I am a gold bug. And a silver bug. And I like trees and land and oil wells.

In short, I am a huge fan of hard assets. The reasons why are numerous but they all rest on my profound disdain for the ruinous policies of the US Federal Reserve and other central banks.

They’ve never met a crisis that they (a) didn’t create themselves and (b) decide needed to be met with a wall of fresh money printing.

Inflation isn’t the price of things going up, it’s the value of money going down.

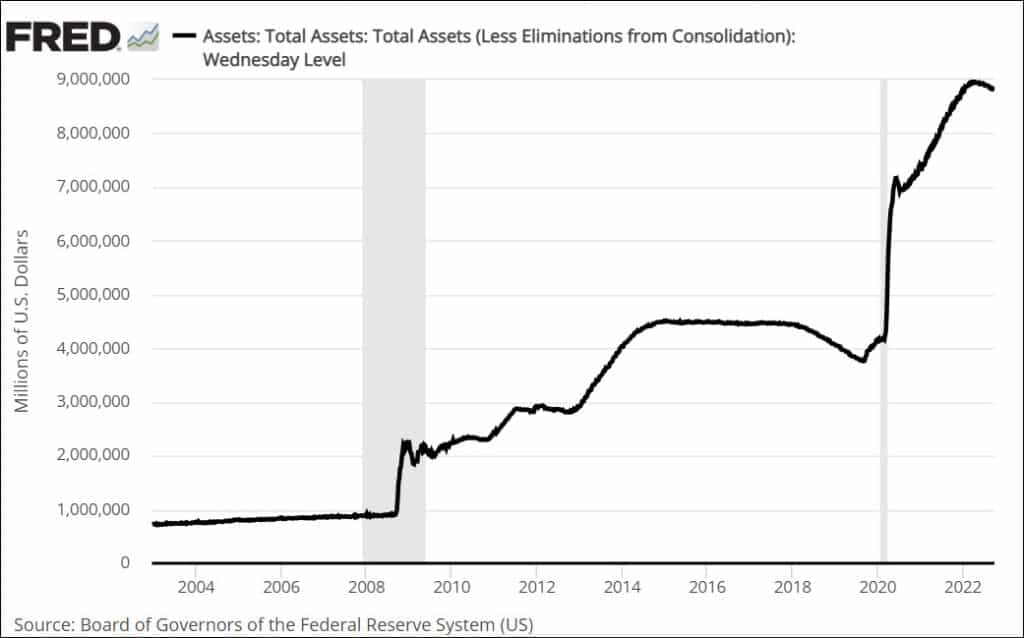

Exhibit A:

I sincerely doubt the Fed manages to work off more than 20% of that last burst of money printing before they are “forced” to fire it all back up again and print, print, print.

My prediction is that the next set of crises are barely a year away if that. While neither of us can do one thing about the Fed’s ruinous tendency to print, we can side-step some of the damage by getting out of paper currency and into hard assets.

In our desire to help you navigate these troubled waters, we are constantly searching for the right partners who bring great customer service and good offerings to the table.

Today I am pleased to introduce GoldCore to you. After many phone calls, and then personally trying out their service (without them knowing about it, of course) I can heartily recommend this firm to anyone who wishes to buy and then securely store gold and/or silver.

I really like the GoldCore team, their philosophy, and their overall approach to providing top-notch client service.

Full disclosure: this is an affiliate relationship. While you will not be charged a single penny more for our referral to GoldCore, Peak Prosperity will receive some compensation should you open an account and buy and/or store gold or silver with GoldCore. I will always disclose such arrangements as a matter of principle. Here’s the link: https://info.goldcore.com/peak-prosperity-contact

Fuller disclosure: Evie and I have silver in a vault in Zurich stored with GoldCore and that feels good. I found the process of opening an account the most seamless of my entire experience of opening various accounts. They’ve done well with their technology and processes.

I plan to have Stephen on my show on a routine basis to help us stay abreast of economic and financial events as they unfold.

Finally, I (and my team) are 100% interested in any feedback (positive or negative) you might have about your experience(s) with GoldCore. We aim to please (and so does GoldCore).

So, without further ado, allow me to introduce Stephen Flood, the CEO of GoldCore.

This is a companion discussion topic for the original entry at https://peakprosperity.com/introducing-goldcore/