Peak Prosperity publishes ALERTs very rarely, and only when my co-founder Chris Martenson and I are concerned enough to take personal action.

On May 8, I released an ALERT informing our premium subscribers that, concerned by the ramifications of the global central banks’ response to the coronavirus, I was moving a material percentage of my portfolio’s cash reserves into precious metals, notably into silver as the gold/silver ratio then of 110:1 remained near a record high.

Since the issuance of that ALERT, gold has broken above it’s previous all-time high price, moving up 14%, from $1,717/oz to $1,950/oz.

And silver has performed strikingly better: rising over 55% from $15.75/oz to $24.50/oz. As anticipated, the gold/silver ratio has fallen nearly 30% to 80:1.

However, much more important than this near-term pop in the precious metals is their outlook going forward.

We’ve been writing for years here at PeakProsperity.com about gold and silver’s extreme undervaluation given the risks we’re facing in our monetary and financial systems. And yet, for years, the metals languished as capital flowed eagerly into “paper wealth”, fueled by central bank liquidity, record low interest rates, and a rampant increase in debt and deficits.

Back in 2017, Grant Williams famously and correctly nailed the neglected state of the precious metals in his prescient work, Nobody Cares.

A year ago, as gold managed to break above it’s longtime ceiling of $1,350/oz, we began loudly alerting our readers that the years of neglect were finally over. That, indeed, investors were beginning to “care” again.

Fast forward to where we are today, a pandemic and +$5 trillion in global central bank liquidity later, and now it’s seeming that suddenly Everybody Cares about the precious metals.

Gold’s – and silver’s – time has arrived. Precious metals are finally back in a secular bull market.

Key questions to address at this moment are:

- How much further are prices likely to move from here?

- What are the odds of a price correction in the near term, given how far and how fast prices have moved recently?

- How well-positioned are you to take advantage of this bull market in the metals?

Fundamentals: Higher Prices To Come

Money Printing/Inflation Concerns

More currency = inflation. Milton Friedman famously and correctly stated: “Inflation is always and everywhere a monetary act”.Well, since March 1, the US Congress has already approved nearly $3 trillion in legislation (with another $1-3 trillion on the way, depending on which political party’s plan gets passed). And the Federal Reserve has already expanded its balance sheet by over $2.5 trillion, with forecasts of another $2+ trillion being added later this year:

<img class=“aligncenter wp-image-576137 size-large” src=“https://peakprosperity.com/wp-content/uploads/2021/09/FT-Fed-balance-sheet-projection-1024x602-2.png” alt="“Projected 2020 Federal Reserve balance sheet” width=“1024” height=“602” />

And that’s just the US. The rest of the world is following suit:

Billionaire seasoned investors like Paul Singer, Ray Dalio, and Paul Tudor Jones are now raising loud concerns about the diminishment in purchasing power all of these new freshly-printed trillions will have on national fiat currencies. When big dogs like these, who have feasted on and benefitted magnificently by the status quo over the past decade, fret about about the central banks “printing too much”, you know it’s time to worry.

TINA (There Is No Alternative)

In today's environment of zero-to-negative interest rates, big financial institutions and pension funds aren't able to get a meaningful return on the bonds the hold in their portfolios:

The absence of yield is forcing portfolio managers to diversify into gold. While gold also has no yield, it offers a hedge against today’s extreme valuations in equity and bond prices, as well as powerful purchasing power protection:

Gold’s Record Rally Fuelled by Unlikely Buyers (Bloomberg)As we've been educating readers about for year, it's very important to note that gold -- and especially silver -- is extremely underowned as an asset class even though the investable markets for the metals are much smaller than many realize. It will only take a small percentage of the world's capital to shift from stocks and bonds into the metals to send their prices soaring much higher:July 29, 2020

“Safe government bonds have always played a very important role as a portfolio diversifier and will continue to be, but we have to recognize that their potency is diminishing due to the low absolute level of yields,” said Geraldine Sundstrom, who focuses on asset allocation strategies for Pacific Investment Management Co. in London.

“We need to diversify our diversifier and look for safe haven beyond government bonds. Given Pimco’s view that rates will be kept very low for years to come causing depressed levels of real yield, gold feels like an appropriate diversifier,” she said.

Pimco, which manages $1.9 trillion in assets, is far from alone. In a May note, Citigroup Inc. cited “new non-traditional investors in bullion, including insurance companies and pension funds” as part of the fuel behind the rally.

The world's privately-held gold bullion amounts to $2.5 trillion, with much of it tightly held by investors not looking to sell anytime soon. If just a few of the large institutional funds not currently invested in gold decide to start accumulating, gold will quickly become known as "unaffordium" (hat tip to GoldSilver.com's Mike Maloney).“There has definitely been more widespread institutional ownership of gold than in previous rallies,” says John Reade, chief market strategist at the World Gold Council. “Gold’s in the conversation now with much more investors than it was 10 or 20 years ago.”

Even so, gold ownership among the professional class is viewed to be low. The total value of investor positions in gold futures and exchange-traded funds is equivalent to just 0.6% of the $40 trillion in global funds, according to UBS Group AG strategist Joni Teves. That position could easily double without the allocation looking extreme, she wrote in a note.

Reade, who previously worked at hedge fund Paulson & Co., reckons no more than one in five institutional investors has an allocation to gold.

Silver is much crazier. Since most of the silver ever mined has either been commercially consumed or used for jewelry/religious purposes, private above ground stores are tiny: about $48 billion (that’s with a “b”, not a “tr”). Even if we add to that all of the $17 billion or so in annual silver expected to be mined this year, that’s only $65 billion.

It would take only a few billionaires taking a stake, or the tiniest amount of demand shifting from the $20 trillion US Treasury market into silver, to convert the metal into “unobtanium” (again, hat tip to Mike).

Technical Analysis: A Short-Term Pullback Likely

With such a large advance happening so fast, a short-term pullback in the prices of gold and silver are probable; even welcome.A 10-15% correction would keep the price action from becoming overheated and turning into a blow-off top, which typically gives up most of its prior gains. Also, such a modest correction would give investors opportunity to enter the market/add to their positions at lower prices.

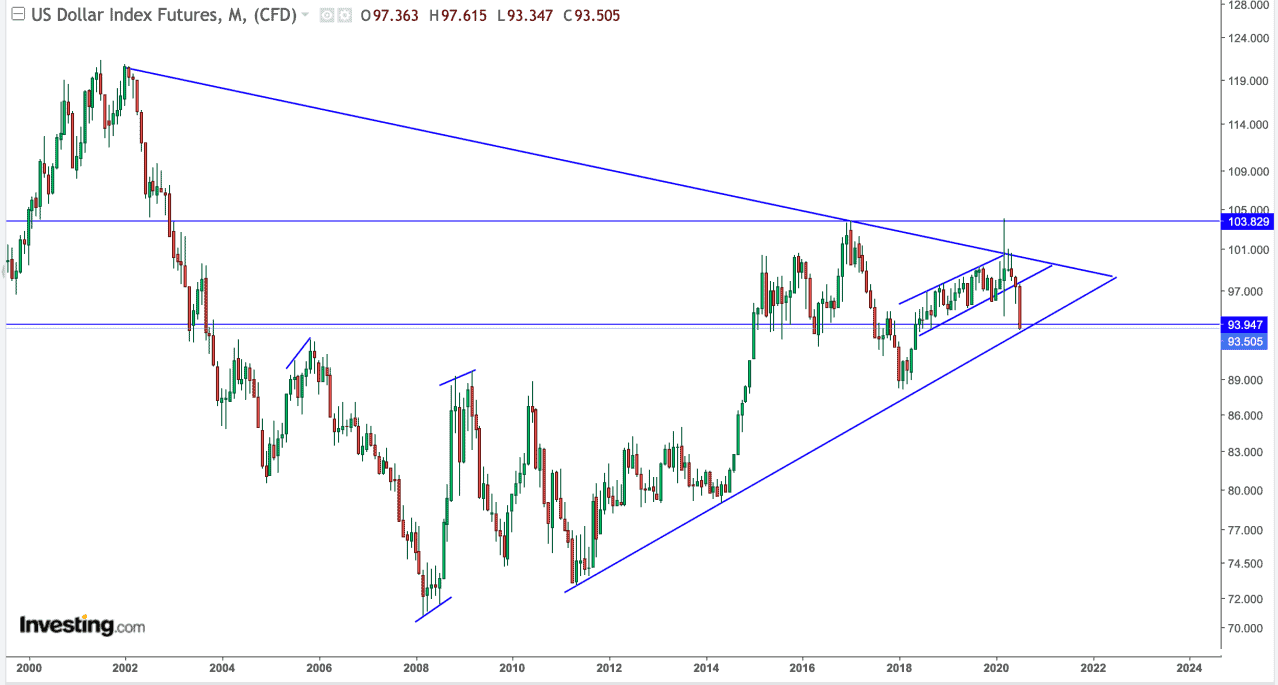

Cup & Handle Formation?

Most technical analysts see gold as in the process of forming a massive multi-year cup and handle pattern. Once the "cup" is formed, a minor cooling off period follows (the "handle"). After the handle is complete, a climb to new highs usually occurs.Here’s a classic example of a cup and handle pattern:<img class=“aligncenter size-medium” src=“https://peakprosperity.com/wp-content/uploads/2021/09/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a-1-scaled.png” alt="“classic cup and handle pattern” width=“3274” height=“2074” />

And here’s gold, along with a projected price zone should a handle indeed follow next:

Should a handle develop and then complete, gold’s price could easily be in the mid-$2,000s (or higher) in short order.

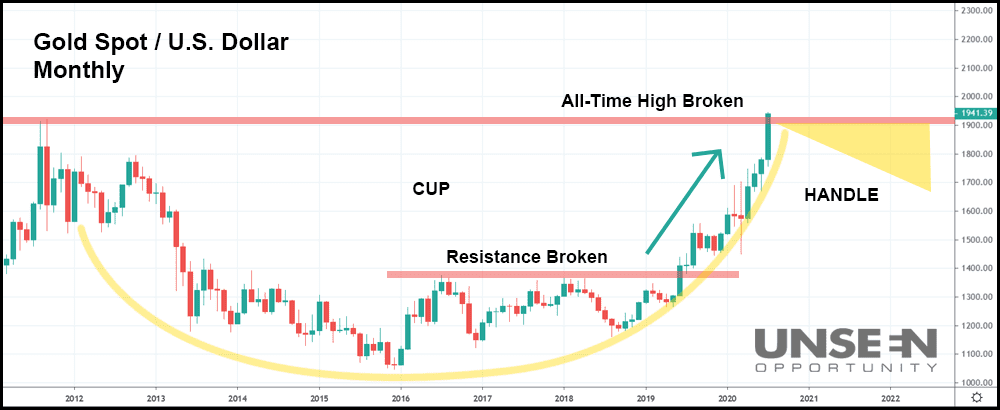

Weakening Dollar About To Strengthen?

Another reason to be prepared for a near-term price correction has to do with gold's trading correlation with the dollar. Most of the time (but not all of the time!), gold trades inversely to the dollar.Gold’s big run-up from $1,500 to $2,000 over the past few months has occurred alongside a sharp drop in the USD. Should that reverse, it would not be surprising to see gold fall as the dollar rises.

And we can see in the chart below that the dollar is now hitting the bottom of its multi-year trading range, which could likely serve as support for it to bounce off:

(Source)

So caution is calling us to expect a short-term price correction in gold and silver before we expect to see new record highs later on.What Investors Like You Should Consider Doing Now

Jeff Clark, senior precious metals analyst at GoldSilver.com, estimates that we are only entering the second inning of this new secular bull market. "The really big gains still lie ahead", he predicts. (you can hear a lot more from Jeff in this video, recorded today)So, what should regular investors like you be considering at this moment?

Here are our recommendations, though it’s important that we make it absolutely clear this not personal financial advice. As always, we recommend working with a professional financial adviser to build an investment plan customized to your own needs and objectives. (If you do not have a financial advisor or do not feel comfortable with your current advisor’s expertise with gold or the market risks we discuss here at PeakProsperity.com, consider scheduling a free consultation with our endorsed advisor)

All right, with that important caveat out of the way, here are the steps we think worth seriously considering:

If You Don't Own Any Gold or Silver (Step Zero)

If you don't own any, then buy some now, whatever today's prices are.Precious metals first and foremost are insurance against financial/monetary crisis. Just as you wouldn’t drive your car without auto insurance, you don’t want to neglect adding this crisis insurance to your investment portfolio.

So get your initial precious metals position in place now. And start sleeping better knowing you’ve got that protection in place.

For guidance on where to purchase bullion (we particularly like the Hard Assets Alliance and its metal storage solutions), what form to own it in, and where to keep it, read our free Primer On How To Buy And Store Gold & Silver.

If You Already Own Precious Metals (Steps 1-3)

If you already hold gold and silver in your portfolio, pat yourself on the back. You've likely enjoyed watching the recent price run-up.Here are the steps we recommend you consider now:

- Explore options for protection against a short-term price correction in the metals. Stops, puts, covered calls -- these are all ways to hedge against lower prices. Don't try using these yourself if you're not already well-experienced with them! Work under the supervision of a financial advisor with deep expertise using these, who can craft a hedging strategy appropriate for your portfolio and your goals. If you don't already have such an advisor, click here to schedule a completely free, no-obligation consultation with Peak Prosperity's endorsed financial advisor.

- Create a regular program to increase your position over time. The best way to accumulate precious metals is to do so over time, letting the power of dollar cost averaging work for you. The Hard Asset Alliance's MetalStream program is our favorite solution for this, as it automatically purchases gold and silver for you at the ratio you want on the frequency you want. But, if preferred, you can certainly create your own DIY program if you have the discipline and don't mind the hassle.

- Determine if and how you want exposure to precious metals mining companies. When gold and silver prices rise, the shares of the companies that mine these metals tend to rise a lot farther. Owning shares of precious metals mining companies can be very lucrative; but you can easily lose a lot of money, too. If you're interested in exploring gaining exposure to mining shares, first read Jeff Clark's free guide on the topic and then talk to your financial advisor (or schedule a free consultation with the one we endorse) about how best to put this into action in your portfolio.

Gold’s re-pricing is reflecting that realization. The big question is: How much more uncertainty remains ahead?

The financial markets remain ridiculously overvalued. The Federal Reserve and the world’s other central banks are hell-bent on continuing to print more $trillions. In the US alone, tens of millions of households have lost their income, while daily deaths from the coronavirus continue to hit records on a daily basis. The upcoming US presidential election is certain to be hotly-contested, should it even happen.

The reality is that the future is packed full of uncertainty. And more uncertainty will drive the price of gold, and silver, higher. Likey much higher – as Jeff Clark reminds us we’re still in the early innings here.

Use the time now to get smartly positioned.

This is a companion discussion topic for the original entry at https://peakprosperity.com/golds-and-silvers-time-has-arrived/