Originally published at: https://peakprosperity.com/a-time-for-caution/

It’s perfectly clear that we’re in yet another massive equity bubble, this time led by the shiny lure of AI and all it could potentially promise.

And that’s the important part, the ‘potential promise.’ Because once the actual reality of the object of bubbly attention is understood, the boundless fantasies are rather violently adjusted to a concrete level of actual profits.

Until reality asserts itself, bubbles are all fun and games.

Once again, by nearly every measure, US stocks are the most expensive they’ve ever been. Price-to-Sales, Price-to-Earnings, Price-to-Book, the Buffet Indicator (Price-to-GDP), are all at record extremes.

To buy stocks at these levels, you have to believe that this time is different.

Spoiler: It never is.

Which means if you’ve got money in a 401k or a managed portfolio, it’s time for caution.

The AI story is starting to get some doses of reality, such as the fact that every AI company is burning cash to build market share:

(Source)

On the other side of the story, companies that have attempted to install generative AI into their business processes have a stunning rate of failure so far (according to an MIT study):

With tens of billions spent, but not much to show for it yet, it’s pretty easy to predict what comes next – a slower, more thoughtful and careful level of spending and adoption.

In other words, a little dose of reality, which is the one thing most toxic to bubble psychology.

None of this means AI isn’t going to be disruptive and transformative, merely that it’s going to go through a very normal adjustment process of transitioning from the current throw-all-caution-to-the-wind frenetic pace of unquestioned CapEx spending, to a more measured level of spend that balances risk and reward so that profitability can be part of the equation.

Next, Paul and I also discussed more recession signs in both the home construction/real estate and trucking industries. Just anecdotes, but those are often very important as early warning signs. Think Mark Baum’s conversation with the stripper in The Big Short.

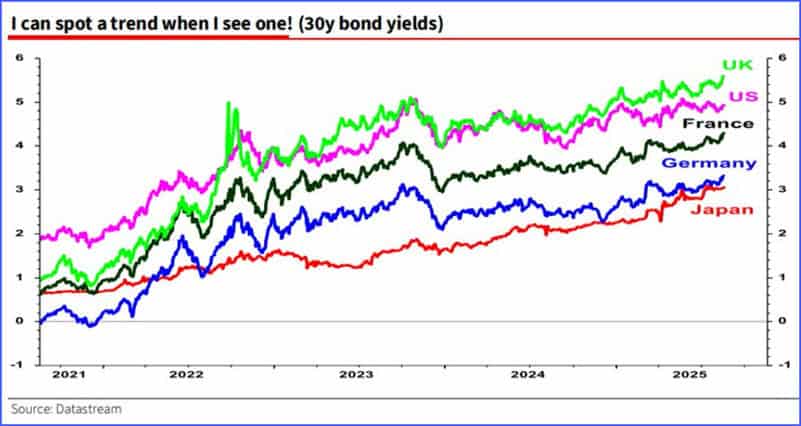

As well, we have to keep our eyes on sovereign long bonds which are clearly in a pronounced upward trend in 5 major countries:

While Trump clearly wants lower interest rates and is willing to fire the Fed Chair over it, getting the Fed to lower short-term rates may not do anything at all for the long bond rates, which set the rates for mortgages. So, pressuring the Fed to lower rates may not even be the economic and stock-boosting move that Trump imagines it to be.

What do these rising long bond rates tell us? Well, clearly, people aren’t comfortable with lending sovereign governments money for a 30-year term. Like us, they are probably thinking that the fiscal prospects of these countries are terrible, especially over a 30-year time frame.

Add it all up, and now is the time to consider how you are going to financially weather a storm. Businesses should be ready to scale back as necessary, and portfolios should be safeguarded from market-driven losses.

But, the storms pass, as they always do, and so it’s equally important to know when to reinvest and what to buy. Me? I am scouring commodities and hard assets.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.