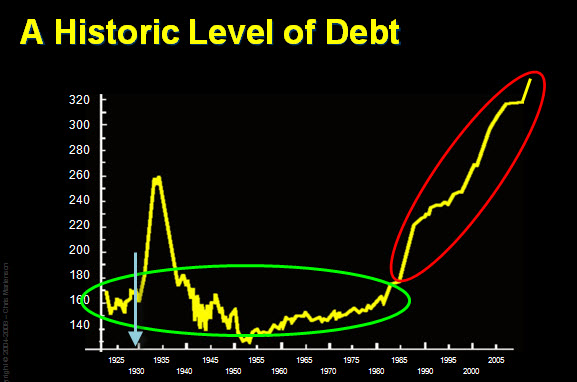

If I was ever given just one chart, just one piece of data, to make the case that we were on an unsustainable path that had a date with a long period of contraction and economic hardship, it would be this one.

Figure 1: This chart compares total debt (or “credit”) in the U.S. to GDP (or Gross Domestic Product) on a percentage basis. Current total credit-market debt stands at more than 340 percent of total GDP.

As we can see on this chart, the last time debts got even remotely close to current levels was back in the early 1930s, and that bears a bit of explanation. The debt-to-GDP ratio back then didn’t start to climb until after 1929 (blue arrow), because debts remained relatively fixed in size, while it was the GDP that fell away from under the debts. With the exception of the Great Depression anomaly, our country always held less than 200 percent of our GDP in debt (green circle). In 1985 we violated that barrier and have never looked back.

What does this chart tell me? It says that what each of us knows to be “just how the economy works” is really a historically unusual experiment with debt that is barely 25 years old. In the sweep of economic history, this barely qualifies as a blink.

It says, if you listen carefully enough, that all of our global economic growth has been fictitious. An illusion of debt.

Consider that debt had most recently been growing at a rate six times faster than the underlying GDP and you’ll begin to appreciate just how bogus the recent “growth” really was.

Here's an example. Consider two families living side by side. Each is earning $50,000/year. At our first “GDP snapshot” of these two families, we find that each has a GDP of $50k. But the next year one of the families goes out and buys an additional $50k of goods and services for itself, using a combination of auto loans, credit cards, student loans, and a home equity line of credit (HELOC).

At our second “GDP snapshot” one family is still mired in a $50k GDP but the other has undergone an exciting 100% growth in their economy and is now sporting a GDP of $100k.

But the underlying reality is that each family still has $50k of earning power. The measurement itself introduced a fallacy by neglecting to factor out the use of credit when measuring “growth.” That is exactly analogous to the US GDP situation and explains why the US, and much of the world, is now in for a very painful adjustment process.

Debt-to-GDP for family #2 assures that they will be living under the strain of paying down those loans for years to come. Time spent living beyond one’s means necessitates a future period of living below one’s means.

And this is why “unlocking the credit markets” is pure fiction.

Nothing needs to be unlocked. What we need is to recognize the vast damage that we did to ourselves as we elevated and then clung to a set of falsehoods.

The interesting part, as is always true of every bubble, is looking back and wondering how it is that we ever believed these falsehoods.

- It never made sense that one country could consume wildly beyond its production forever.

- One cannot borrow and consume one’s way to greater prosperity.

- It is not possible for an economy to be 80% service based, at least not sustainably.

A point I made in the Crash Course chapter on debt, which was that assets are variable but debts are fixed, can be broadened to include the claim that incomes are variable but debts are fixed.

That same spike in debt-to-GDP that weighed down the US during the Great Depression is now set to vault to some new stratospheric record of possibly 500% or 600% or more.

And the choices for reversing this ratio to a manageable level, notwithstanding Paulson’s confusing alphabet soup array of government bailout programs, are quite limited.

- Pay the debts down

- Default on them

- Inflate them away

That’s it. Those are all the options. All you have to do is decide which is the most likely outcome, and position your life and investments accordingly.

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-crisis-explained-in-one-chart-debt-to-gdp-2/