Hmmm… a whole new angle on the AI thing to consider.

which part? Sprot trusts doing well or Ag is going to dip again? Got a link to your Michael Oliver podcast?

In the long run, until the long awaited train wreck, the graph goes up and to the right (finally, how long have we been waiting?). Clean water, warmth, food and family may be all that matters eventually.

Looking at the Interlinear bible, I saw some other stuff too.

https://www.bibliatodo.com/en/interlinear/genesis-6-2

Roughly translated: “The sons of the El-o-him that saw the daughters of man (ha-adam) were beautiful, and they took for themselves wives of all whomever they chose.”

And then: “And said Yahweh, my spirit shall not strive with man forever, for indeed he is flesh, and yet his days shall be 120 years.”

So human women were so cute, the “sons of the Elohim” (the “powerful ones”) just couldn’t resist. Were the human women so much prettier than the “daughters of the Elohim”?

Yahweh sounded somewhat irritated - but he consoled himself that ha-adam would “only” live for 120 years.

After reading this, I wondered - if ha-adam lived 120 years back in the practical stone-age, why are human lives so short today what with all of our “science”?

I thought you were taking the weekend off? ![]()

![]()

![]()

Heh my report takes me a lot longer to write than 15 minutes for an Interlinear Bible review. ![]()

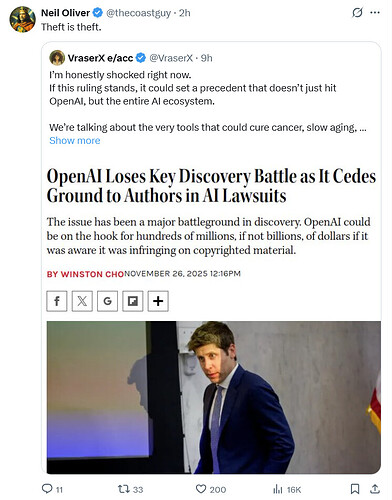

It was my primary thought about AI. I spend alot of time thwarting the bots just on my dog’s website. They’re slurping up the entire web providing few if any citations. Some bots do read my robots.txt, others swarm in via different IPs and lap everything up.

Of course the bots are infringing on copyrighted material. Typically, just provide a link to the source and all is well.

.

bitCON ETFs bring in tasty fees for BlackRock, from Grok:

.

.

Are Bitcoin ETFs the Primary Source of Revenue for BlackRock?

No, Bitcoin ETFs are not the primary source of BlackRock’s overall revenue, but they have become a major and rapidly growing contributor, surpassing some of the firm’s flagship products in fee generation. As of November 2025, BlackRock’s total revenue is dominated by its core asset management and advisory fees from a vast portfolio of ETFs, mutual funds, and institutional services (~$19.4 billion in Q3 2025 alone). The iShares Bitcoin Trust (IBIT) and related crypto ETFs are a standout performer, generating hundreds of millions in fees and outpacing older giants like the S&P 500 tracker (IVV), but they represent only a fraction (~1–2%) of the company’s total AUM-driven income.

Revenue Breakdown (BlackRock Q3 2025)

Based on BlackRock’s latest earnings and analyst reports:

| Revenue Source | Est. Annual Contribution (2025) | % of Total Revenue | Notes |

|---|---|---|---|

| Core ETFs & Index Funds (e.g., IVV S&P 500, bonds) | ~$10–12 billion | ~60–65% | Bread-and-butter; low-fee, high-AUM products ($13.4T total AUM). |

| Institutional & Advisory Fees (pensions, sovereign wealth) | ~$4–5 billion | ~20–25% | Long-term contracts; stable but slow-growth. |

| Alternatives & Active Management (hedge funds, private equity) | ~$2–3 billion | ~10–15% | Higher fees (0.5–1%) but volatile. |

| Bitcoin & Crypto ETFs (IBIT, ETH ETFs) | $245–$260 million | ~1–2% | Explosive growth: IBIT alone hit $70.7B AUM in <2 years, generating $245M fees by Oct 2025 at 0.25% expense ratio. Outpaces IVV’s $187M despite IVV’s $624B AUM. |

- Why Bitcoin ETFs Stand Out: Launched in January 2024, IBIT reached $70B AUM faster than any ETF ever, with $52B inflows in year 1. At 0.25% fees, it edged out IVV ($187M fees) by July 2025. Combined with ETH ETFs, crypto now tops BlackRock’s revenue sheets for new products, a “big surprise” per execs. However, this is dwarfed by the firm’s $19B quarterly revenue—crypto is a high-margin slice, not the pie.

- Trend: Crypto’s share could hit 3–5% by 2026 if inflows continue ($100B+ AUM projected), but it’s volatile (e.g., $2.34B outflows in Nov 2025 amid BTC dips).

BlackRock’s strength lies in diversification—Bitcoin ETFs are a win, but far from primary. For context, their total AUM is $13.4T, with crypto <1%. Sources: BlackRock Q3 earnings, Bloomberg Intelligence, CoinDesk. If you mean a specific quarter or metric, let me know!

I’ve seen some interpretations of this to mean that God was signaling that the “striving” between him and mankind would only last 120 jubilees- where each jubilee is a 50 year period. Meaning, 6000 years of human history before God (in the person of Jesus Christ) establishes a 1000 year millennium kingdom on Earth.

Ken Johnson has published a lot of material on this subject. According to the calendar that the Essenes preserved from ancient times (solar, not lunar), we just entered the last 50 year jubilee period which started September 2025.

I have to say, I’m allergic to “interpretations” post-Covid.

Pfizer trial: numbers showed, vax killed more than it saved. Interpretation: “Safe & Effective.”

Post-Covid, I just read what is written. I don’t assume “God”, I just read “Yahweh” (singular), and “Elohim” (group), and “El Yon” (singular, most-high El). Same with “jubilee” - I just read “year”.

You can feel free to blame Covid for my simplistic approach.

Ag dipping back to 50-51 area…

Don’t have a link but in latest interviews he raised his age price prediction significantly…

Uk man visits Florida goes to a shooting range and posts pic of him shooting at the range. Returns home to UK and is promptly arrested and spends a night in jail. This is yet another reason why I will never set foot in the UK. It’s a conquered nation.

Joe Salaten uses pigs as the last step before tilling an area for gardening.

It’s getting so absurd.

https://x.com/iamyesyouareno/status/1995578685223768174?s=61&t=Mwt6vB5qMDygkHDLxH9PhQ

It’s Time to Believe Your Lying Eyes?

Or MAYBE NOT!

Perhaps it’s all SLOP!

SLOP Beyond Media: IT, Support And Cybersecurity

"While SLOP is most obvious in media, the same dynamics creep into other parts of organizational life. A recent Harvard Business Review article coined the term “workslop” to describe low-quality content that requires rework and lowers productivity. In IT, support, coding and documentation, AI can amplify either sloppy habits or strong ones. And in cybersecurity, adversaries can turn SLOP into a weapon.

Documentation SLOP refers to AI-generated documents that look authoritative but contain errors or contradictions. They create friction disguised as clarity.

… AI amplifies what’s already there. Sloppy habits scale into SLOP. "

Ag seems to be holding so far. Some strange looking vertical drops on the charts (for both Au & Ag), but then zig-zags up and to the right. What will be the next “consolidation” range to buy the dip, if there’s even any available? Took a quick peek today and couldn’t find any Ag under $60/oz. retail price. Am Eagles…don’t ask ~$70.

Edit: typos

Uh. $62.50 or so

You can get them a lot cheaper on Ebay. They may not weigh the same though.

I’m Not expert on silver/market/charts by ANY STRETCH OF IMAGINATION!!! therefore I’m listening a lot of PM channels to get me an idea"where the puck is going…" and it seems like it will be going LOT HIGHER then where we are now… And since I started to stack way too late(4 years ago)… I’m trying to buy any pullback I can… Last couple of weeks ago at around 47… Now it seems if I’ll get any around 53 (50 would be a load a truck moment…??) I’d be happy…

I’m hearing also about a big crash in market… BUT even if it’s probably inevitable… It might not be imminent(Rick rule…?) so I’m thinking we could get bigger pullback but maybe from lot higher prices that could be even higher then where we at now…

So for someone like me with no knowledge or experience… Pretty confusing…(Especially when I’m hearing about market collapse since I started to stack…)

[quote=“Vlastimil “V”, post:79, topic:46254, username:vlastimil”]

I’m Not expert on silver/market/charts by ANY STRETCH OF IMAGINATION!!! therefore I’m listening a lot of PM channels to get me an idea"where the puck is going…" and it seems like it will be going LOT HIGHER then where we are now…

[/quote]

Check out Vince’s updates with Arcadia Economics on youtube if you don’t already.

He thinks that the squeeze in Silver isn’t here yet (but will come). He also said in today’s update that he is talking to industry people who think there is a plan in the works to open various 401K type accounts to invest in PMs in ways they couldnt before.

What I like about Vince is that he has a lot of market experience. So he puts his theories into historical context. Rather than just saying, “A guy I can’t name told me something secret that he can’t source” he tells you about an idea he had that links to what has happened previously during times of change or stress.