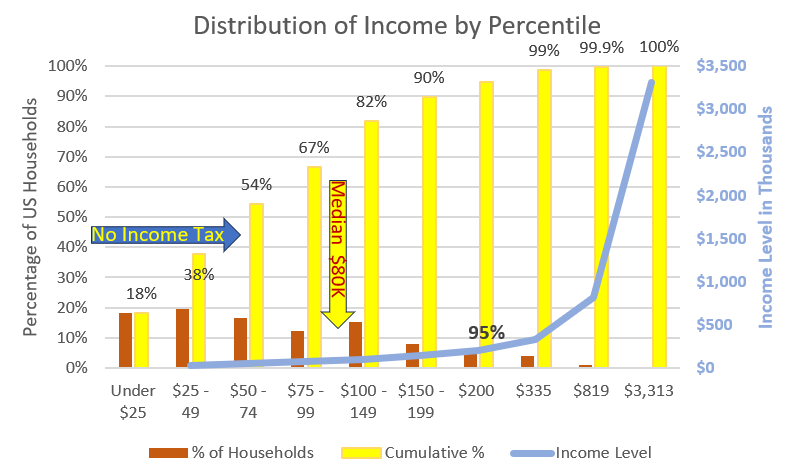

Given where we are now as a society and economy, I don’t see how removing income tax is anything other than a transfer of wealth from the poorest to the richest.

There are only so many real things to buy, so increasing the amount of dollars people have access to just leads to inflation. Moreover, income is so greatly skewed that the greatest increase in spending power by far will go to the d.i.n.k. upper middle class who will just pour it into assets, in particular pushing home ownership even further out of reach for many.

This is not to say I think income tax is a good thing. Like sales taxes it introduces economic friction increasing the barrier for efficient transactions. This might need some explanation:

Suppose, in a world with no income tax, it takes a professional painter 2 days to paint some rooms and it takes me, an accountant, 3 days, and we each charge our clients $200 per day for our work. In that case I would hire the painter to paint the rooms as the opportunity cost to me of painting the rooms is $200 greater than paying the professional, as I can earn $600 in 3 days, but only have to pay the painter $400 because he can get it done in 2.

Next suppose (to keep things simple) both our marginal tax rates are 50%. Well, the painter still charges $400 for the job, but I have to now earn $400 post income tax to pay for the work. i.e. I would have to earn $800, which is 4 days work. In this case, I’d be better off spending 3 days painting the rooms myself. That’s not efficient.

Next suppose the painter needs his accounts done, and these would take me 2 days, but him 3 days. Well now, by the same reasoning, if there is no income tax the painter will get me to do his accounts, but if there is income tax the painter will do his accounts himself.

So, we have two worlds. In the one with no income tax, painters paint rooms expertly in 2 days and accountants do accounts expertly in two days. In the one with income tax, accountants paint their rooms (badly) in three days and painters do their accounts (badly) in three days.

The greater the marginal tax on a transaction (income/sales tax, professional insurance costs, business taxes etc.), the greater the barrier for people to transact and reap the efficiency gains of the diversity of skills in society. Once the transaction tax exceeds the differences in efficiencies between average people and experts, people just stop transacting and waste time doing it themselves. i.e. transactions can function smoothly with small income/sales taxes, as long as they stay below the threshold of normal differences in “skill” or efficiency, but beyond a certain point people stop transacting.

We’d probably all be better off if our tax systems had been based on Georgist principles, which don’t have such transactional friction built into them, but we are where we are now, and if one wanted to get there, I wouldn’t start from here.