Originally published at: https://peakprosperity.com/the-fat-pipe-12-22-25-silver-gold-japan-seems-to-be-in-big-trouble-families-under-attack-energy-oil-grab-bag/

It’s Monday! Time for another Fat Pipe, let’s dive in:

Silver and Gold New Higher Highs

As a long-time silver and gold accumulator, the moves we’re witnessing today are leaving me a little bit nervous and slightly disoriented.

Last night, both went up again during Asian trading hours:

As usual, when we peer at the action more closely, we see a very typical pattern of late – Asia buys, “someone” tries a slam sometime after midnight, but that slam doesn’t do much more than prevent silver from going a lot higher.

The losses are becoming quite serious for “someone.” These are big boy numbers. Since Nov 24th, the accumulated losses by the silver shorts is a staggering $14.5 billion

At least on paper, and in their brokerage accounts, where more and more margin has to be posted to cover the losses which will have to be recognised when the positions are closed out.

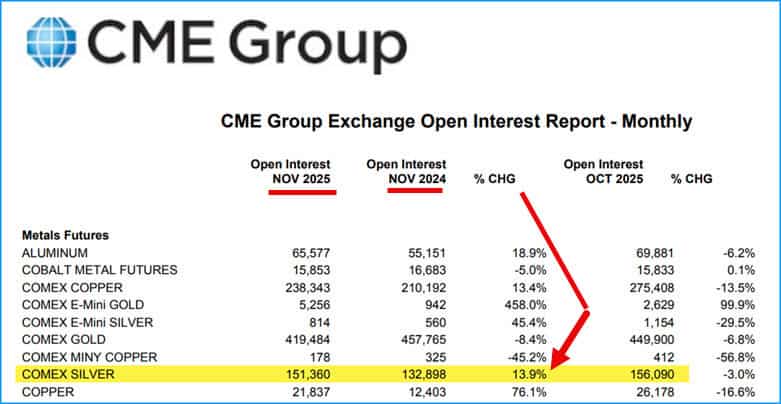

Quite oddly, or perhaps ominously, those carrying those losses are not backing down. Instead, over a year in which silver has exploded 133% higher, for some reason, the silver shorts figured that would be a good time to increase their collective shorts by nearly 14%

(Source)

As I said, they are not backing down and they are nursing enormous losses. They piled on another million ounces short just on Thursday last week.

An ounce of silver is worth 20% more than a barrel of oil? That’s is crazy:

BREAKING🚨: An ounce of silver is now worth more than a barrel of oil.This has only happened once before. pic.twitter.com/inTGEBMhhG

— Hedgeye (@Hedgeye) December 21, 2025

As I said, this is hard to believe, and I am growing more and more nervous that ‘something’ else is happening behind the scenes that I really need to know about, but don’t.

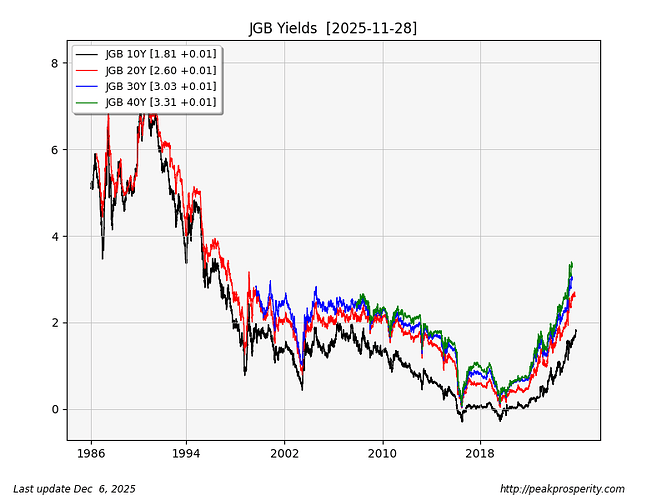

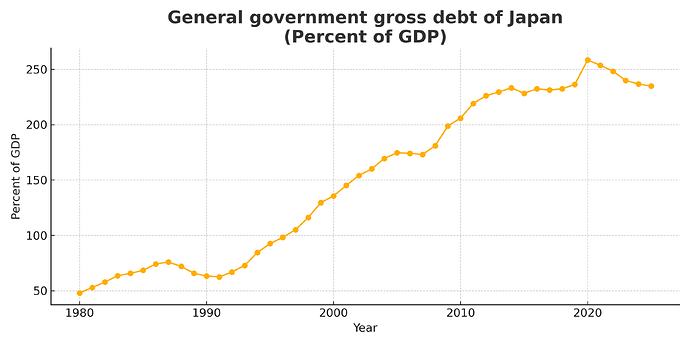

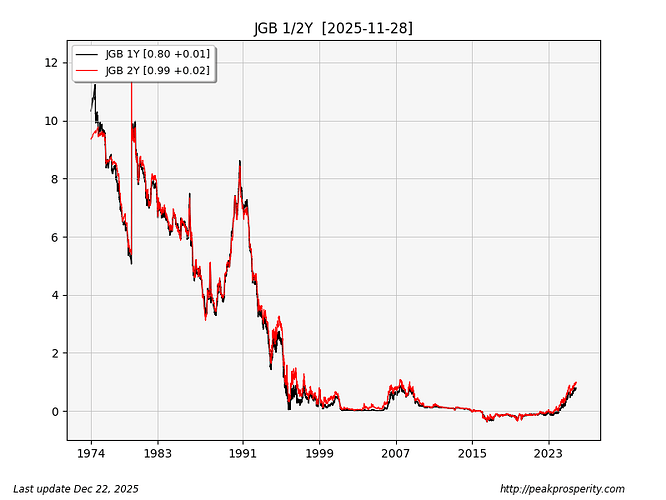

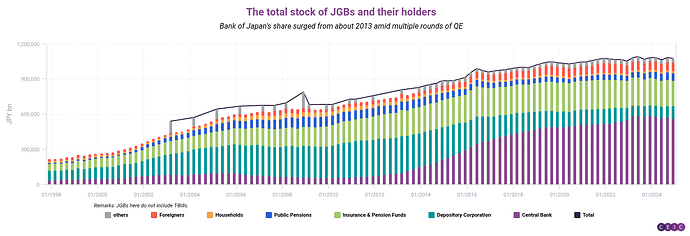

Oh, Japan!

Japan is my Darkhorse candidate for being ground zero of the next gigantic banking/financial/economic crisis that will engulf the West.

The reason is simple: their debt loads are completely ridiculous all on their own, but when you compare them (and their growth rates) to the fact that the population is ageing and shrinking, then the whole thing becomes a question of “when” and not “if.”

Well, it looks like “when” has arrived.

This massive move overnight in the Japanese 10yr yield must mean something to someone somewhere right?!Wow… pic.twitter.com/HE7UIeJ1UO

— Heisenberg (@Mr_Derivatives) December 22, 2025

Now, the idea here, as discussed extensively with Luke Gromen a while ago, is that when a sovereign nation gets into a situation of too much debt, they are at a fork in the road.

Down Path A, they defend their bond market. This means the central bank prints money and buys the government’s debt, preserving the illusion of demand and desirability for the debt. But this ends up causing the currency to weaken.

Down Path B, the central bank steps back and allows market forces to rip bond yields higher, opting to preserve the currency (in this case the yen). But this raises interest costs for the government which has too big of a pile of debt, and the whole situation cam rather suddenly turn into fiscal and then a national solvency crisis.

This looks like Path B:

Japan is facing a debt implosion. Its 10-year government bond yield is 2.1% (blue), but markets price that same yield to be 4.3% in 20 years' time (red). That kind of yield level is completely unsustainable for Japan and is why the Yen is falling so much.https://t.co/0wSrEd3Al9 pic.twitter.com/zUkX0w0zRW

— Robin Brooks (@robin_j_brooks) December 22, 2025

As you can see in the above chart, Japan is allowing the bond yields to rip higher. Or possibly they’ve somehow lost control of the situation, but regardless, bond yields have not been this high for Japan in decades.

🚨 THE BIG COLLAPSE IS COMING!!This could hurt global markets MASSIVELY, but nobody seems to be paying attention.Japan’s 30-year bond yields just reached 3.42%, the highest level in HISTORY.And when Japan moves like this, the whole world can feel it.Here’s why it matters:… pic.twitter.com/186AfGataW

— NoLimit (@NoLimitGains) December 20, 2025

So, it looks like they’ve selected Path B, “save the yen.”

But, oh no! Problem!

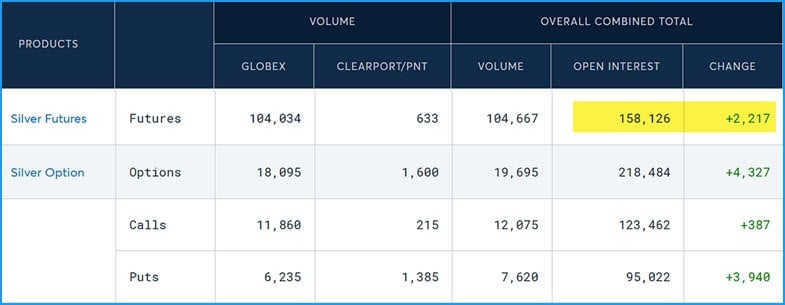

For some reason, not only are yields blowing ou,t but the yen is also weakening (in this chart, both are expressed against dollars and US yields):

From a longer-term perspective, 160 yen to the dollar seems to be an important line in the sand:

the Yen goes through 160 and there's nothing but daylight above... pic.twitter.com/oq4nYsJR25

— Santiago Capital (@SantiagoAuFund) December 20, 2025

But Path A and Path B are happening at the same time? It’s really not supposed to be happening this way speaking to a much larger and far more serious problem than is being openly discussed.

This is the sort of crisis that could rapidly convert into a banking crisis or even a sovereign funding crisis.

Two clues supporting this are the explosive performance of the Japanese stock market which could possibly be interpreted as “get me out of government paper!” which includes both debt and, of course, the yen.

Martin Armtrong has long talked about how the final stages of loss of faith in government management of debt and money would be expressed in private money fleeing to private companies.

Or maybe gold:

GOLD in fiat Japanese yen has already +3X'dfrom its 1980-2020 price cup breakoutYet white Precious Metals of Silver | Platinum,have yet to go beyond their old 1980 nominal price high levels (in then, much stronger yen terms)That's how early we are IOWsh/t @BruceIkeGold pic.twitter.com/mwM8tOLCYR

— James Henry Anderson (@jameshenryand) December 3, 2025

Under Attack

Maybe it’s all about the Benjamins? Maybe all the nonsense we’re witnessing is just what happens when humans try to operate under a system based on abstractions?

We see it in the left when they try to promote and enforce fealty to abstractions such as “gender identity” or “equity” when nobody has a clear and commonly held definition of what these things even are.

But isn’t fiat money also an abstraction? It sure is, which is why it’s possible that the sustained attacks on family farms by mega corporations is possibly nothing more than humans chasing the abstraction of “more profits.”

This is a sobering look at the process:

This short documentary offers a powerful look at the harsh realities threatening American farmers. It is a sobering, but essential watch. https://t.co/xCPZ1ydvIY

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) December 21, 2025

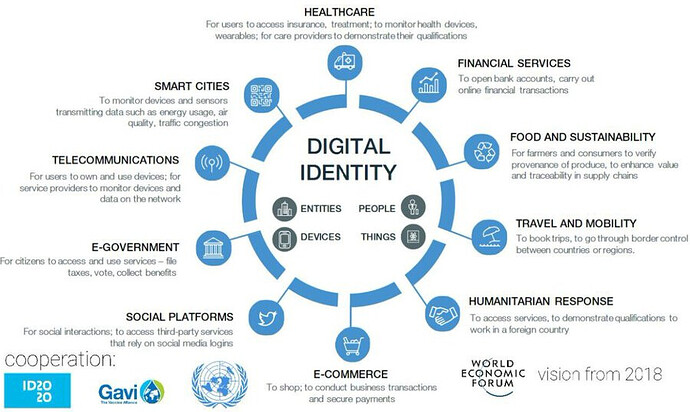

Or what about the combination of money and “public health” (another abstraction)? Then you get this:

Just coincidentally - all the world leaders - that all meet up in Davos - all made the exact same errors - open borders - COVID - vax mandates - Digital ID - CBDC - green energy - trans - all at the exact same time - all in the exact same direction - just coincidentally. pic.twitter.com/Vfixqedloe

— Resist CBDC (@Resist_CBDC) December 15, 2025

Michael Burry has caught onto the main bit of reality that is going to put an end to the abstract concept of US dominance in AI:

Why China will win AI in one chart. Power hungry Nvidia chips are not the way forward for the U.S. It is not just the total power advantage. It is the slope. pic.twitter.com/qNXh1e4lZj

— Cassandra Unchained (@michaeljburry) December 20, 2025

Energy

The biggest set up in investing history is coming for oil. The best investments happen when ‘everyone’ is looking the other way. Hated assets become loved again. The cycle doth repeat.

More people are beginning to notice:

Permian tight oil production is officially rolling over. Rigs down 29%Wells completed per month down 20%Actual production now declining YoY (3-month moving avg)After years of relentless growth, the U.S. shale engine is slowing just as global demand keeps rising.Peak… pic.twitter.com/KCFNOf1rDP

— Jack Prandelli (@jackprandelli) December 19, 2025

“As an investor in hard assets, I’ve never seen greater opportunity in 35 years.”

World infrastructure growth continues to surge. New car sales, new superhighways, airports. All the $Oil glut in 2026 chatter will go down in flames, just like it did in 2025. As an investor in hard assets, I've never seen greater opportunity in 35 years.

— Highheat (@2020Upstream) December 20, 2025

Putin For The Win

Every time I hear Putin talk, he strikes me as solid, measured, and extremely well-informed. This most recent speech of his was no different:

“You talk about values, but you refuse to respect the choices of the people; you talk about international law, but you violate it whenever it doesn’t serve your interests; you talk about peace, but you sow war wherever you intervene. Russia is not the enemy of anyone, but we will never allow anyone to decide our future. We want cooperation, but on equal terms. We want peace, but not at the expense of our freedom, our identity. And let’s be clear: Russia will never be defeated. We have withstood centuries of hardships, seen empires rise and fall, and we are still here. And tomorrow, we will be there, in this new multipolar world that is already emerging.”

The whole speech is worth reading. It’s not that long, but it’s absolutely spot on.

Putin:"Ladies and gentlemen, I have carefully listened to the speech of President Emmanuel Macron, who emphasized the end of Western hegemony and the emergence of a multipolar world. He is right on the key point: the world is undergoing profound changes, but he forgets to… pic.twitter.com/sKWA2jjyhd

— Sprinter Press (@SprinterPress) December 20, 2025

If Europe goes to war with Russia, it will be because they kinda wanted to, and for no other reason.

Here’s exactly the sort of lawlessness that Putin was referring to:

I did not have "Make Piracy Great Again" on my bingo card. https://t.co/lDFmlK07uj

— Chris Martenson (@chrismartenson) December 21, 2025

Grab Bag

I found this to be a very handy guide for buying fish at the store:

🚨 “DO NOT FEED THIS TO YOUR FAMILY” - 15-YEAR CHARTER BOAT VET GOES NUCLEAR ON GROCERY STORE FISH A man who says he worked 15 years on a charter boat stops in an Aldi grocery aisle and unloads:“Do not ever buy tilapia.I don’t care what they tell you - it’s a sh*t eating… pic.twitter.com/l33rHXEecC

— HustleBitch (@HustleBitch_) December 20, 2025

I don’t know who else needs to see this, but I sure did:

the right solution to cut it more neatly https://t.co/GfeUxCSxiY pic.twitter.com/8ZoJuFdbP8

— vaajaa✨ (@kerduscoksu) December 17, 2025

The White House is REALLY doing such a terrible job on the Epstein files it cannot be overstated just how poorly they are doing. I’ll let a UFC fighter explain:

Sean Strickland says he is not interested in participating in the UFC White House event:"Just to go hang out with the fucking Epstein list? I'm good, dude." pic.twitter.com/snExlWI5DJ

— FactPost (@factpostnews) December 19, 2025

It really doesn’t get much worse than this:

FBI Director Kash Patel Under Oath: “There’s no credible information that Jeffrey Epstein trafficked minors”40 minors gave sworn testimonies that they’d been trafficked by Jeffrey Epstein.This is treason. pic.twitter.com/pYla3gnhkF

— ADAM (@AdameMedia) December 20, 2025

Anger is the first stage of waking up and noticing:

I’m angry. We’ve done everything we’re supposed to. Everything that used to work. Grow up, get married, have kids, he served our country, worked hard, went to school, we’re constantly trying to better ourselves, serve our communities, eat healthy, raise strong Christian’s.…

— Eve (@Eve_hel1) December 21, 2025