Three months ago, Chris told our paying subscribers he was predicting the coming collapse of the U.S. housing market. Unfortunately, he was right, and it is here. (Scroll down to see the original video.)

The data is now confirming his early prediction as you can see below. And, as our Peak Insiders learned in May, it’s time to make plans to either hunker down and weather the storm, or make big moves to find a safe haven. The news can no longer be ignored. Sales are down markedly and it will impact more than just real estate.

Fox News contributor Charles Payne took it a step further giving us an undeniably bleak visual of how far we’ve fallen in just eight months.

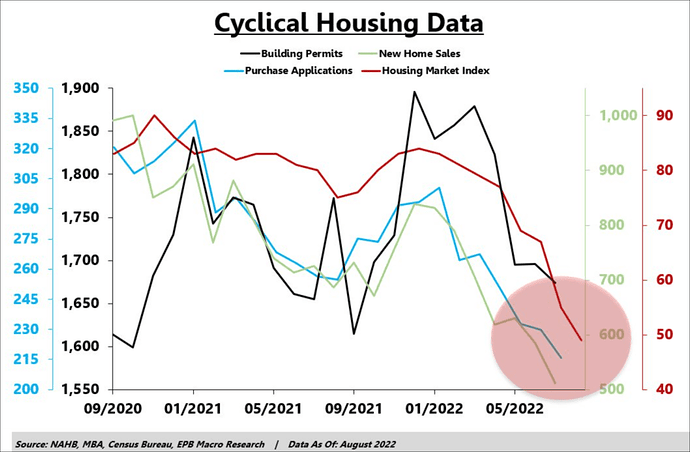

And then there is this bombshell chart below. Every component of the housing cycle is in steep decline.

Unfortunately, it’s more than personal home values currently at risk. There is the downstream economy which is imploding along with it.

When sales and applications and permits all take a dive, construction, supply and retailers all go down with the ship.

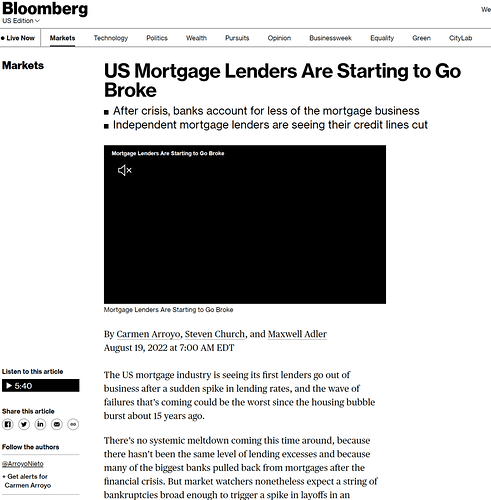

Banks are shedding mortgage components and laying off employees. Sales are trending downward for Lowes, and if demand continues to crater, the recent uptick for other home-related retailers like Home Depot and Ace Hardware will be short-lived.

If you're in a position to purchase a new home (somewhere less volatile than major cities), prices should go your way. If moving is not in the cards, consider other options like a sale-leaseback. (Obviously, do your research first.)

Bottom line: Chris has a strong track record of surfacing important issues long before the mainstream catches on...and while we didn't want to make this article a hard sell about membership, our subscribers were forewarned months ago. Take a look at our subscriber options and consider upgrading your subscription if this kind of news and advanced warning is important to you and your family. The video we are making public below is the very kind of information we give regularly to our subscribers. If you're reading this, you know you don't want to miss out on it. Stay ahead of the curve with us.Here’s Chris’ original story and video on this unfolding situation:

The Great Real Estate Crash of 2022/23

(Published May 3, 2022)I know it seems quite unlikely to people who have been struggling to buy a home that a real estate crash is possible, but I assure you that one is not only possible but has already started.

How do I arrive at this conclusion? It’s partly from data, part deductive and part inductive.

Also, this isn’t my first rodeo. I was front and center in the 2007/08 real estate crash and was one of the earliest analysts calling for a housing bust. It was just too obvious. NINJA loans, Vegas hairdressers with 19 homes bought with extreme leverage, and the pervasive attitude that real estate could never go down again were all factors.

This time it’s price-to-income ratios that are more extreme than 2007/08, slowing sales, and sudden price corrections that have already begun from "the outside in.” Canada, New Zealand, Australia and multiple small city locations in the U.S. have already experienced steep price corrections very quickly.

Certainly, a part of this is the quick rise in mortgage rates which, truthfully, have a long way to go yet before they will be done rising.

So, my advice is to build cash and wait for better prices if you are in the hunt. They will come.

However, the crash will not be contained to real estate alone. The Federal Reserve is now very publicly committed to reducing its balance sheet by an astonishing $95 billion per month. The data says they have already stopped growing the balance sheet.

Sounds boring and arcane but I assure you this is the single biggest financial event of recent times.

It’s all fun and games on the way up, but devastating on the way down. Particularly for the unprepared.

Stocks and bonds are going to get slaughtered as they owe much of their currently lofty prices to all that magical money printing which is now set to go in reverse.

As they say, prices take the escalator up but the elevator down.

Can the Fed manage to run off its balance sheet to this the tune of $95 billion per month without causing the biggest financial asset crash in all of history? Possibly one that ruins economies and tosses us all back into the dark ages? All while food and fuel shortages mount?

It’s doubtful.

It’s equally doubtful that they’d let things run that far before they toss in the towel and resume money printing. Which means the final phase of currency destruction and hyperinflation is what lies in our collective future.

My best guess? This all plays out this calendar year.

The Fed – and all of us by extension – are caught in a box canyon of their own making. There is no path forward, it is blocked. To the left, we have a hard place (crashed financial markets and a resulting Great Depression), and to the right, we have a rock (hyperinflation, destruction of the currency system).

The policy errors that brought us here aren’t a couple of years in the making, but several decades. They won’t be easily fixed. It’s a right proper mess, it is.

This is a companion discussion topic for the original entry at https://peakprosperity.com/as-predicted-the-housing-crash-is-here/