Originally published at: When Everything Seems Nuts, It’s Time to Play Defense – Peak Prosperity

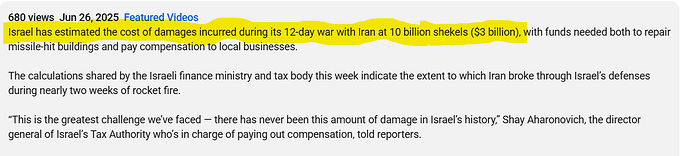

In today’s episode of Finance U, Paul Kiker from Kiker Wealth Management and I discussed the bizarre economic and geopolitical events of the past week. The world seemingly almost tipped into World War III, but thankfully dodged that outcome. Amidst the chaos, there were significant economic undercurrents that we felt were crucial to address.

We talked about how the markets feel increasingly artificial (“Kayfabe” in ‘professional wrestling’ parlance), with interventions from big banks and the Federal Reserve setting prices rather than letting the free market do its job. This manipulation is more widely recognized at this point and has led to a growing distrust among investors, who are now questioning the authenticity of market movements.

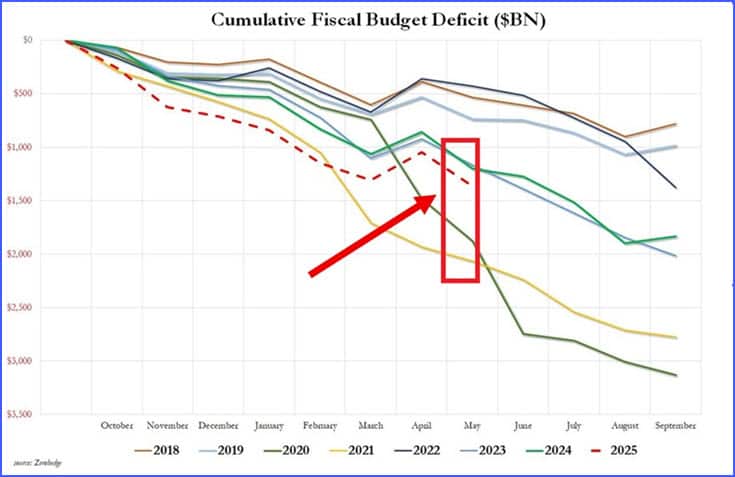

Of course, of equally deep concern is the fact that the U.S. budget deficit is on track to be one of the top-three worst on record. Despite promises to control spending, the government continues to spend like a drunken sailor.

While this injects liquidity into the market, helping to keep everything propped up, supporting economic activity, it also fuels inflation. Deficit spending effectively steals from the future becuase it fuels inflation.

We also delved into the housing market, where sales are significantly below average, signaling potential trouble ahead. This, combined with softening home prices, paints a worrying picture for homeowners and potential buyers.

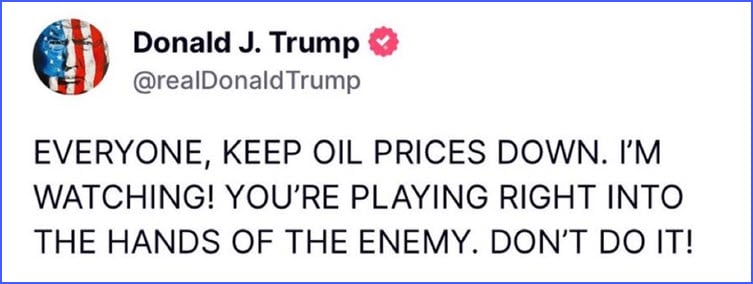

Oil markets were another focal point for our conversation, especially after President Trump’s wild Tweets about oil prices, which we both found quite unusual and potentially detrimental to market dynamics.

Was that a threat? I don’t know, it kind of sounded like a threat.

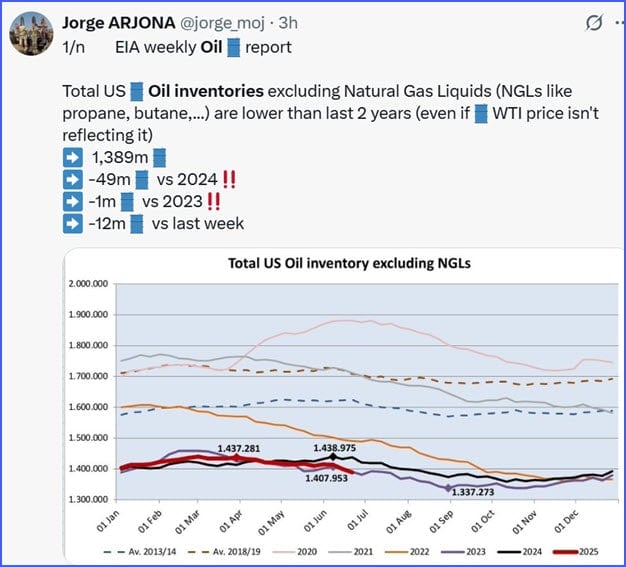

The truth is that U.S. oil inventories are quite low on a 5-year basis, and global inventories are not particularly high.

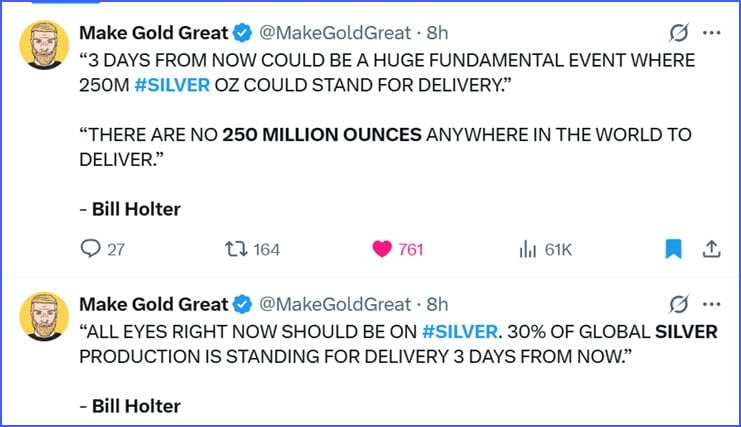

Gold and silver markets are once again seeing signs of large, if not enormous, physical demand that could signal signs of imminent price spikes.

Lastly, we touched on the broader implications of these economic signals. The U.S. dollar’s strength is waning, and with the geopolitical landscape shifting, particularly with actions like Mexico’s decision to halt new mining concessions, the investment landscape is becoming increasingly complex.

In summary, while the world’s attention was on geopolitical tensions, the economic indicators are flashing warning signs. We’re navigating through a time where traditional investment strategies might not suffice, and nimble adaptability, along with a keen eye on real economic indicators, will be the keys to managing wealth effectively. Stay tuned for our next episode, where we’ll dive deeper into retirement planning in this volatile environment.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.