Originally published at: https://peakprosperity.com/deja-vu-all-over-again-ais-many-similarities-to-the-dot-com-bubble/

With every era of financial speculation comes a reason why the old economic laws must be suspended. Today is no different.

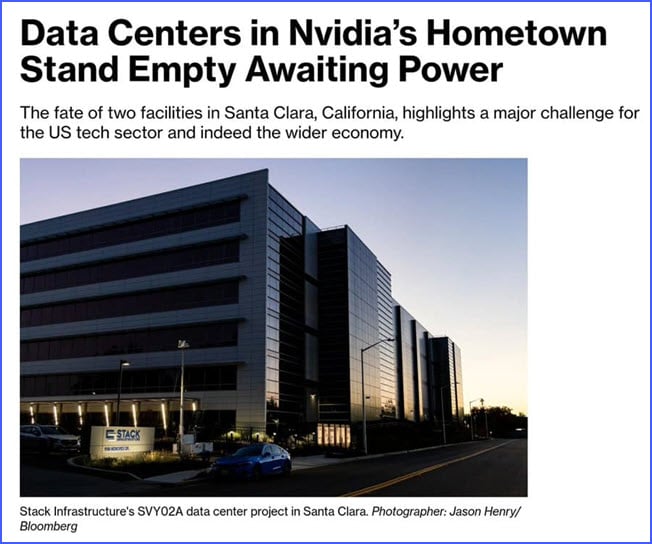

What was sold as a “new era” of limitless growth is starting to look like every other speculative mania. Companies are spending tens of billions on data centers and chips, but many of those facilities sit empty, waiting for power that may never come. One massive Texas project—complete with its own nuclear, gas, and solar plants—can’t find a single major tenant.

Many companies have turned to the most transparently inappropriate of accounting tricks, like expensing (‘depreciating’) chips over a 10-year period instead of 3 or at most 5 years. Sure, this keeps the bubble bubbling, but all false narratives eventually end in tears.

In many ways, the AI super bubble reminds me of the internet bubble. Most pointedly, the internet bubble overbuilt internet capacity detected in the form of “dark fiber” which was optimistically laid hither and yon at great expense. It was not “lit” in some cases for a full decade. But, hey, at least it sat there ready to be used.

Not so for data centers, built but unused, either because tenants can’t be found, or because – get this – there’s no power available.

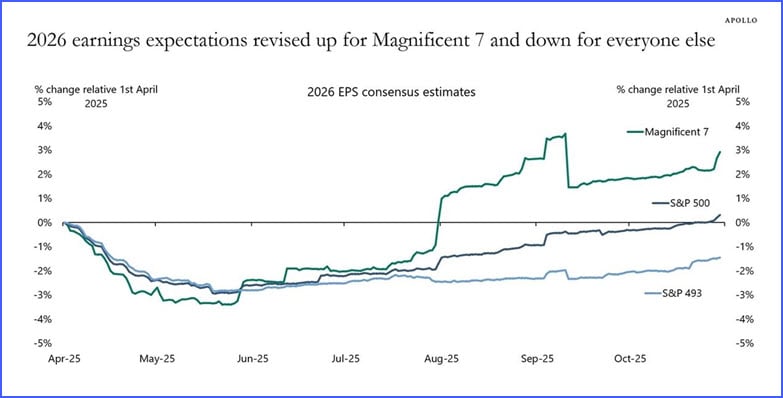

The Market Is Dangerously Top-Heavy

Beneath the calm surface of the headline S&P 500 index level, a skinny handful of mega-cap tech stocks are holding everything up. The rest of the market – literally hundreds of companies – are seeing falling earnings expectations. Healthy above, but rotting below.

Without the Mag 7, the other 493 S&P 500 companies are experiencing negative earnings growth. This means anybody investing in the S&P 500 index is really making an AI-Tech investment.

Value stocks, consumer staples, and anything “boring” have been crushed. Retail investors are all-in at the exact wrong moment, with more money in stocks than even at the peak of the dot-com bubble.

Meanwhile, Warren Buffett has been quietly selling stocks and piling up cash for over two years—the clearest signal that even the legends see storm clouds.

Trump’s “America First” Vision Is Already Fracturing

The president wants to reshape global trade and keep the dollar dominant, but that’s going to require political muscle, and for some reason, Trump is busy undermining his own base.

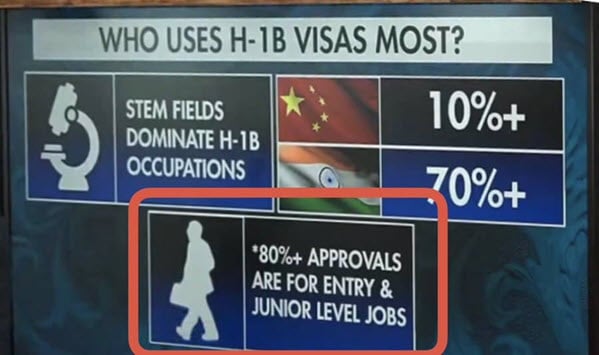

He’s expanding H1B visas, opening universities to hundreds of thousands of foreign students, proposing stimulus checks but only to certain citizens, and floating the idea of 50-year mortgages, sending a clear message: Americans and their future are unimportant.

All of this while young Americans face near-10% unemployment, can’t afford homes, and are being told by the President that they lack skills, all while tech giants import cheaply paid junior talent.

This isn’t just bad policy; it’s political suicide. Trump cannot launch a grand national project to reshape the internation economic landscape without robust domestic support, especially the vigorous and energetic young.

If the reshaping project goes off the rails, the economic consequences are likely to be quite severe.

Deflation First, Then Chaos

Given all this, the model we’re operating under remains the same. First the fall (deflation), then the printing (inflation).

Those deflationary forces have already made landfall:

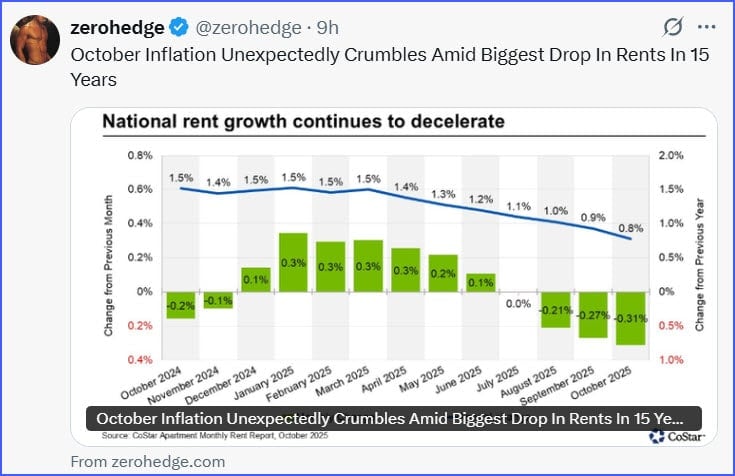

Rents are falling fast, with October 2025 recording the biggest drop in 15 years. The rental price pressures caused by demand from millions of migrants is reversing, and the housing market is about to feel it.

Deflation may soon show up in official inflation numbers, thereby handing the Fed the cover it needs to print again. We’re already being “prepped” and we won’t have to wait long:

While the Fed may start slow, our prediction is that before too long, the response won’t be measured: it’ll be panic. Stimulus checks, infrastructure splurges, and money printing on a scale beyond COVID are already being discussed. That’s the path to a dying dollar. Which brings us to…

Silver and Gold: The Real Story

While everyone chases AI dreams, a quieter crisis is playing out in physical commodities.

Silver is in its seventh straight year of supply deficit. It has been projected by some that in 2025, every single ounce pulled from the ground may go straight to industry, leaving nothing left for investors or jewelry.

Russia is stockpiling silver, while the US and China have declared silver a ‘critical mineral,’ opening up the prospect of export controls or even national stockpiling.

Gold, meanwhile, is still deeply under-owned compared to the flood of dollars in circulation and vast mountains of financial assets.

Morgan Stanley has even gone so far as to suggest that a 60-20-20 portfolio might make sense:

(Source)

Note that gold still remains under 2% across the universe of invested assets, so the question is, “How high would the price of gold go if that 2% tried to move to 20%?”

Answer: A lot higher.

How to Survive (and Thrive)

You can’t time the top perfectly, but you can manage risk. Paul Kiker’s approach:

- Develop a sound and comprehensive strategy and stick to it.

- Stay mostly invested, but keep one foot near the exit.

- Define clear sell triggers—price drops, volume spikes, momentum shifts.

- Hold cash not out of fear, but to pounce when others panic.

- Favor beaten-down value stocks when they finally stabilize.

- Talk straight with yourself and your family: protecting capital now matters more than chasing the last 10% of upside.

Kiker Wealth Management – Our Endorsed Financial Advisors

All of the above make a strong argument that it’s time to set aside passive investing approaches in favor of a risk-managed approach. To schedule a free, no-obligation meeting with Paul Kiker’s team at Kiker Wealth Management to go over your portfolio and strategy.

People constantly report back that Paul’s approach and recommendations were exactly what they needed to hear.

To schedule your initial meeting, please visit PeakFinancialInvesting.com, complete the simple form, and a member of Paul’s team will contact you within 48 business hours to arrange the first call.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.