>>> Please people correct me if I’m wrong. After Dr. Kory’s testimony, the NIH begrudgingly removed its recommendation against Ivermectin, but has since reversed again and now recommends against it. I was having a debate with a fellow lawyer and Hare Krsna who let me know the NIH reversed its position on Ivermectin.

Hladini, the NIH changed it’s recommendation once since Dr. Kory’s Senate testimony - from “not recommended for C19” to “neither for nor against for C19” and I can’t find anything about another change. You might want to ask your fellow lawyer for sources.

https://www.covid19treatmentguidelines.nih.gov/antiviral-therapy/ivermectin/

You wrote:

Is that too much to ask? Oh and dark humor too. Really sick twisted stuff that makes me realize how good I have it in this life.

Is this allowed on the site? I’ve been holding back.

I was worried about you or your family. Thanks for the update. Stay Gold Ponyboy

Umm, typical response. The entire video is political and yet I am the one politicizing. Right. He speaks repeatedly of “Republicans”. My comment has no mention of political sides. In fact, I claim just the opposite, that our problems are not red/blue.

Maybe you could kindly point to the “politicization” I am guilty of. It was a short comment, it shouldn’t take long.

He might “have the numbers right”, but to state that debt to build productive assets is comparable to debt to fund many of our social programs couldn’t be farther off the mark. The “numbers” just don’t support that conclusion.

Loose him or lose him?

So, it’s not recommended for or against. Got it. Thanks.

C’mon, quit trying to drag me down rabbit holes. Oliver accurately portrayed the accumulation of debt and under whose administrations it was built up, or paid down, as the case may be.

The question in my mind is why we haven’t seen runaway inflation or economic collapse while both have been predicted loudly and repeatedly for four decades now, particularly on this site for the past 13 years. What is actually happening and why?

A comment about this element of wotthecurtains’ statement with personal gender alterations, because I will always use gender specific pronouns when I am aware of gender, which is sometimes more difficult than others.

<<Most of all, I just want to be a dude(ette) living his (her) life in a crazy time making better decisions because I have relevant salient information. I already understand why that information is usually not available so I know I want that “second order thinking” that gives me an edge in a world dominated by crazy events.>>

I think wotthecurtains’ statement sums it up for me. This is the “Why?” of Peak Prosperity. For me, it’s the most basic and important aspect of Peak Prosperity. and what makes it valuable to me. Knowledge gained here allows me to step outside the fray with more confidence and clarity. I have gained information that has allowed me to move a few steps ahead of the thundering herd. I gain insight from every post, whether I agree or not. IMHO, this is the only site on the internet that is worth paying for.

We don’t know what we don’t know until someone offers up the spark of information that we need to explore the idea.

I want to ask the question to PP members. Given what Chris has presented re WEF, Gain of Function, censorship, safe treatments for Covid (IVM) and everything else crazy in 2020, what drives a PP member to take the “Vaccine”? I am very curious. I would like to know if there are datapoints or alternative science that has driven you to make a decision of this nature. I am actually shocked and would like to know your thoughts if you would share… curious minds.

Thanks!

Tough question, but here is some of my thinking as I have helped a senior with this question:

–with ages over 60 or so, chance of death about 1% on average, up to 10% for age 90, according to some databases. That is average, with common health issues and probably no FLCCC protocols.

–If one ends up in a hospital or care facility (not uncommon at the older ages after a fall or ??, then the medical care (such as FLCCC protocols) is essentially out of your hands, and into the hands of the institution. So with any kind of emergency, you’re exposed to high risk setting, with poor prophylaxis. Yes, maybe you can get a lawyer for IVM in time, maybe not.

–At age 90, expected life is not that many years so trade-offs with future complications like ADE are not as acute as say a 50 year old.

–As my Naturopath rightfully decries: there is not any good data on "if you’re this age, and you have these health conditions, then if you use (IVM, Vit D at x levels, Melatonin, etc) then we can expect about these ___ outcomes. In other words CDC nor Universities have given us any good data on these. I have heard from a physician in India that with 60 to 100 nl Vit D that most can get Covid and almost not even know they have it. But where are the studies with specific outcomes for specific ages and conditions.

–No long-term studies on safety/side effects of weekly or bi-monthly IVM use.

Not saying to VAX up. Just saying these are some of my thinking for an older person.

I’m going to reread Scott Nearing…

https://www.mayoclinic.org/diseases-conditions/coronavirus/in-depth/coronavirus-vaccine/art-20484859

If you can start a thread, im happy to explain why I took the vac even after understanding IVM and potential downsides of vac.

I am might be close to you in the Vancouver, WA area.

You said,

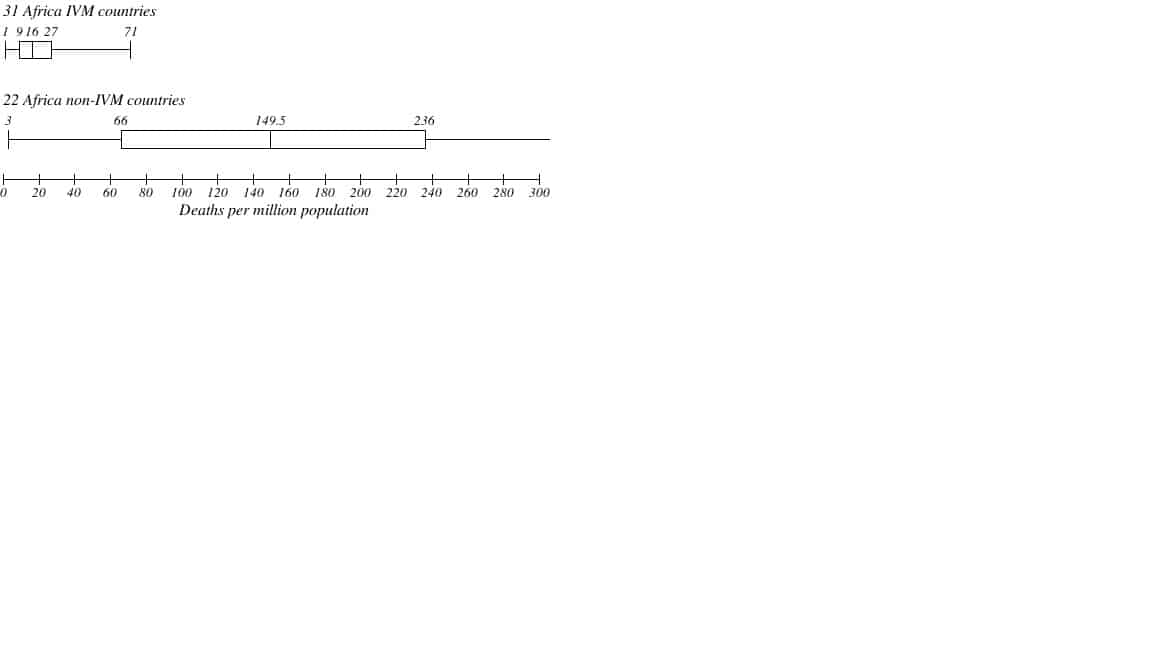

No long-term studies on safety/side effects of weekly or bi-monthly IVM use.I don't think this is really true. For it's use in, for instance, African nations fighting parasitic diseases, it is given very long term in infrequent dosing (I need to research how infrequent - the FLCCC protocol may call for more dosing that is really necessary). As I have published several times on this website, when you look at the Covid-19 mortality statistics and compare them for African countries that have WHO-based community Ivermectin programs vs those that don't, as stunning difference becomes apparent. This ends up being a testament to the efficacy of low and infrequent Ivermectin vs Covid-19. People have rights to their own bodies... as far as I am concerned they should have the right to choose Vax or (IVM/HCQ) prophylaxis, or simply their natural immunity.

Conversely I think anyone of child bearing age (or younger) should avoid the vaccine.

There are vaccines we give to older people( pneumonia, shingles, flu) that we don’t give to those who are younger why should this be any different?

Life is all about risk vs reward. When you are young the Covid risk is low and the vaccine risk is high. When you are old the Covid risk is high and the vaccine risk is lower (sterility isn’t an issue).

Doug wrote

The question in my mind is why we haven't seen runaway inflation or economic collapse while both have been predicted loudly and repeatedly for four decades now, particularly on this site for the past 13 years. What is actually happening and why?Part One Here are three answers for that question, interconnected: 1. Monetary stimulus (originated at the Federal Reserve) mostly goes almost directly into the pockets of high net worth individuals who then park that money in assets. It's what drives up the prices of luxury goods and equities. Since it doesn't circulate across the economy, it has near-zero volatility; hence no measurable effect on the cost of living of the average Jane and Joe Mainstreet. It just pumps the nominal value of rich people's portfolios and possessions. 2. The limited monetary stimulus that does trickle down to Main Street affects the price of consumer goods. However, the cost of producing many consumables has been steadily decreasing over the last 40 years. Lower cost of production means prices for many goods could decrease (which would make each dollar purchase more), except that the surplus dollars trickling into the system offset that deflationary trend. It is this battle between production-caused deflation on one hand and excess dollar-caused inflation on the other hand keeps the official rate of inflation around 1 or 1.5%. 3. The official government calculations of inflation (CPI) is based on periodic sampling of the prices of a basket of common consumer goods. That basket is periodically revised. One effect of that revision is that we don't have an accurate measure of inflation over time. You cannot, for example, compare the official rate of inflation from 1980 and 2000 and 2020. In each of those years, a different basket was used, making a direct comparison impossible. Additionally, the vast majority of the items in those baskets are items whose prices are positively affected by the production gains I mentioned in #2. That produces a downward pressure on price inflation that comes from being selective about what to include in the basket at any particular time in history. At the same time, what is removed from the basket are items that are, over time, showing the impact of inflation. And thirdly, items that people really want and need are excluded from all baskets. For example, what most people want and need is good food, healthcare, homes to own or rent, gasoline for their cars and oil for their winter heaters, and higher education for their children. (We can all do without the latest, cheaper but more powerful iphone; we cannot do without food and shelter.) Those are areas where the real impact of inflation is evident, but it is not officially tracked. So even though rent, for example, has climbed from about 20% of income 40 years ago (when I rented) to a third of one's income when my kids rented, to a half or more today, officially there is no significant inflation in the economy. Ditto for food, gasoline, healthcare expenses, and university tuition, among other things. Lesson: You only get what you look for; the government looks for items to measure that can blithely and untruthfully make a case that there is little to no inflation despite all of the dollars pumped into the system since 2008. Part Two 1. Money generated by the Federal Reserve and spread through large financial houses to corporations and high net worth individuals is known as monetary stimulus. That's what I was talking about in Part One. Notice that monetary stimulus in recent decades is made available to large institutions at zero or near zero interest rates: it's essentially free money that's handed to those who already have plenty. They, in turn, lend it to their best customers at very slightly higher interest rates - making the first users of that money beneficiaries of lower interest rates than you and I will ever see. The further down the economic ladder that money travels, the higher the interest rate to the borrower, because everyone in the chain is taking their percentage. The poorest borrowers - Jane and Joe Mainstreet - pay the highest rate of interest on what started out as free money for the uber-wealthy and highly connected. 2. Money added to the budget because of Congressional action is known as fiscal stimulus. It can be given out to Joe and Jane Mainstreet either as tax rebates and offsets, or as "helicopter money," like the recent 3 stimulus checks we've been handed since the Covid lockdown. That money - whether it's borrowed to offset tax benefits or to pay directly into citizen bank accounts - has to be borrowed into existence from the Federal Reserve, therefore it carries a real interest rate. Joe and Jane don't have extra money, but are living paycheck to paycheck, so unlike rich Morris and Mavis, Joe and Jane will spend their stimulus checks on consumables (food, gasoline, rent, clothes). Morris and Mildred's Fed-direct monetary stimulus was parked long term in assets. It has no volatility. Joe and Jane's Congress-direct fiscal stimulus is put into motion. Depending on how quickly they turn those dollars into consumables, the velocity of that money will rise off of zero more or less quickly. The more times it turns over in the economy, the more it causes inflation - because it's now more dollars chasing the same amount of goods at a growing rate of turn-over. When more dollars chase the same amount of goods, especially at increasing volume, it increasingly takes more dollars to buy each good. We think of that as prices increasing, but actually it's purchasing power decreasing due to a glut in dollars circulating through the economy at a faster and faster rate. (When the Fed gets around to increasing interest rates because inflation is running higher than they like, that will be to sop up some of those extra dollars - because the more you have to pay in interest rates the less you have available to spend on consumables. That slows volatility, hence lowers the rate of inflation.) Part Three: The expectation of many economists has been that the three stimulus checks will cause inflation, making it even harder for Joe and Jane to make ends meet. Several things have prevented that, at least so far. 1. Joe and Jane used the initial check(s) to pay down credit balances. That was smart of them because Americans are, on average, dangerously in debt and many are at risk of bankruptcy. From a policy standpoint, however, it was a disaster because it did not stimulate consumption. 2. The Covid lockdown has had the effect of drastically idling spending. We don't consume gas, take-out or sit-in meals, entertainment venues, travel lodging, or transportation services like we used to; we don't even get our hair cut or nails trimmed. 3. Many renters have been excused from paying rent; students don't have to repay student loans, etc. As a result, dollars that would have been spent on rent, loan repayments, etc., are not circulating in those circles, depressing the rental unit owners, staff and contract companies for student loan processing, etc. Where those dollars are being spent is a question that needs better exploration. On the face of it, I'd say some of it is going to food, which is subject to inflationary pressure. We're also seeing used car prices rise dramatically with nary a peep from retail buyers who seem willing to pay whatever increase is asked - perhaps they're replacing or adding cars with money not being spent on rent and loans. (I'm speculating; I haven't seen data or narrative explaining these correlations.) Aside: Some observers have argued that governments don't want to release citizens from Covid lockdowns too quickly for fear of massive consumption binges that would put a lot of sidelined stimulus cash into high velocity. Phased opening and release from lockdown might be the strategy, to moderate the potential spike in inflation. Maybe. I don't know, but it's not inconceivable, sadly. It makes economic sense, if not ethical. The government will provide more fiscal stimulus checks because one trend is clear: the month stimulus is released into the populace, and the month after, consumption returns toward pre-Covid normal. But in the month(s) following, consumption drops back to dangerously low levels. Apparently, as long as people don't have jobs, they don't spend unless the government hands them money. Go figure. And because so many small businesses have been destroyed by the lockdown, it's going to take multiple years to re-create a healthy economy. In the interim, fiscal stimulus will be necessary to both prevent the economy from caving in on itself, and keep people eating and housed. I think UBI has arrived, and is here to stay - at least until the rising load that's threatening the whole economic edifice hits its load limit and the dollar crashes. We think that's not possible because the dollar is the strongest national currency in the world. True; but all that means is it's the best floater in the toilet bowl. Sooner or later they're all going to get flushed. Some are flushing now. The dollar will eventually. The declining interest of other countries in purchasing US debt (government bonds) suggests that day might come a lot sooner than most Americans are awake enough to realize.

vaccines for those over 60? in 6 months it may be more obvious; the noravac product is better in its science, but not yet out of its preliminary trials.

If you use the flu vaccine as a model, it demonstrates its lack of rigorous examination; the repeated use of the flu vaccine makes you more vulnerable to new stains, does not prevent infection or transmission and it’s effective targeting spotty at best. less than 50% of healthcare providers get it unless coerced by management, even then it is hard to get it above 85%; tetanus, 100% no problem. All vaccines are not equally effective, safe, or worth the (usually small) risk. No one wants to compare the flu vaccine to adequate vit D supplementation, wonder why. The rise in covid19 case numbers in jurisdictions with high vaccine penetration (cases and mortality should be dropping more than areas that are not vaccinated) are enough to give me pause. It is most marked with countries adopting the Sinovac product but the trend may also be there for Pfizer’s product.

However, given that over 70 year olds with 2 comorbidities still only have around a 2.75% chance of dying if they are symptomatic, I’m certainly not convinced all elderly people should get a jab. And that of course is before taking into account IVM and Vit D.

The government will provide more fiscal stimulus checks because one trend is clear: the month stimulus is released into the populace, and the month after, consumption returns toward pre-Covid normal. But in the month(s) following, consumption drops back to dangerously low levels. Apparently, as long as people don’t have jobs, they don’t spend unless the government hands them money. Go figure.

The repuglicans are going to fight this tooth and nail, so dems will have to deal with it by eliminating the fillibuster. And they will do it. It is literally a matter of life and death.

Also, the close to 2 trillion (or more. I forget) for building back better will create a LOT of jobs, over the next 10 years.

Automation helps to curb actual run away inflation too. There’s that.

But yeah, a spike in inflation where it will be running hot, as Wolf Richter describes…like between 4 and 5 %, followed by either higher interest rates to curb it, or it burns itself out after a few months, once pent up demand runs its course.

Renters who can’t afford to pay their rent are being protected from eviction for now, but their bill is still accumulating. Unless more stimulus money is given to them, they’re going to have to pay it all back or file for bankruptcy. Imagine your rent is $1,000/month which is 40% of your monthly income of $2,500. Now imagine when your long-suffering landlord can finally make you pay up, your back rent has become $12,000. If you still have an income of $2,500 (not a certainty at all), how will you pay that $12,000 and resume paying $1,000/month? How many renters who haven’t been paying rent and have income, have been saving to eventually pay that back rent bill?

So, 1) will many thousands of renters be evicted for failure to pay and/or file for bankruptcy? 2) will many thousands of landlords have to sell off their rental properties at fire sale prices or file for bankruptcy? or 3) will the government borrow a couple trillion dollars from the Federal Reserve to pay off all the back rent?

Quite the dilemma. Printing the money seems like the path of least resistance and therefore the most likely course of action. More inflation, or not?

Over 70, here.

The current shots are genetic enhancement, not a vaccine. They do not stop catching the catching of, or spreading the disease. We know effective remedies, which a competent person, in good health, can apply to self and family members. Some of us have made choices, all our lives, to be educated and live a healthy lifestyle. Not all people over 60 are the same. I’d rather die of Covid. My choice.