Originally published at: https://peakprosperity.com/its-time-to-believe-your-lying-eyes/

Happy Thanksgiving to all our US listeners! We hope you are enjoying your fellowship and food with gratitude.

On the one hand, the stock market keeps bouncing back, demonstrating nothing but resilience and strength. Up and to the right! On the other hand the real economy – the one that consists of the vast bulk of people working, shopping and living – is in miserable shape.

At least as measured by ADP payrolls, freight traffic, consumer sentiment, spiking insurance bills, skyrocketing real estate taxes, manufacturing recession, and corporate bankruptcies.

We’re really being asked to believe in something that is not true. Namely, that somehow AI capital investments are the same thing as having a robust economy.

So, the invitation here is to believe your lying eyes.

Do not “listen” to the stock market for direction, but rather notice how the people around you are behaving; are they in expansive spending moods, or are they retrenching a bit? Alos take notice of the economic data and decide for yourself where the truth lies.

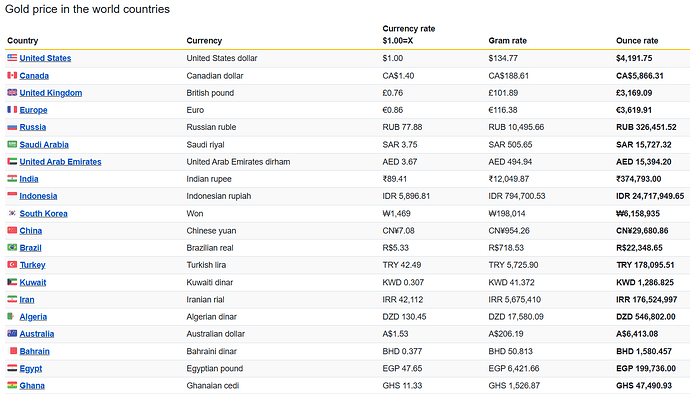

Here are some of the base “real” data Paul and I discussed this week:

- U.S. consumer sentiment recorded its second-lowest reading ever (51), surpassed only by the COVID lows; sentiment among 18–34-year-olds is at all-time lows (worse than GFC or 1970s stagflation), signaling deep frustration and potential political radicalization.

- The “real” consumer-driven economy is weakening rapidly:

- ADP employment change trending negative

- Trucking volumes down 17–30% y/y (GFC levels)

- Manufacturing PMI contracting for 23 of past 25 months

- Corporate bankruptcies on pace for worst year since 2010

- Cost-of-living squeeze intensifying for households:

- National average property-tax increase +7% in 2025; Chicago homeowners hit with record +16.7% hike as commercial RE collapse shifts burden to residential

- Home, auto, and health insurance premiums up double-digits again

- Food prices still elevated (rate of increase slowed, but no absolute declines)

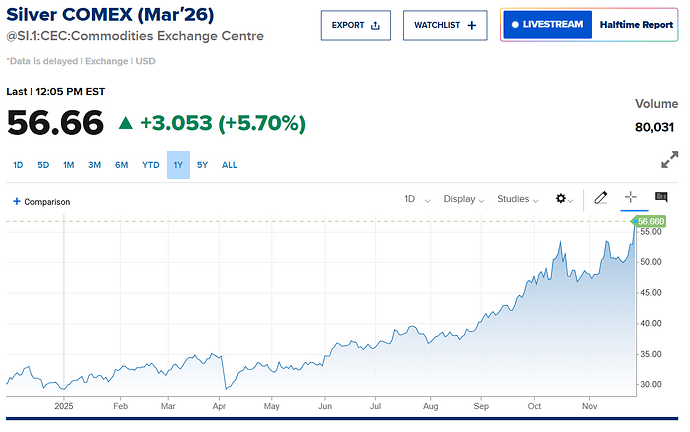

Further, the AI bubble, upon which everything rests, is showing some real cracks in its surface. Most profoundly, Google has developed and deployed ‘tensor’ chips called TPU’s which are a huge improvement in efficiency, cost, power consumption and shortened processing times.

Oops!

Nvidia’s impossible moat has turned out to be a muddy ditch.

And, like broken records, Paul and I continue to marvel at the ridiculously expensive equity markets which would have to fall by -30%, -50%, or -70% to reach ‘extremely overvalued,’ ‘overvalued,’ and ‘fairly valued,’ respectively.

How to Survive (and Thrive)

You can’t time the bubble’s burstings perfectly, but you can manage risk. Paul Kiker’s approach:

- Develop a sound and comprehensive strategy and stick to it.

- Stay mostly invested, but keep one foot near the exit.

- Define clear sell triggers—price drops, volume spikes, momentum shifts.

- Hold cash not out of fear, but to pounce when others panic.

- Favor beaten-down value stocks when they finally stabilize.

- Talk straight with yourself and your family: protecting capital now matters more than chasing the last 10% of upside.

Kiker Wealth Management – Our Endorsed Financial Advisors

All of the above make a strong argument that it’s time to set aside passive investing approaches in favor of a risk-managed approach. To schedule a free, no-obligation meeting with Paul Kiker’s team at Kiker Wealth Management to go over your portfolio and strategy.

People constantly report back that Paul’s approach and recommendations were exactly what they needed to hear.

To schedule your initial meeting, please visit PeakFinancialInvesting.com, complete the simple form, and a member of Paul’s team will contact you within 48 business hours to arrange the first call.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.