Originally published at: https://peakprosperity.com/ais-energy-and-resource-crisis-with-the-rebel-capitalist/

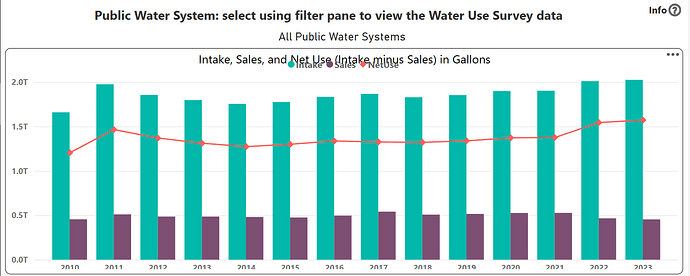

I’m thrilled to share a recent podcast discussion with my friend George Gammon, otherwise known as the Rebel Capitalist. We dove deep into the explosive growth of AI and its massive resource demands, particularly energy and water, which I believe are not getting the attention they deserve at higher levels. As a resource guy, I’m always following the numbers, and what I see with AI is staggering. Data centers are consuming 2 to 5 gigawatts of power—Denver, by comparison, is a 1-gigawatt city. These Nvidia H100 and H200 chipsets are energy hogs, turning electricity into heat and, well, cute cat pictures on skates. But it’s not just energy; cooling these chips often requires vast amounts of pure water—Texas AI supercenters are on track to use 49 billion gallons this year, in a state already struggling with water scarcity.

I’m concerned about the exponential rise in energy and water needs for AI. We’re not ready for this demand. The U.S. grid can’t handle it, and while natural gas is the immediate go-to, production has been flat for over 16 months, and we’re exporting LNG while facing new domestic demands. Nuclear, especially small modular reactors, could be a solution, but regulatory hurdles and labor shortages mean it’s years away—maybe a decade. Meanwhile, China’s energy output has surged to 10,000 terawatt hours, 150% more than ours, with a clear plan involving coal, hydro, and nuclear. We lack such a strategy, and our flat energy growth since 2000 puts us at a disadvantage.

There’s a real risk of conflict between AI’s needs and human needs. I was shocked to learn of language in a recent bill—thankfully removed—that would have prioritized AI over people for energy and water, framing it as a national security issue. If we don’t increase energy capacity, we could face rolling blackouts or rationing, especially if AI is deemed critical to compete with China. Our shale oil boom, once hailed as “Saudi America,” is peaking, with production down to just two counties in New Mexico. The EIA’s 2025 outlook shows flat total energy production through 2050, a stark contrast to China’s trajectory.

Prices for energy and resources like copper are likely to rise—natural gas could jump from $3 to $12 per therm to incentivize drilling, but that shortens reserve lifespans. Higher energy costs will ripple through the economy, impacting fertilizer, plastics, and manufacturing, contributing to inflation the Fed can’t control with rates. I worry this could trigger economic contraction, lowering standards of living as a release valve if we can’t meet demand. AI might take jobs without clear economic returns, and I’m skeptical about its promised prosperity beyond benefiting chip makers and data center operators.

For preparation, I suggest stress-testing your plans against 5-7% inflation and investing in personal energy efficiency—insulate your home, consider solar, live smaller. Commodities are worth watching, though timing is key. For a Plan B, look at energy and food-self-sufficient countries like Argentina with its Vaca Muerta shale play. I’m passionate about ensuring prosperity, but we’re on a shaky path without a coherent energy strategy.

Let’s keep this conversation going—our future depends on it.