Originally published at: https://peakprosperity.com/the-bank-of-japan-is-ruining-life-for-its-people-same-as-the-fed/

John Maynard Keynes, the famed 20th-century economist of enormous influence, once quipped that, “Markets can remain irrational longer than you can remain solvent.”

Financial markets have always been prone to excesses due to the self-amplifying human herd proclivity for stampeding first toward greed and then back again toward fear.

On top of that, we now have to add the non-economic participant influences, which is a fancy way of saying Central Bank market interference and manipulation activities.

Perhaps the best way to get our minds around it is to look at the excesses of the Japanese stock market, or should I say ““market”” due to its inexplicable behaviors.

Stocks are supposed to be barometers of economic activity. Recessions are not ‘good’ for stock prices, and for easily understandable reasons. When GDP is in recession there’s less economic activity and therefore lower revenues and profits – the two things that drive stock prices higher.

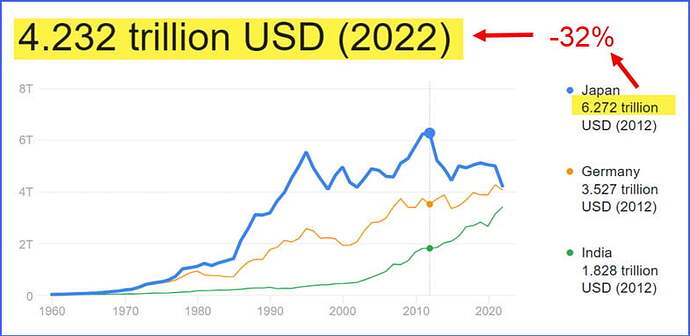

So let’s start here, with Japan’s GDP:

Yikes! That’s a Great Depression! A 32% loss of GSP over a ten-year period is pretty bad. Actually, is downright awful.

Zooming into the current year, the trend is equally bad, with Jul-Sept ’23 a -4% loss, Oct-Dec ’23 a flat 0.1% gain, and the first three months of 2024 being a 2.9% erosion.

Japan downgrades Q1 GDP on construction data corrections

By Reuters

June 30, 2024

TOKYO, July 1 (Reuters) – Japan’s economy shrank more than initially reported in the first quarter, the government said in a rare unscheduled revision to gross domestic product (GDP) data on Monday, darkening prospects for a fragile recovery.

The downward revision is likely to lead to a cut to the Bank of Japan’s growth forecasts in fresh quarterly projections due later this month, and could affect the timing of its next interest rate hike, analysts say.

Japan’s real GDP shrank an annualised 2.9% in January-March, down from an earlier estimate of a 1.8% contraction, the revised data showed.

The real GDP for the October-December period was also revised down to an annualised 0.1% growth versus the previous 0.4% increase, while that for the July-September period was revised down to an annualised 4.0% decline from the previous 3.7% drop.

(Source)

The past nine months were -4.0%, +0.1% and -2.9% (all annualized numbers). Summing that all up means that over the last nine months, Japan’s economy has contracted by -1.7%.

Bizarrely, Japan’s stock market is up 100% over the past 4 years and up a whopping 24% just in 2024 alone, a time during which its economy has been in a recession.

The only way to explain this that makes a bit of sense is by looking at the stunning 50% loss in the purchasing power of the Japanese yen since 2020:

Where it used to take 106 yen to buy a dollar, now it takes 50% more yen, or 158 to buy a single dollar. Everything that Japan exports is now generating 50% more yen. So, yay for Sony!

But everything Japan imports such as food and fuel and raw goods to use in their export-driven economy also cost 50% more, which is very bad for the citizens of Japan.

But the Bank of Japan does not exist to serve the people of Japan, it exists to slavishly serve the needs to he Japanese banking and financial systems. So, it routinely throws the people of Japan under the wheels of the inflationary bus as it works to assure the abstract world of high finance has everything that it needs.

As goes Japan, so goes the rest of the Western world.

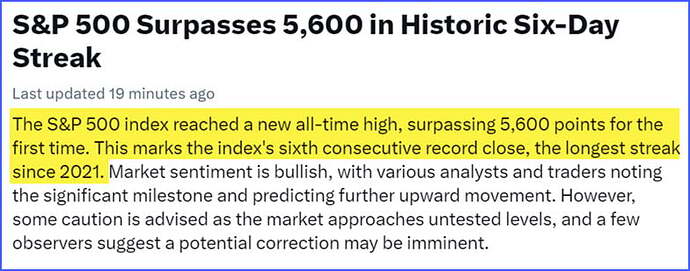

To wit, we see the same weird dynamics at play in the US and EU equity ““markets.””

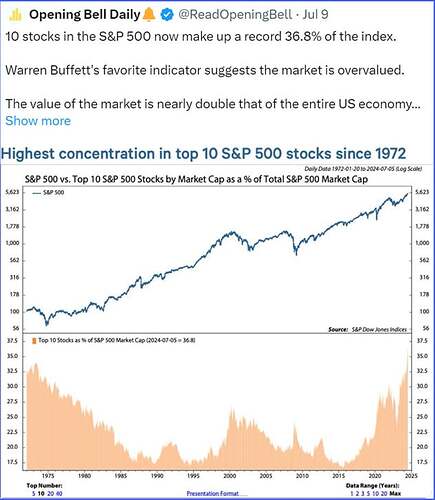

Lots of weird records are being set day after day, including this one which is difficult to explain away:

Things have never been this lopsided or irrationally exuberant.

But now they are. Plan accordingly!

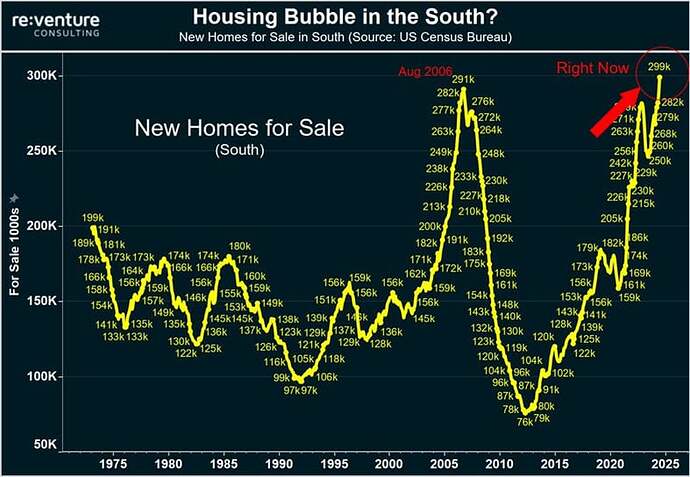

Topping this all off, it looks like the housing market in the US is finally rolling over, and good riddance! Young people deserve the chance if not the right to start households and families and the Fed’s atrocious meddling has stunted and delayed an entire generation. For that alone, the Fed should be disbanded, and the salaries of every key player clawed back for the past 20 years.

In the entire South region, things have never been as out of balance as they are right now, not even including the absolute peak of the infamous Housing bubble of 2006.

Conclusion

“It’s never different this time” are good words to live by when it comes to investing. Is it possible that ‘this time’ stocks can be as lopsided as they’ve ever been, and completely decoupled from actual economic potential and still be a good investment going forward?

History says no.

Who knows, with all the central bank interventions, maybe this time is different?

It’s certainly not the same as before when market forces could pull things hither and yon without being tripped up by activist cubicle dwellers in the NYFed’s Dungeons of Aurora (Illinois) banging on the VIX to thwart every nascent downturn.

But the excesses are now manifold and multiple. Everything in the US stock ““market”” now hinges on just ten stocks, with more than half of that performance itself hinged on the idea, but not yet the reality, of AI’s possibilities. Hey, maybe those dreams pan out, maybe they don’t. After all, aren’t we still waiting on our long-promised ‘killer apps’ for blockchain? Here we are a decade later and where are they?

The worst thing of all, is that much like the suddenly unavoidable decrepitude of Joe Biden at that last debate, many people are starting to realize that their kindly central bankers aren’t actually doing anything close to what the media has been portraying.

They have ruined an entire generation and have badly damaged the entire future.

There’s no possible way for their many excesses to return to sanity. The only way left is forward. That means more printing, more lying, more grifting, more rewards to insiders and Wall Street’s many outfits while a front of economic despair marches steadily northward through the social ranks.

To watch this happening in advance, just keep your eye on Japan. It’s the fractal part that illustrates the whole.

And now, onto the podcast with Paul!

Peak Prosperity endorses and promotes Kiker Wealth Management’s financial services. To arrange a completely free, no-obligation discussion of your personal financial circumstances and goals with someone who speaks your language and thoroughly shares your outlook on the world, please click this link to go to Peak Financial Investing to begin the process.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.