Originally published at: https://peakprosperity.com/gold-is-screaming-are-you-listening/

Gold is screaming higher, and that’s concerning to everybody who is paying attention. Gold’s price has been actively suppressed by the West for so long, that we now have to ask if the West has finally lost control of something important.

At a minimum, it will have lost the trust in, and respect for, its dominant pricing power and abilities. Which is a solid scoop taken out of the narrative foundation upon which our entire faith-based system of fiat money rests.

No faith = no control = a system of money that can very rapidly break down.

So is that what it signals? Has ‘the time’ finally arrived, or is this just another spurious signal we should tune out?

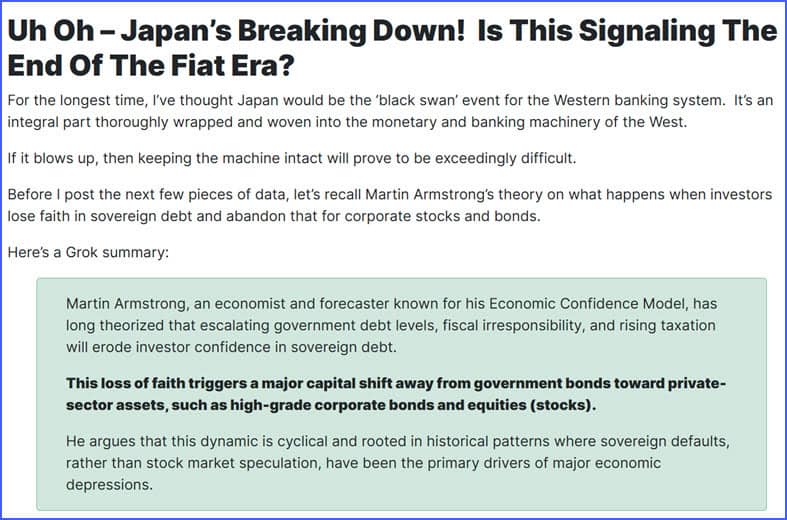

Well, one possible clue to help us answer that lies within the recent actions within the Japanese financial and monetary systems.

The set-up for having that conversation begins with this element, first raised in this week’s Fat Pipe:

As I wrote a bit later in that bit, “In practice, what that would look like is a decline in the price of long-dated government paper (bonds) and a corresponding spike in interest rates, with a concomitant shift to purchasing the stocks and bonds of the domestic corporations.”

This dynamic is exactly what we saw over in Japan earlier this week:

Japanese long bond yields spike higher:

Japanese equities spike higher:

Japanese yen falls sharply:

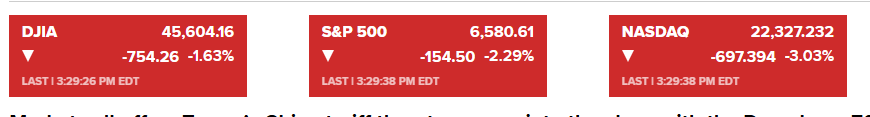

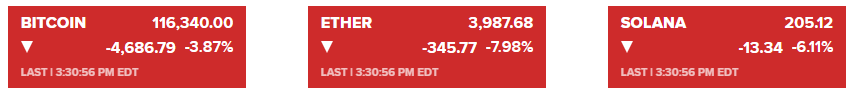

ngs us back to gold. What if it’s ‘telling us’ that big players are now worried about systemic financial risk? Or maybe even the complete loss of confidence in fiat ‘money’ itself?

ngs us back to gold. What if it’s ‘telling us’ that big players are now worried about systemic financial risk? Or maybe even the complete loss of confidence in fiat ‘money’ itself?

We can’t say for sure yet, but it’s definitely worth keeping a very close eye on things from here on out.

Listeners are encouraged to seek a truthful portfolio review with Paul Kiker’s team to prepare for potential market volatility and inflation by going to peakfinancialinvesting.com. Click here and fill out the simple form to get started.

We also discussed:

- China’s Economic Dominance: This podcast contrasts China’s manufacturing prowess and infrastructure investments (e.g., advanced robotics, high-speed bridges) with Western economic policies, suggesting China’s strategic accumulation of gold and manufacturing capabilities positions it favorably in a potential monetary reset.

- U.S. Economic Warning Signs: We cited several concerning U.S. economic indicators, including a record 15% home purchase cancellation rate in August, a 40% drop in luxury home sales, and significant losses in auto loan values, signaling potential economic distress and a possible recession.

- Wisdom in Financial Planning: Paul Kiker once again emphasized the importance of seeking wisdom in financial decisions, advocating for prudent, long-term strategies over chasing short-term gains. He encouraged investors to prepare for volatility by maintaining diversified portfolios and emergency funds.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.