What if you could carry and exchange gold in the exact same manner as you do with the dollar bills in your wallet?

Two years ago, we introduced the precious metals community to a company called Valaurum, which has developed a technology that's making this possible.

From that write-up:

Democratizing Gold

In short, a fractional gram's worth of gold is affixed to layers of polyester, creating a note – called an "Aurum" – similar in dimension and thickness to a U.S. dollar bill. This gold (usually 1/10th or 1/20th of a gram) is commercially recoverable. So an Aurum offers similar potential as a coin or bar, in terms of providing a vehicle for storing and exchanging known, dependable increments of precious metals – just in much smaller (and more affordable) amounts than commercially available to date.

The big idea here? In a world where a 1oz coin of gold costs over $1,200, an Aurum will let you hold a few dollars' worth of gold in a single note. If you've got pocket change, you can be a precious metals owner.

And you don't have to change your behavior. You can store and transport an Aurum in your billfold along with your dollars.

Understanding the Aurum

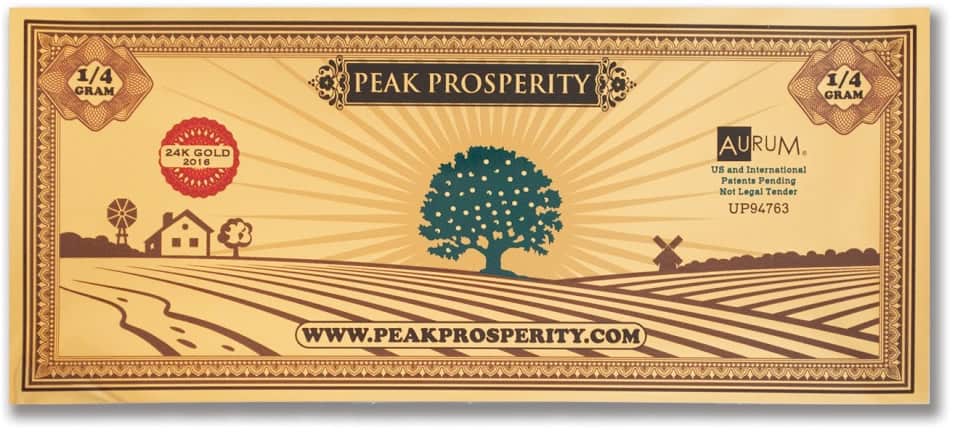

As the saying goes, a picture's worth a thousand words. Here's a picture of an Aurum designed for Peak Prosperity that the Valaurum team produced for us:

You'll see that with even just 1/20th of a gram of gold involved, it's enough to make the Aurum appear to be "made of" gold. The characteristic luster, color, and shine of the 24-karat gold used is immediately apparent.

The Aurum is designed to be handled in the same manner as we do with our "paper" money. And, despite having a more 'plastic' feel to it (resulting from the polyester backing), it's as flexible, lightweight, and familiar-feeling as paper currency.

The big difference, of course, is that instead of being a claim on something else, it simply is what it is: a fractional gram of gold. It can be stored, traded, or melted down – just like a coin or bar.

Here's a brief video that gives an overview of the production process:

//www.youtube.com/embed/eKYxlmwrKQw

Implications

Being able to hold gold in this form is significant for several reasons.

First, it makes gold ownership available to all budgets. Many of the world's households have been priced out of gold to date. This changes that completely.

Second, it enables the potential for everyday transactions should we ever return to a precious metal-backed monetary standard. It answers the challenge: How will you pay for your groceries with gold? With an Aurum, it's now easy.

Whether Valaurum's product emerges as the winning horse or not, the world definitely needs this type of solution (i.e., convenient fractional physical metal) to go mainstream.

I'm very excited by this new innovation in the bullion industry, and I explore the matter in depth in this podcast. If you're similarly intrigued, it's worth the listen.

The response to that podcast was tremendous. It quickly became one of the most popular in Peak Prosperity's history. If the description above interests you, and you haven't listened to it already, you can do so by clicking here.

So, what has happened with the aurum over the past year? With gold increasingly looking like it put in a long-term bottom back in Dec 2015, and modern-day hyperinflationary currency crises underway in countries like Argentina (33% annual inflation), Ukraine (50% in 2015), and Venezuela (720%!), the wisdom of not only owning precious metals as a means of wealth preservation, but holding them in some small-denomination tradable form, makes more sense than ever.

Is the concept of the aurum note catching on with precious metals investors?

We've invited Adam Trexler back to the program to find out. In this week's podcast, he shares with us a number of positive updates about adoption of the aurum, demand by the bullion dealer community, and product enhancement to the gold note itself.

Introducing The 2016 Peak Prosperity Aurum Note

The Peak Prosperity aurum notes we've printed up in the past quickly sold out. Demand was much higher than we had expected.

For those who did not have the chance to purchase any -- or for those who did, and are interested in collecting each new series that gets produced -- we have good news: the new 2016 Peak Prosperity aurum (1/4th gram) is now available for purchase.

Note that this year's aurum note contains more fractional grams of gold than both the 2014(1/20th gram) and 2015 (1/10th gram) versions. In the podcast, Trexler mentions that Valarum's technology innovations now allow for a thicker note, so we thought we'd give it a go this year.

Also note that the premium-to-spot price of this year's aurum note is lower due to several factors, including the higher denomination and technical efficiencies Valaurum has put in place over the past year. But in addition to that, Trexler and his team are giving Peak Prosperity readers a discount of 15% on the 2016 Peak Prosperity aurum note. To receive the discount, enter the code PEAK16

Click the play button below to listen to my interview with Adam Trexler of Valaurum (44m:09s):

This is a companion discussion topic for the original entry at https://peakprosperity.com/adam-trexler-a-new-way-to-hold-gold-2016-update/