I know this super highway. This bright familiar sun. I guess that I'm the lucky one...

The financial markets were certainly correct in dismissing that rather abysmal first quarter 2014 GDP print, no? After all, the current 4.2% GDP growth snapback revision in Q2 is proof positive Q1 was just a one-off fluke. Right?

The fact is: for a good five years now, economic pundits have been both hoping for, and then repeatedly disappointed by, the US economy's inability to achieve "escape velocity”.

From the 'misery loves company' department, the "good" news is that the other major global economies have experienced relatively worse economic outcomes than the US. So, in the land of global perceptual relatives, the US economy remains one of the lead sled dogs.

But, until proven otherwise, we remain in a slow growth macro environment, as has been the exact character of this historically subdued growth cycle since its start coming out of the 2008 crisis.

Is it all bad, though? Of course not. There is some good along with the bad, yet there also exists some outright ugly. It's the balance, rhythm and interplay between The Good, The Bad and The Ugly over time that shape both the headline economic stats as well as theoretically support financial asset prices. Indeed, the manner in which this unprecedented global slow growth cycle has impacted global flows of capital has been much more responsible for raising the prices of financial assets prices than any actual economic realities.

So what lies ahead for the US economy? And for the financial markets? Are things going to get better or worse from here?

"The Good" (The Case For Optimism)

One of the true standout anomalies of the current recovery cycle has been that domestic small businesses have had a very tough time actually recovering (to say nothing of growing) in any meaningful manner. It’s not hard to understand why: their very large global corporate brethren have been able to partake in global stimulus, something not finding its way directly to the small business community.

Also, unlike their large corporate brethren, small businesses do not generally have direct access to the capital markets. In this cycle, large corporations have been treated to once-in-a-lifetime lows in the cost of debt capital. Historically, we've seen the economic and financial fortunes of large and small companies relatively joined at the hip. Not so in the current cycle. The reason this is very important is that at least historically, small businesses have been the key creator of jobs in the US. With the small business sector so left out of the party, it's no wonder we’ve had the slowest job recovery of any cycle of the last half century (at least).

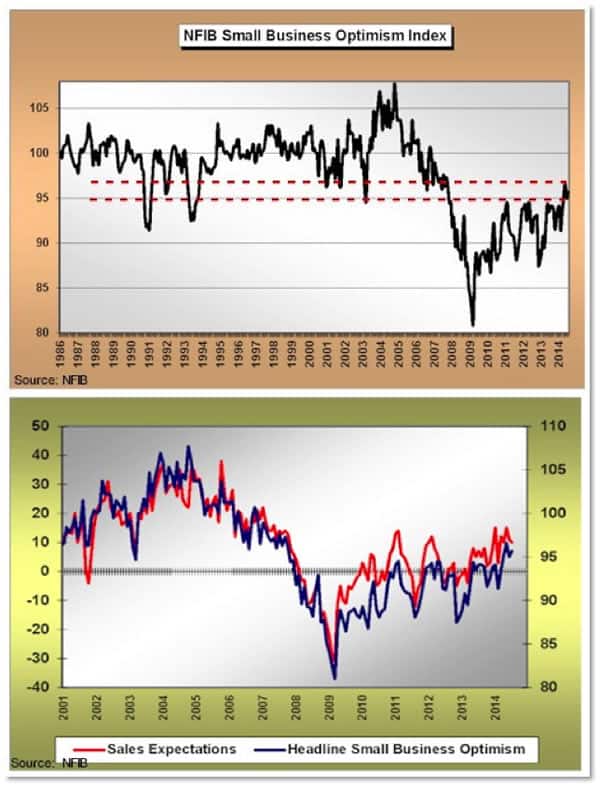

A fingerprint characteristic of the current cycle has been that small business optimism has been living in what has been recessionary territory, historically. Although it has only been in recent months, after five years of theoretical economic 'recovery', we've just witnessed a (small) breakout to the upside in small business optimism. Although this may not sound bright and cheery, we’re now back to the lows in optimism seen in prior economic cycles. In all sincerity, this is a big improvement, and a good sign if it can be sustained.

Is small business optimism necessarily a Holy Grail indicator? Absolutely not. It is anecdotal and, alone, will not drive an economic recovery cycle. But in terms of where we find ourselves at present, it is welcomed improvement at the margin, even with its late cycle arrival:

The lower chart above importantly tells us sales expectations are and have been a big driver of headline optimism at the small business level (no big surprise). One thing to keep in mind as we move ahead is that like so many things in this special cycle of the moment, “emotions” generated by short term stock price trends have driven real world business actions and responses to optimism surveys such as this.

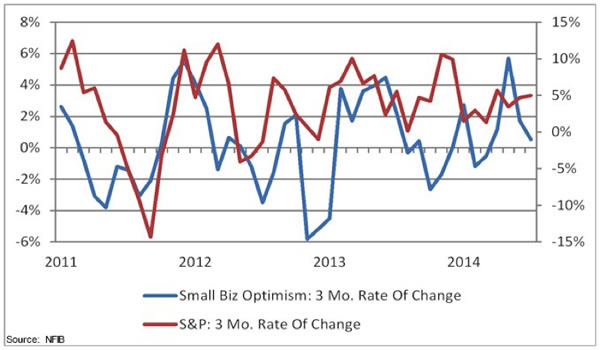

The chart below shows us that from 2011 through mid-2012, the stock market followed the short term change in real small business optimism. But from mid-2012 onward, the direction of equity prices instead has driven business sentiment, once again highlighting the perceptual importance of equities in the current cycle. In one sense, the good news for the Fed is they have gotten when they wanted: economic reactions to short term stock price movements. Of course, this is also the bad news; as now stock prices need to hold and move higher, or we'll see potentially suffer adverse real economy reactions:

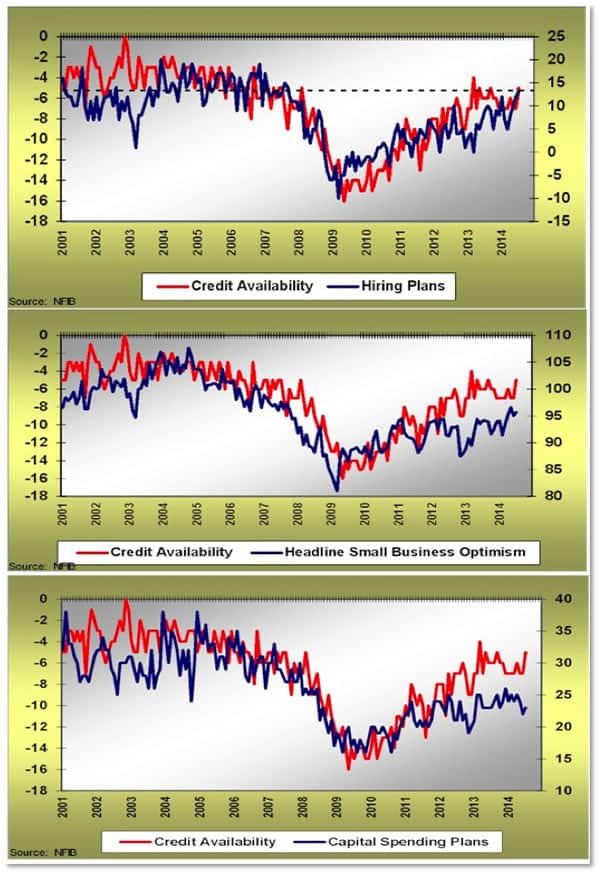

I have heard many analysts suggest small business has had a tough time as their access to credit has been limited in the current cycle. To be honest, that’s total B.S.

The fact is that there has been plenty of credit available for the small business community. The current cycle has seen the emergence and growth of business development corporations – non-bank entities, free of banking regulations, that make loans to small and mid-size businesses, crowding out the banks at the margin. So small businesses no longer are totally reliant on banks for capital.

In each monthly small business survey, respondents list their top concerns. Not once has 'credit availability' hit number one over the entire cycle. Not once. The chart below is a look at how small businesses perceive their access to credit, alongside data for headline optimism, hiring plans and capital spending plans.

What's very striking in this trio of charts is that from the inception of the data in 2001 through 2010, all of the individual data points you see above have been joined at the hip with credit. Interestingly enough, over the past two to three years small business owners’ response to credit availability has been pushing toward the highs of the prior cycle.

The big positive in the chart above can be found in the top clip – hiring plans. Not only are we at a new high for the current cycle, we’re now back to the mid-range experience of the 2001-2007 expansion cycle. If small business is to have a positive impact on the real economy ahead, this is where it happens in job creation. In all sincerity, the increase in small business optimism and increase in hiring plans we have seen in recent months is a big plus for the current cycle if it can be sustained and elevated from here.

Less positive are the lower two charts, which show that since 2012, headline optimism and capital spending plans have not followed along with credit availability expectations. Such is the macro of a slow growth economy.

Small business optimism and activity has been a key missing ingredient of the current cycle. So a critical question is: Have small businesses found their home at last in the current cycle? Stay tuned. Continued improvement in small business outcomes could easily carry the economy forward with some positive momentum. That is, if that momentum can outweigh the headwinds generated by The Bad and The Ugly.

Conclusion

In Part 2: The Bad & The Ugly, we analyze the increasingly concerning trends undermining the positive data above, most notably the fundamental lack of final demand -- the "elephant in the room" of this current economic cycle. Small business (and large business, for that matter) is not expanding robustly for the simple reason that consumption is not. The economy has not healed enough to support the growth seen in recoveries past. And certainly not to support these all-time high stock market prices.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/where-to-from-here/