Originally published at: https://peakprosperity.com/economic-collapse-approaches/

I believe an economic crash is now unavoidable for the United States. Let me explain.

The core of my argument rests on the undeniable link between energy consumption, particularly oil, and economic output. When you look at the data, it’s clear: countries with higher GDP consume more oil. This isn’t just a correlation; it’s causation. Every aspect of our economy, from transportation to manufacturing, relies heavily on oil.

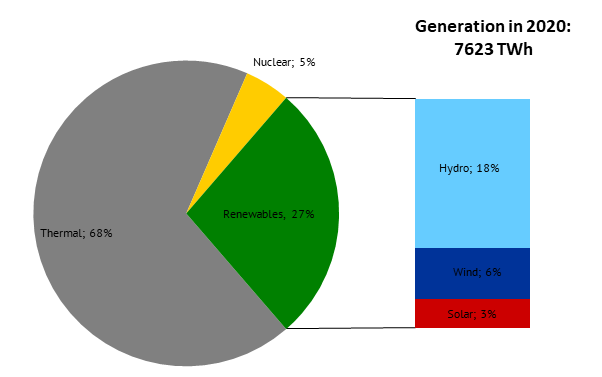

Ditto for electricity and GDP. As the saying goes, “There are no low-energy rich countries!”

However, we’re facing a critical issue. The U.S. has been on a debt-fueled growth path, with debt growing much faster than our GDP. This is unsustainable. You can’t indefinitely increase your debt faster than your income, whether you’re a family, a business, or a nation.

The debt-to-GDP ratio for the US has been on a thoroughly unsustainable trajectory for years. Everybody knows this, too. Jerome Powell has testified to this effect in front of the US Senate (2023), and Scott Bessent has said the same thing in May 2025.

The Trump administration has essentially given up on fiscal restraint, pushing for policies that will increase federal debt by $2 to $2.5 trillion annually for the next decade. The “Big Beautiful Bill” is a gargantuan heaping of “something for everybody” style deficit spending. Except for the average person. All they have to look forward to is lots of inflation before the dollar keels over entirely.

The Trump administration has abandoned fiscal restraint and is instead betting on economic growth to outpace all the existing + new debt.

But, here’s the catch: as the GDP/energy charts above reveal, economic growth requires energy, and our primary energy source, oil, is hitting a peak. And that’s not just me saying that anymore, now I’ve got the EIA on my side (courtesy of the most recent 2025 STEO report):

The shale oil boom, which many thought disproved peak oil theory, is now showing signs of geological exhaustion. Not a lack of capital, or will power, or cleverness, but plain old boring geology. Major shale basins like the Permian are experiencing declining well productivity, and despite technological advancements, once a field starts to decline, it’s a one-way street.

This peak in oil production isn’t just a blip; it’s a fundamental shift. The implications are vast. If oil production declines, and with it our economic output, how will we manage our colossal debt? The answer isn’t clear, but it’s evident that our current economic models, which assume endless growth, are about to be tested like never before.

We’re entering a new era where energy scarcity could redefine economic stability. This isn’t just about oil; it’s about all forms of energy. Our leaders need to understand this, but there’s a widespread ignorance about energy’s role in our economy.

But the big news is that I think I’ve uncovered another major blind spot in our energy planning, this time on the side of Natural Gas. Hey, one man’s bad news is another man’s terrific investment thesis. That’s in Part II for subscribers…

Click here to go to part 2.