Gold has been in a bear market for three years. Technical analysts are asking themselves whether they should call an end to this slump on the basis of the “triple-bottom” recently made at $1180/oz, or if they should be wary of a coming downside break beneath that level. The purpose of this article is to look at the drivers of the gold price and explain why today’s market value is badly reflective of gold’s true worth.

First, I think a reminder would be timely. Those who seek to trade gold are at substantial disadvantage:

- they line themselves up against too-big-to-fail banks which have the implicit backing of the taxpayer to bail them out of their trading positions;

- furthermore markets have become so manipulated and dangerous that gold should be considered as insurance against systemic risk instead of a punt.

Technical Analysis & Gold

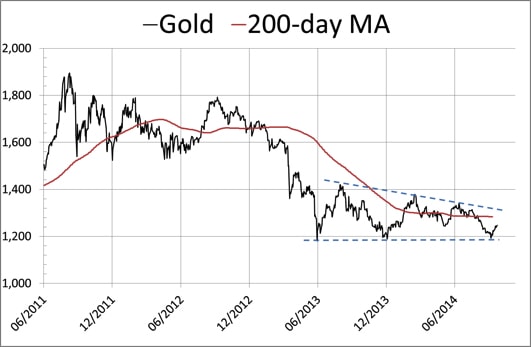

Using charts has the theoretical advantage of taking the emotion out of trading. So long as there is no significant change in the purchasing power of the currency against which it is traded, prices in the past have relevance to the future, because recent price experience sets an expectation in the human mind. The chart below shows the gold price since the peak in September 2011.

However, this pattern is rare and should not be the first conclusion we jump to. The definitive work on Dow Theory (Technical Analysis of Stock Trends – Edwards & Magee) describes an unconfirmed triple bottom as “treacherous”. But the characteristics we’re seeing in this current formation, with the third low on low volume and the subsequent rise on improving volume, are encouraging. Confirmation of the pattern according to Edwards & Magee requires the gold price to move above $1375, a level worth noting. Once confirmed, a triple-bottom “almost always produces an advance of distinctly worth-while proportions.”

The danger of course is non-confirmation. One can imagine a price rally to say, $1300, unwinding the shorts, at which point subsequent bears might then mount a successful challenge on $1180.

Additionally, since Edwards& Magee published their work, computers have allowed us to define trends by moving averages, and a commonly accepted indicator is the 200-day MA, which stands at about $1280. If that level is broken and the gold price stays above it long enough to cause the MA to rise, that should trigger computer-driven buying. So any price over $1300 will likely confirm the bullish case, yet it would be a mistake today to be unreservedly bullish on technical grounds alone until this price level is exceeded.

Valuing Gold

None of this reins in the truly subjective nature of tomorrow’s prices. Instead, we should turn to relative valuations to get a sense of whether gold should be bought today or not.To do this, we need to compare the quantity of gold with the quantity of fiat currency. While we have reasonable estimates of the total amount of above-ground gold stocks over the last few centuries, we really don’t know how much the central banks actually hold, on the basis their figures are for “gold and gold receivables (i.e. leased, loaned or swapped and not in their physical ownership). Equally, the task of assessing the true total amount of the world’s fiat currency and how that has grown over time is too great to be a practical proposition.

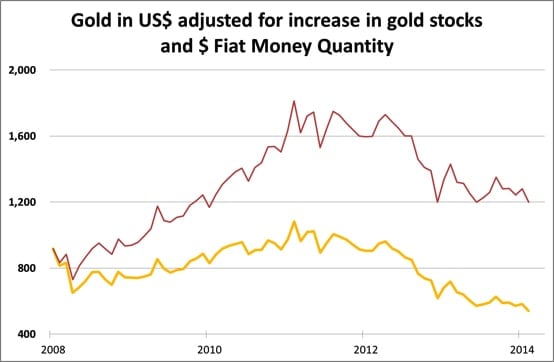

Instead, I have devised a simple and practical approach, by comparing the increase in the world’s above-ground gold stocks with a measure of the increase in the quantity of USD fiat currency.

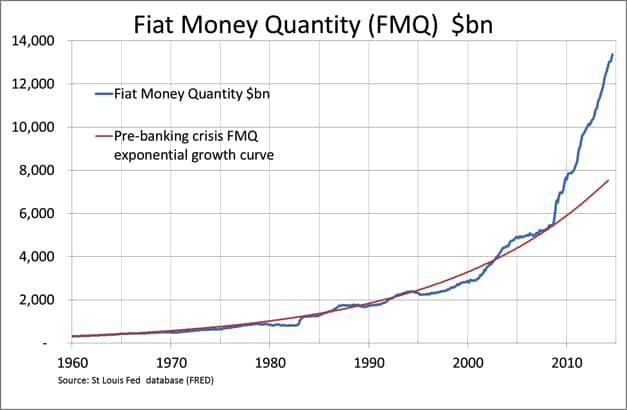

I’ve devised a metric called the “fiat money quantity” (FMQ) which reverses the process by which fiat money was originally created. Our forebears’ gold was taken in by commercial banks, which would issue currency notes and record deposits in gold substitutes (dollars payable in our forebears’ gold). When the Fed was created, the Fed took in the same gold from member banks and issued its notes and recorded reserves against that gold in its balance sheet. So FMQ is the total of cash, accessible deposits in the commercial banks and bank reserves held at the Fed, adjusted by temporary factors that affect those reserves such as Repos and Reverse Repos. More details on how FMQ is calculated can be found here.

The chart below shows how FMQ has grown since 1959. It shows a steady rate of exponential growth prior to the Lehman crisis, after which it has increased alarmingly:

So to summarize, before the Lehman crisis, investors’ appreciation of systemic risk was relatively low. After the crisis, there were concerns that we faced a deflationary price contraction, so the nominal price of gold dropped (from $918 to $651). When it became clear the Fed would successfully inflate the financial system out of immediate trouble, gold rose to its high-point in September 2011 – but on an FMQ-adjusted basis the high was considerably less, reflecting the sharp increase in the quantity of new fiat money being issued: gold only rose about 20% from July 2008 on this basis. While there was undoubtedly some froth in the gold price at this point that needed correcting, given the circumstances the price level was otherwise reasonable. The subsequent bear market in gold since has taken it to an extreme undervaluation today.

Gold is not alone in having a market value divorced from reality. A bankrupt government such as Greece has had no problem borrowing 10-year money recently at only 6.5%, though this anomaly is beginning to correct. Other insolvent nations, such as Spain and Italy were recently able to borrow 10-year money as low as 2% and 2.2% respectively, though their bond yields have also subsequently risen slightly.

Think about this for a moment: the US dollar is the reserve currency and its government bond yields are the benchmark for global fiat money risk-free return. Governments with a demonstrably (much) worse borrowing record have been able to issue bonds at what amounted to a yield backwardation – significantly lower than the US 10-year Treasury bond. This has never happened before, so far as I’m aware.

Key market valuations are totally screwed up in a world of 0% interest rates and manipulated markets. If gold was alone in its extreme undervaluation, without a counterbalancing overvaluation in fiat-currency bond markets, something would probably be wrong with our analysis. The fact that this is not the case offers confirmation that gold is mis-priced and incorrectly valued in markets that have become divorced from reality.

Defining the Gold Market

It is common knowledge that dealings in paper gold are greater than that in physical bullion. Paper gold includes the following categories:- Unallocated gold accounts held with bullion banks.

- Sight accounts held with central banks on behalf of other central banks.

- Over-the-counter derivatives and options

- Forwards on the London market (deferred settlement never intended to settle)

- Regulated futures markets (Comex, Tocom etc.)

- Gold ETFs not backed by physical gold.

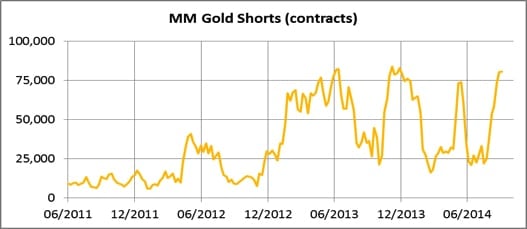

But we can get an idea of the overall interest in paper gold from numbers released by the Bank for International Settlements covering off-market derivatives, plus outstanding Comex interest. This is shown in the next chart:

This tells us that, given that their hedge positions are historically low, bullion banks have reduced their outstanding liabilities to customers with unallocated accounts, which would be consistent with the late stages of a bear market. Ironically, the unwinding of unallocated accounts has been hastened by the withdrawal of bullion from the London market redeployed to satisfy Asian demand, because ultimately physical bullion is the basis for the whole market. It is obvious that if the trend outlook for gold improves, given that the decline in outstanding derivatives has not led to reducing leverage on the physical market, liquidity could rapidly become a serious issue.

Meanwhile, physical gold goes from West to East.

Asian Demand

Physical gold features in the family pension fund for the average Asian. We are all familiar with this being the case for Indians, but it is also true for most other countries on the continent. The reason is simple: no Asian government has been able to suppress the ordinary citizen’s interest in gold as a store of wealth, and generally currency issuance has been badly abused by Asian governments. For example, in Turkey accumulating inflation from the 1980s led to six noughts being lopped of the lira in 2004. In India, since the 1960s the rupee price of gold has gone from INR160 to about INR76,000 per ounce today.The history of Asian demand goes back to the oil crisis in the 1970s, when the Middle East suddenly became immensely wealthy from the rise in the price of oil. Naturally, they invested a portion of their new-found wealth in gold. The pace of gold acquisition by Arabs slowed in the early 1990s, because a new western-educated Arab generation began to manage the region’s financial resources, and these youngsters were doubtless discouraged by gold’s prolonged bear market. Instead they turned to equity markets and infrastructure investment. Then in 1990 India repealed the Gold Control Act.

This legislation banned Indians from owning gold in bar and coin form, which gave added impetus to smuggling and jewellery manufacturing. Its repeal was part of a process of economic liberation in the wake of a financial crisis which led to market-friendly economic reform. Since then, recorded private sector imports grew from a few hundred tonnes to as much as 1,000 tonnes annually before the Reserve Bank of India reintroduced import controls last year. Predictably the effect has been to restrict officially imported gold and increase smuggling.

Turkey is the gateway to Iran and the Moslem world to the east beyond the Caspian Sea. Gold has been actively used as money by this region since time immemorial. According to the Borsa Istanbul, Turkey has imported 3,060 tonnes of gold since 1995. Some of this has gone to Iran and to the east of Turkey, but equally the rest of the region will have had other sources over the decades. Lastly, South-East Asia is populated with a Chinese diaspora, and since its industrialization in the 1990s this region has also been stockpiling significant quantities of bullion. But the big story is China itself, which we investigate in detail in Part 2 of this report

Summary (Part 1)

When the gold price is being smashed in western capital markets, it's easy to forget that Asia is quietly buying up not only all or most of its own mine and scrap supply, but significant quantities of the above-ground stocks held in western vaults as well. It's a process that dates back to the birth of the petro-dollar in the 1970s and has continued ever since. The three big ownership centers are the Middle East, India and China -- the latter two having in recent years enjoyed high rates of economic expansion, with increasingly wealthy middle-classes with a high propensity to save.We cannot know in truth how much of the world’s above-ground stocks of gold are in the hands of these three centers. But they are only part of the Asian story, with Turkey and its sphere of influence plus the whole of South-East Asia, whose people also regard gold as a prime savings medium. All we can say is that it is likely that significantly more than half the world’s gold is in Asian hands. Importantly, over the last ten years the pace of Asian accumulation has increased, draining the west of its physical liquidity. And in this respect perhaps the most important indicator is the decline in outstanding OTC derivatives shown in the last of the charts above.

So not only do we have evidence that the price is based on western paper markets with declining liquidity, but by comparing above-ground stocks with the Fiat Money Quantity of the world’s reserve fiat currency, we can see that gold is extremely undervalued at a time of high, possibly escalating systemic and currency risk.

In Part 2:The Case For Owning Physical Gold Now we delve more deeply into the flows of bullion to Asia which will soon create supply shortages in the West, as well as detail the growing systemic and currency risk factors that few asset besides physical gold can offer protection against.

Click here to access Part 2 of this report (free executive summary; enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/why-gold-is-undervalued/