Originally published at: https://peakprosperity.com/did-the-fed-begin-stealth-qe-if-so-that-has-huge-implications/

In today’s Finance University episode, I once again had a great discussion with Paul Kiker from Kiker Wealth Management.

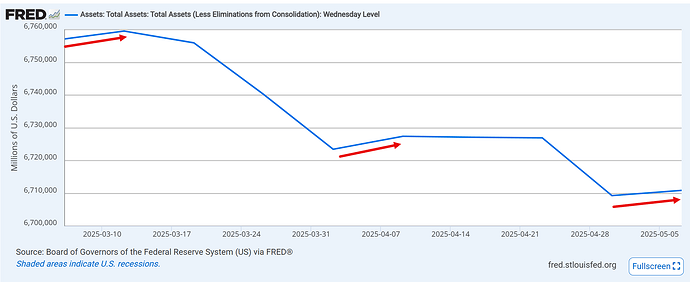

First, we discussed the Federal Reserve’s recent decision to do nothing. No rate cuts for you! Despite the lack of movement in this week’s Fed meeting, there’s evidence suggesting that quantitative easing (QE) might have quietly been restarted. On May 5th and 6th, the Fed purchased some $35 billion of US Treasury bonds. If such an enormous burst of purchasing wasn’t QE, then what exactly was it? I speculate that it was a stealth move to inject liquidity into the system. This is particularly interesting given the backdrop of a market that’s been under a lot of stress, with bond yields fluctuating and a notable failed bond auction in Germany.

We also touched on the topic of Peak Oil, which is no longer just a fringe theory but is now being discussed in mainstream financial news like Bloomberg. The CEO of Diamondback Energy has stated that U.S. shale oil production has likely peaked, which signals a truly massive moment in global energy history. Too few are paying any real attention to this story, but our specialty is getting you to the action early and often.

We also discussed Central Bank Digital Currencies (CBDCs). Both Trump and Treasury Secretary Bessent have voiced opposition to CBDCs, which is a blessing as far as we’re concerned.

We also explored the broader economic implications of these developments. The bond market has been in a drawdown for an unprecedented 57 months, and with the Fed’s actions, it seems they’re trying to manage an unsustainable debt trajectory without causing a market rebellion. This could lead to a scenario where the benefits of monetary policy primarily enrich those closest to the money creation process, exacerbating economic inequality.

Lastly, we discussed the potential for a nuclear renaissance in the U.S., contrasting our slow progress with China’s advancements in thorium reactor technology. This shift towards nuclear energy is completely essential for energy security, and it cannot come a moment too soon for our taste.

In summary, we’re navigating through a complex economic environment where traditional financial tools are being used in unconventional ways, potentially setting the stage for significant shifts in energy, finance, and economic policy. It’s a time for vigilance and strategic planning, as the decisions made now could define the economic landscape for decades to come.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.