Originally published at: https://peakprosperity.com/our-money-system-is-a-ponzi-scheme/

Today’s podcast guest is Simon Dixon (ex-investment banker, early Bitcoin investor, author of “Bank to the Future”), a dynamic figure who describes the current fiat debt-based money system as a deliberate, debt-based Ponzi scheme that is mathematically guaranteed to collapse once interest rates exceed economic growth.

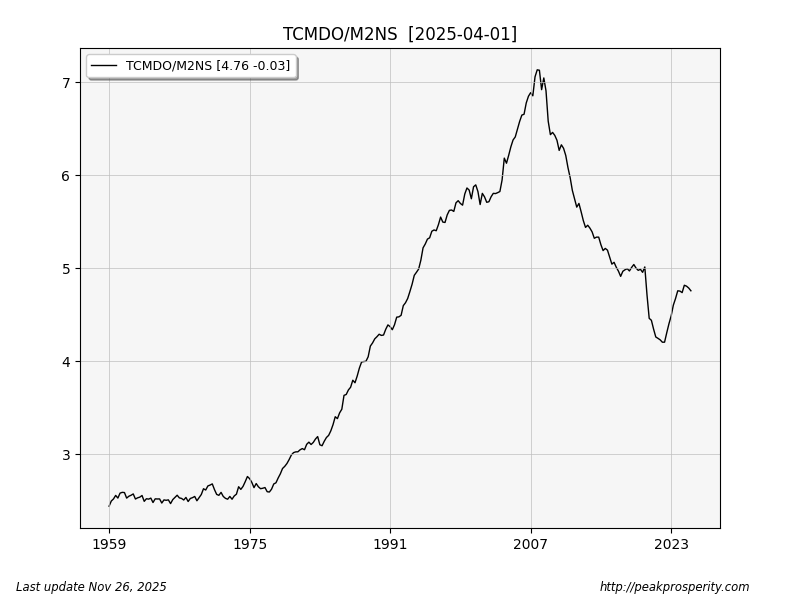

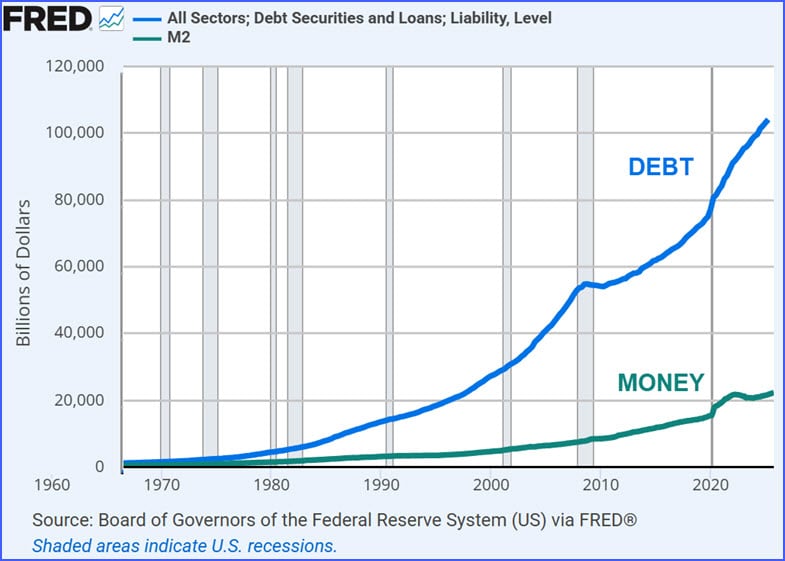

In other words, a true kindred spirit of ours, as we not only believe that to be true but can offer empirical evidence in the form of this chart:

Would you look at that? Debts are accumulating faster than money. Exponentially faster. The not-so-subtle subtlety hiding in the exponential insight is that this is a system with an expiry date. It’s a math problem waiting to become a calamitous societal problem.

Simon thinks and speaks in long-form thoughts. My very favorite, of course. The world cannot be reduced to sound bites and 60-second TikTok videos.

If you’ve heard of Simon’s “Proof of Weapons” concept, I truly believe that in this video, he gives the best, most understandable, and concise explanations of it that I’ve heard.

In this video, Simon explains:

Almost all money in the world (dollars, pounds, euros, etc.) is created by private banks when they make loans. This means:

- When a bank lends you $100, it also charges interest (say $10). But that extra $10 wasn’t created along with your loan, so the only way it can be paid is if someone else takes out a loan later on. And then their interest requires someone else to take out another loan later on, and so on ad infinitum. This is why total debt in the world keeps growing forever (see chart above)

- The implication is that what we call our system of money actually operates like a giant Ponzi scheme: it works as long as more and more loans are made, provided that the economy also keeps growing faster than the interest payments. If or when the economy cannot keep pace, the whole thing starts to crack.

Simon brings a fresh view to who the “they” are in this story. His contention is that the governments are not actually the true seats of power. They are really taking orders from a higher network, one predicated on money and control of financial assets.

- Governments look powerful, but Simon says they are not the top bosses.

- The real power is a network of giant banks, asset managers (like BlackRock, Vanguard, State Street), investment funds, and hedge funds. He calls this the “Proof of Weapons” network because it uses money as a weapon, as well as lobbying, media, intelligence agencies, and even blackmail to control politicians and countries. Think of each of these forms of exerting power and control as a ‘weapon.’

- These big financial players own shares in almost every important company (including military, tech, and media companies), so they can decide who gets rich and who doesn’t.

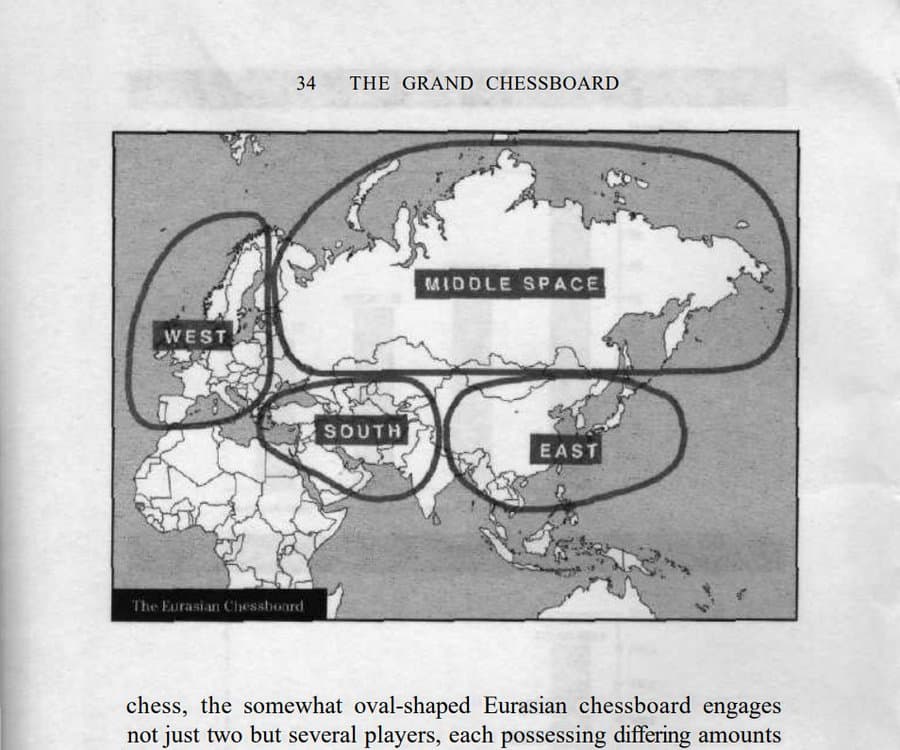

But the world is changing fast. Simon claims that the old system is dying, and power is moving East.

- The U.S. dollar has been the world’s main currency for 80 years, backed by oil (the “petrodollar” – Saudi Arabia and others sold oil only for dollars). This is now ending.

- Countries like China, Saudi Arabia, UAE, Qatar, and Russia are trading with each other in their own currencies or in gold.

- The giant financial companies (BlackRock, etc.) see this coming, so they are now making deals with Gulf countries (via the “GCC”) and China instead of just with the U.S. government. They don’t care about “America First” – they care about securing control and power wherever that may be settling next.

For normal people in the West, Simon believes this means:

- Europe and the USA have been slowly “hollowed out”: factories closed, energy got expensive (partly on purpose – cheap Russian gas was cut off), and good jobs disappeared. The looting operation is nearly complete, but they are not quite done yet.

- The plan is to replace many workers with robots and AI, give people a small universal basic income or other pacifying government payments, and monitor everyone with digital money (central bank digital currencies in Europe, private “stablecoins” in the USA) so behavior can be nudged and controlled.

- Big wealth inequality, anger, and division (left vs right, race vs race, religion vs religion) are made worse on purpose through social media to scare people into accepting more government/corporate control.

Here’s Simon’s advice for us ordinary people:

- Don’t expect the government to save you.

- Get out of debt if you can.

- Own “hard assets” that the system can’t easily print more of: physical gold, silver, or Bitcoin (Simon prefers Bitcoin because it’s digital and easy to move/store yourself).

- Build real-world community – know your neighbors, make local friends you can rely on.

- Move away from big cities if at all possible; have access to food, water, and energy.

- Strengthen your mind and spirit – don’t let algorithms make you hate other people.

- Prepare for 5–10 very chaotic years of change (AI, robotics, new money systems, possible big inflation or breakdowns).

Bottom line:

The people who control most of the money have squeezed almost everything they can out of Europe and the USA. They are now shifting their bets to China, the Middle East, and new technology (AI, robotics). Life in the West will probably get harder and more controlled for ordinary people. The best defense is to own real assets, build real community, stay calm, and don’t trust everything you see on the news.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.