Originally published at: https://peakprosperity.com/ed-dowd-it-has-begun-housing-credit-and-fcf-have-cracked-stocks-are-next/

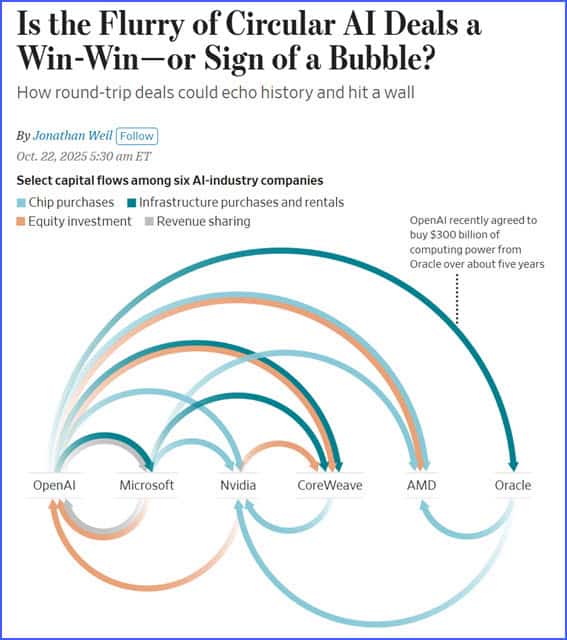

In this podcast, I sit down with Ed Dowd, the former BlackRock portfolio manager, to discuss the AI bubble and how the stock market is entirely being propped up by just 7 companies, most of whom are engaged in what is being termed “circular financing.”

That practice hearkens back to the dot.com bubble when companies engaged in what was termed ‘vendor financing.’ In other words, you pay your customers to buy your products. In this era, ‘circular financing’ is vastly more complicated in is workings, but the essence is exactly the same when the maneuvers are boiled away.

Ed explained that the math just isn’t mathing. OpenAI, the company behind ChatGPT, needs something like $900 billion of annual subscription revenue at 25% margins just for a 10% ROI.

Nope, not going to happen.

And certainly not before their first waves of chips wear out and have to be replaced at enormous cost.

So, what happens when this bubble bursts? Ed believes that a serious market crash is in the cards. Of course, this means stocks will drop in price, but the main action is going to be in the credit markets.

Treasuries will continue to advance in price (fall in yield), making them an attractive option to ride out the storm, while other forms of lesser credit will implode, as is already happening across the subprime lender space (TriColor, PrimaLend, First Brands).

When will this happen? According to Ed, it already is. He tracks the Free Cash Flows (FCF) as the more important arbiter of company health and by that metric, all of the Big 7 companies are experiencing declining FCF, while Oracle’s debt is getting more and more expensive to insure against a default.

And, oh by the way, stocks are at historically expensive levels, a condition that has historically resulted in very poor returns over the following years:

Ed’s view is Deflation first (in housing & credit destruction), which will force the Fed back to QE again, leading to a second inflation wave (energy + money printing).

At the same time, Ed views Trump and Bessent’s messaging on the economy as tone-deaf (“Greatest economy ever!”) while the real economy implodes. Ed thinks that a “Hoover scenario” is highly probable, where Trump is remembered for overseeing one of the greatest economic collapses in US history.

Given all this, what should a prudent investor do? Tune in to hear Ed’s outlooks…

For those who now realize that having a risk-managed approach is more important than ever, please do yourself a favor and schedule a free, no-obligation meeting with Paul Kiker’s team at Kiker Wealth Management to go over your portfolio and strategy.

People constantly report back that Paul’s approach and recommendations were exactly what they needed to hear.

To schedule your initial meeting, please visit PeakFinancialInvesting.com, complete the simple form, and a member of Paul’s team will contact you within 48 business hours to arrange the first call.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.