In response to yesterday's post, titled The crisis explained in one chart: Debt-to-GDP, Lisa G did her homework and then asked a great question:

This debt/GDP % of 403% from 2+ years ago compares to the % in today's post of "340 percent of total GDP. "

Are these calculated differently or has the percentage actually dropped from 2006?

Any help here? I am getting lost.

Kudos for doing the research and resisting the call to become 'a believer'! Well done. There's a perfectly good explanation for all this....

[See the postscript for my take on this.]

The difference you have surfaced can be explained by what is tossed into the bucket called "debt" and what is, somewhat conveniently, left out.

The 340% cited in the figure yesterday refers to everything that the Federal Reserve collects and calls debt in its Z.1 Flow of Funds report (I focus on the "Level Tables"). This is actual, hard debt that consists of a contractual, legal obligation to repay. That is what I, very conservatively as it turns out, use to compare against GDP.

In the Z.1 report, the total government debt recorded by the Fed, even as late as December 2008, is 'only' $5.80 trillion. That's because the Fed does not include the debt the government "owes itself" (think about that concept for a minute....), nor does it include any of the outstanding entitlement liabilities of the federal government.

The 400+% Debt-To-GDP ratio that I quoted (waaaay) back in 2006 refers to just the federal government position when one includes both the debt the government owes to itself plus the entitlement liabilities of Social Security and Medicare/caid. These are not counted by the Fed in the Flow of Funds report because, technically, these are not debts. They are a liability of the US government, but not a contractual, legal obligation so they are not counted as debts.

We are barely talking about the same things in these two examples. The 340% figure is all credit market debt as counted by the Federal Reserve of which barely 10% of the total is assigned to the federal government. The 400+% figure is purely the federal government position when one counts all their liabilities.

If this all seems confusing, well, that's the purpose of slight of hand maneuvers.

Now, we all know that the US government has a straight debt obligation of slightly more than $10 trillion.

But that's nothing compared to the entitlement liabilities fo the US which the Treasury department is kind enough to post in the US annual report every year for those who care to see it.

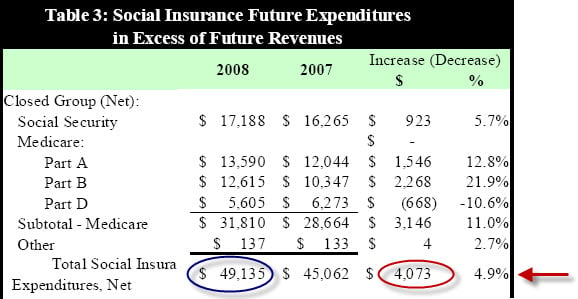

The blue circle reveals that when we only consider entitlement underfunding, the US government is short some $49 trillion dollars. Meaning that if the US government wanted to be even on the whole deal, they would have to come up with $49 trillion, in cash, today to make it all work out.

The $4.073 trillion figure in the red circle shows that the size of the Net Present Value of the liability grew by some 28% of the total value of our (Fuzzy Number) GDP.

The red arrow indicates one more way to assess the severity of the situation. If the entitlement shortfall is some 4 times larger than the economy and it is increasing by nearly 5% per year. Then for the entitlement shortfall to remain in proportion to economic growth, the US GDP would have to be increasing at nearly 20% per year.

Sorry folks, that's just flat out impossible. The main reason I refer to the US as "insolvent" is because that's what it is. This data proves it beyond any shadow of a doubt. Any solutions by this next administration, or any to follow, must start with this simple conclusion or risk being tagged as a "deck chair rearranger" by future historians.

Why are the entitlement shortfalls not included in the Fed's survey of total credit market debt? Because Congress can modify the rules for the entitlement programs at any time and say "Sorry, no payments!", so technically they are not debts.

I counted and included the entitlement liabilities in my 2006 article because I reasoned that whether the federal government dutifully paid them off or they reneged on them, either way they behave like debt.

If the federal government does pay them off, then they will behave exactly like debt.

If the federal government doesn't 't pay, then the burden of meeting the accrued liability would revert to citizens who would then have to curtail other spending to make up for these shortfalls in their retirement and health care accounts.

Either way, whether the payments are made or reneged upon, they represent a drain on future spending/purchasing power which is a very workable definition of debt.

By the way, under this set of definitions, if we add the entitlement "debts" to the Fed's Z.1 definition of debt, then our Debt-To-GDP calculation vaults to a stunning, unpayable ratio of 680%.

Where this places the US relative to other countries is more of an academic than a practical consideration to me, although it might be a useful categorization for short to medium term currency trading. But eventually? Does it really matter if the US is 2.5 times vs. 'only' 1.2 times more insolvent than some other country? Nearly all western countries have been playing the same game by the same rules.

The few who remain solvent tend to be sparsely populated and resource rich. Exactly where the US was back when it was solvent.

Best,

Chris

PS - I squirm uncomfortably at the use of the word "followers" and I doubt I will ever do otherwise. That's just how I am built. My entire focus is, and always has been, to nudge people towards thinking for themselves. I have had plenty of opportunities to play the guru role, and I have turned them all down, without exception. Each of us needs to think for ourselves and come to our own conclusions. If we don't, we' run the risk of using the same thought processes that got us into this mess.

This is a companion discussion topic for the original entry at https://peakprosperity.com/whats-the-total-debt-to-gdp-ratio-for-the-us-2/