So let's pretend for the moment that the Federal Reserve gets everything it has stated it wants. And even further, that Washington, D.C. gets everything it wants, too.

The credit markets are repaired, and massive new loan growth flows out the door. Loans are made to businesses that hire gobs of new people. Consumers borrow and borrow some more to go to school and buy homes, cars, and gadgets.

Inflation remains low and job growth explodes. Tax receipts climb and the deficit falls. The stock market goes higher and higher, gold falls and then falls some more, as confidence in the system, its masters, and its institutions grows.

The Fed wins and D.C. wins.

But in reality, we all lose.

It's all just a matter of timing.

Unsustainable

If we hold the view that humans are behaving unsustainably in terms of any of the 'three Es' – the economy, energy, or the environment – then any rapid resumption to a paradigm of exponential growth in our consumption of natural resources -- or in our growth of debt over income -- simply takes us more quickly to the bitter end of this story.

What good does it do to return to rapid economic expansion if we have not figured out how we are going to supply sufficient water for agriculture and basic living needs to the major population centers around the world? What's our plan for reversing collapsing oceanic fisheries? When do we have the substantive conversation about the long-term implications of the continuing Fukushima disaster?

Omnipresent signs of ecosystem stress -- ranging from dying bees to increasingly chaotic weather patterns -- suggest strongly that we need to be doing things differently and with an eye towards resilience. On the energy front, the temporary bonanza of oil and gas from U.S. shale plays is just that: temporary. We need to be talking about where we want to be positioned when that, too, ends.

The really big picture here is that our economy, such as it is, is predicated on ever larger amounts of stuff being extracted, refined, produced, and then discarded. It's a model that works – just not sustainably.

Instead of wondering where we're headed and engaging in a bit of introspection, all eyes are on the Fed to see if it can engineer higher stock prices while keeping interest rates low. So conditioned are the masses locked in this system, it's as if financial assets all by themselves are both necessary and sufficient to secure a prosperous future.

Without understanding the actual nature of where we are in this story, there's no way to meaningfully adjust our course towards a different destination. For now, I will constrain this analysis to the Fed and to the economy, and show that their efforts have not borne the fruit they hoped for and that it's well past time to admit that the grand money-printing experiment has not worked out as planned.

If we simply pump the economy back up at any and all costs, we will win that battle. But we'll lose the larger war. What we should be doing instead is using this as an opportunity to address some of the hard questions about where we are, where we are headed, and what kind of world we wish to enter into (and leave behind for our progeny).

Turning Japanese

In 1999, when Bernanke was essentially campaigning for the position of chairman of the Fed, he wrote a paper that lambasted Japanese monetary officials for not doing enough to prevent a sustained period of low inflation, sluggish economic growth, and torpid credit market growth:

Before becoming Fed chairman, Mr. Bernanke led a band of U.S. academics who argued that Japanese officials weren't doing enough to jolt their economy out of its torpor. In a 1999 paper, Mr. Bernanke lashed out at Japanese officials, saying their country's woes were the result of their own "self-induced" paralysis. Japan's responses to deflation, he charged in atypically blunt terms, were confused, inconsistent and too cautious.

(Source)

The basic ideas he set forth were simply that the proper course of action for Japan (said easily enough from his armchair academic position at Princeton) was to simply do more, promise more, and not pull back from stimulus until the economy and inflation were behaving properly.

If they had, he argued, then they could have avoided a prolonged period of low growth, high unemployment, and declining inflation.

More from that same article:

At a conference at sponsored by the Boston Fed in Woodstock, Vt., that October [1999], Kazuo Ueda, then a BOJ policy member, issued a warning to the largely American audience: "Do not put yourself into the position of zero rates," he said. "I tell you it will be a lot more painful than you can possibly imagine."

Mr. Bernanke shot back that Japanese policy makers might be making the same "extreme policy mistakes" Americans made in the 1930s—being too timid about reversing deflation. A few weeks later, in a blistering research paper, he said even though conventional tools were expended, there was plenty the Japanese could do to boost consumer demand, business spending and prices.

Among his suggestions: Cheapen the yen by selling it in the currency markets; or buy long-term debt from the Ministry of Finance to finance tax cuts, something he said was akin to just dropping money from a helicopter.

One objection at the time was that Japan's economic problems weren't the result of too little stimulus by the central bank but of structural problems in Japan's banking system and in protected industries.

Mr. Bernanke said structural problems didn't negate the need to find ways to push up consumer demand and business spending.

"Japanese monetary policy seems paralyzed, with a paralysis that is largely self-induced," he concluded. "Most striking is the apparent unwillingness of the monetary authorities to experiment, to try anything that isn't absolutely guaranteed to work."

Well, here we are, six years into Bernanke's own Japanese experiment, and the U.S. is mired in low growth, high unemployment, and declining inflation. To be blunt, none of his ideas are working out as easily in practice as they did on paper.

The hubris, the easily rankled ego of an academic, was on high display in Bernanke's comments to the Japanese. And that brings us to the nub of the issue today: the Fed's utter failure to back up and admit that its grand strategy is simply not working as planned here.

The (Ugly) Data

The evidence that the Fed's own efforts to shock the economy back to life have failed is quite clear. Anecdotally, pretty much everyone knows exactly what would happen to the equity and bond markets if the Fed stopped injecting $85 billion into the financial system each month: they would crater. So even there, we'd have to give the Fed a poor grade, if not a failing one, for creating markets that are now over-dependent on easy money.

Let's start with employment – or rather, its inverse, unemployment – because that's the main thing to which the Fed has tied its quantitative easing (QE) program (QE).

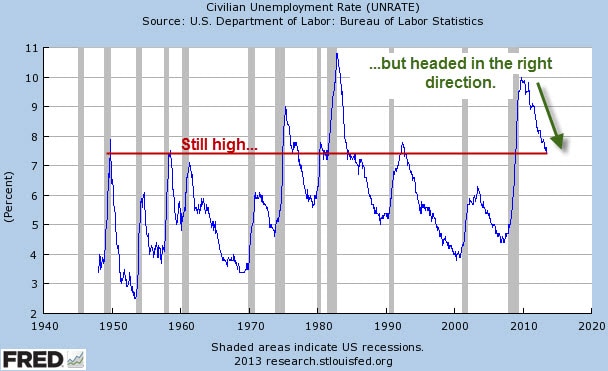

At first glance, it looks as though the Fed is winning the day, because even though unemployment is quite elevated by historical standards at 7.4%, it's at least moving in the right direction:

Like all U.S. government statistics, the headline number is about as fuzzy as they come, and it deserves just a little bit of inspection before we place much confidence in it.

To calculate the unemployment rate requires you to know two things: how many people are out of work, and how many can work. But the Bureau of Labor Statistics (BLS), the government agency that calculates the employment figures, has spent decades introducing one exclusion after another in order to reduce the accounting total for people who are out of work – each time with the effect of reducing the headline unemployment rate.

After all, if fewer people are 'out of work', which means they are not counted, then the unemployment rate will be lower. A smaller numerator creates a smaller fraction.

Fortunately, the BLS still calculates a more rigorous definition of total unemployment (although it is still not completely accurate) that goes by the name "U-6", which it defines as follows:

U-6 – Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force

This alternative measure of unemployment and underemployment stands at 14.0%, or nearly double the headline rate. It excludes those who have not even looked for a job in the last 12 months, and there's good reason to believe there are a lot of those individuals right now.

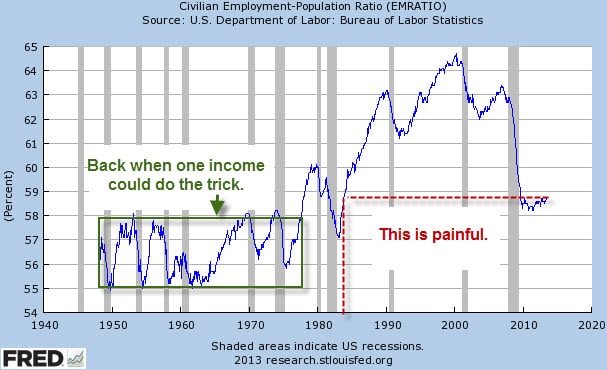

Evidence of that comes from the labor force participation rate, which measures all those who have a job (and, yes, having a part-time job counts the same in this calculation as having a full-time job). It has fallen to painful levels:

In the above chart, where everyone who is employed is divided by everyone of employment age, we can see that just under 59% of working-age Americans are employed. We have to go back to the early 1980s to find a similar employment proportion, and here we'll note that it is much harder to get by on one salary today than it was in times past, indicating something of the hardship embedded in this number.

It stands to reason that a lot of people who want to work, but have not looked recently enough to be counted, are contained in the above chart.

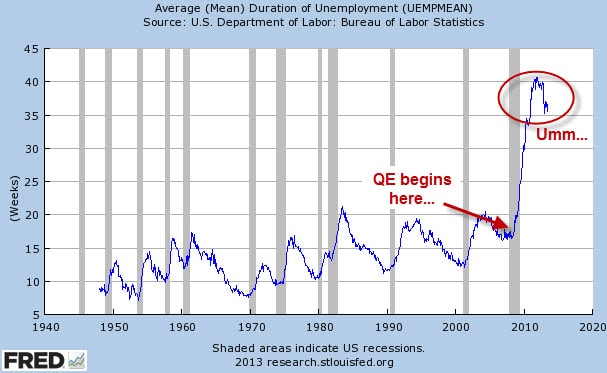

One other way we might surmise that some people have not looked for a job in over a year is to look at how long people tend to remain unemployed once they lose their job. Here the data is particularly grim:

Note that this chart is of the mean duration of unemployment. So roughly half of all people are out of work for just over 35 weeks, and half are out of work for longer than that. If we imagine a nice spread to the data, perhaps a reasonable bell curve, then it's not hard to imagine that quite a few people are well over the 52-week mark and that some of them could easily fall through the statistical cracks.

If QE is helping to bring down unemployment as the Fed claims and the media carefully repeats, then it's not clear at all that it's helping to bring down the mean duration of unemployment from levels that are without precedent in the 60-year-old data set.

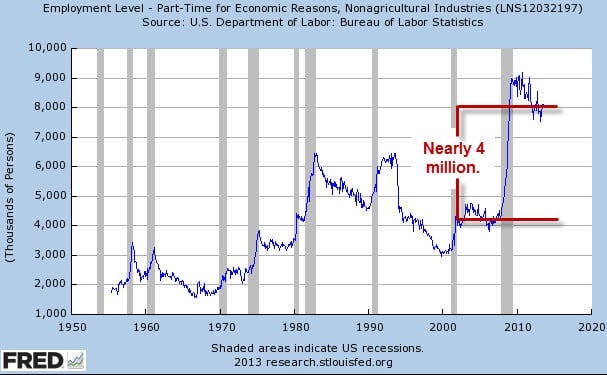

One other area in which QE has failed to help is in the types of jobs created. Of the meager few jobs created since the start of the financial crisis and recession in 2008 and 2009, respectively, nearly 4 million of them have been part-time jobs, which are counted and reported by the BLS with the exact same weighting as full-time jobs:

Here again we will note that QE is not having its intended effect if the goal is to create high-paying, full-time jobs. Instead, all we are getting are a lot of part-time jobs (i.e., lower pay and without benefits). Through the first 7 months of 2013, 953,000 jobs have been created. A full 731,000 of those, or 77%, have been part-time.

Of course, it's silly to blame QE for this, because QE has nothing to do with initiatives like Obamacare, which is one of many contributing factors towards more part-time work being offered and performed. But then again, that's the point. It's just plain silly to tie QE to employment at all in the first place, but that's what Bernanke did, which is why we're taking such a detailed look at it here.

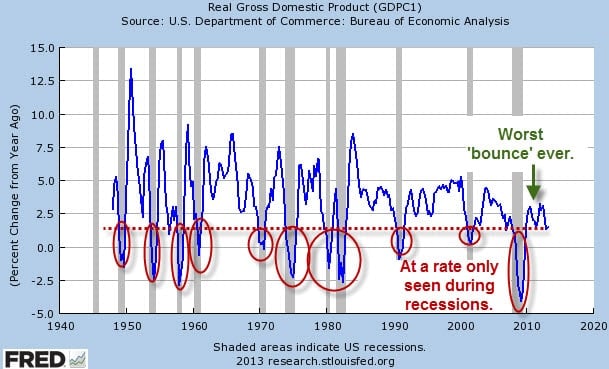

On the subject of GDP growth, the data is even more dismal. The 'bounce' seen after the recession allegedly ended in 2010 is the worst on record, and GDP growth currently stands at a rate not seen outside of the context of a recession at any point over the prior 60 years:

For all of the talk of recovery and improvement and corporate earnings and such, and even with all of the statistical wizardry of the Bureau of Economic Analysis (BEA) at work, the GDP numbers here are indistinguishable from those of Japan after its bubble burst and the Bank of Japan began fighting its deflationary monster.

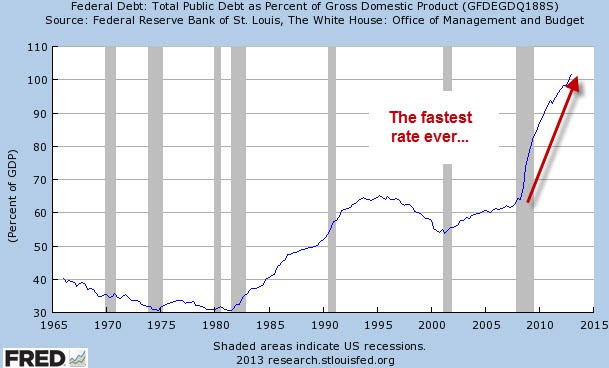

The other similarities to Japan are that the U.S. Fed is now stuck with a zero interest rate policy and finds itself in the business of monetizing enormous quantities of U.S. federal debt.

Like Japan, the U.S. finds its sovereign debt loads not just growing, but exploding at the fastest pace on record for six years now:

The summary here is that Bernanke, after dissing the Japanese efforts, has little more to show for his efforts than they do. The economy remains weak, inflation is low, he's trapped in a 0% interest rate policy, unemployment remains stubbornly high, and federal debt is exploding.

In fact, he does have results. It's just that they are indistinguishable from those of the Japanese.

In Part II: The Real Story to Focus On, we clarify the real issues we need to be dealing with if we want our entry into the future to be anything longer-lived than a kamikaze mission.

The Fed is doing an excellent job of demonstrating how fighting the wrong battles leads to losing the war.

If we want different results (and I do), then we need different behaviors. To get those, you must either change willingly through insight, or else stonehearted reality will force you to on its terms.

If we don't chose the former, the latter is a guarantee.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/why-we-all-lose-if-the-fed-wins/