Despite market prices remaining at maximum stupid heights, we’ve seen some notable weakness, volatility and a rare ‘bearish engulfing’ this week.

All of these are advance indicators we would expect to see preceding a fall in prices.

So, what exactly is a ‘bearish engulfing’?

It’s a term used by technical analysts to describe a relatively infrequent event when a rise in price is immediately eclipsed by a larger drop in price, suggesting that sellers now outnumber buyers:

<img class=“aligncenter” src=“https://peakprosperity.com/wp-content/uploads/2021/09/MW-IG421_NDX_en_20200513115904_NS.png” alt="“bearish engulfing chart” width=“1223” height=“843” />

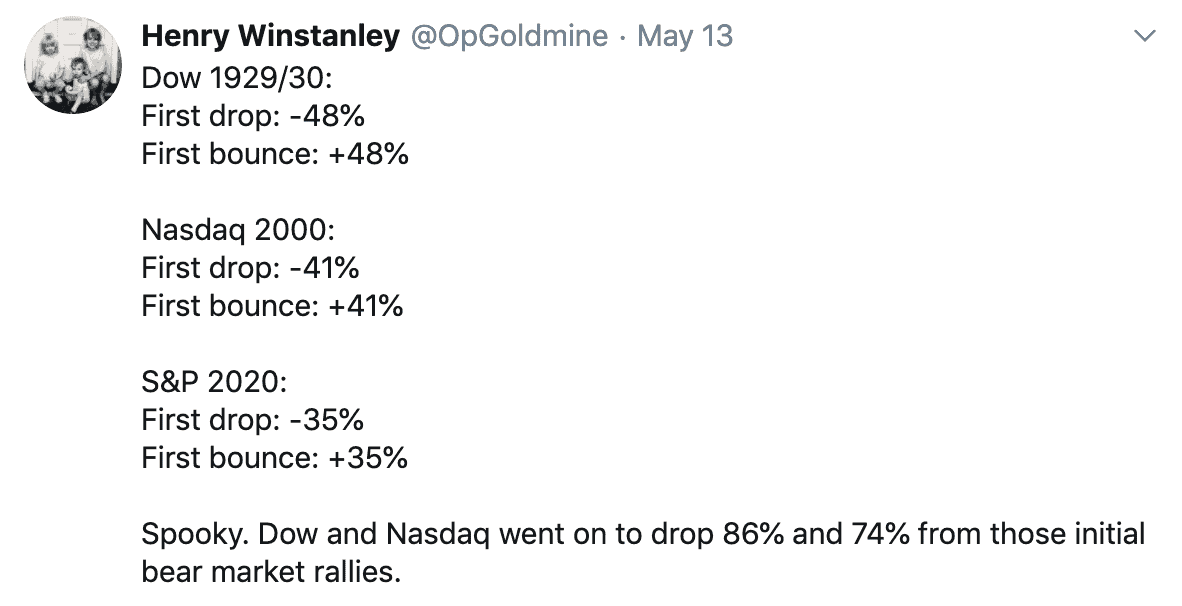

In addition to the above, the markets have struggled to move higher all week. This action has all the hallmarks of a rally petering out at its terminus.Which is occurring at an ominous milestone: for whatever reason, history appears to love symmetry.

The table below compares the initial drops seen during major market corrections to the initial rallies that followed. In both 1929 and 2000, the drop/rally percentages were identical. Each was then followed by a vastly larger second decline.

And today, we’re now at that exact same milestone for the S&P 500:

Have we been in a classic bear market rally since mid-March? One that will be soon followed by second and much larger decline?

In an attempt to prepare for what’s likely ahead, we’ve once again asked the lead partners at New Harbor Financial, Peak Prosperity’s endorsed financial advisor, for their latest perspective.

In the below video, we discuss the recent bearish market signals, the Fed’s latest guidance and its implications, and address reader questions on investing in real estate and opportunities for holding tangible assets within retirement accounts:

<

Anyone interested in scheduling a free consultation and portfolio review with Mike and John can do so by clicking here.And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/market-update-a-bearish-engulfing/