Originally published at: https://peakprosperity.com/the-goldilocks-gamble-on-a-perfectly-imperfect-future/

This week, Paul Kiker of Kiker Wealth Management and I discussed these crazy markets and just how much crazier it is that the people (ostensibly) in charge seem to have no care or concerns for future generations.

As men of integrity and big hearts, this makes zero sense to either Paul or me.

Look, nothing makes sense. Stocks are powering to new all-time highs under the theory that Trump’s policies will be good for stocks. But how can they be good for US and German stocks?

But then, at the same time, you’re supposed to also believe that oil is down because of concerns that the future economy might suck and be recessionary.

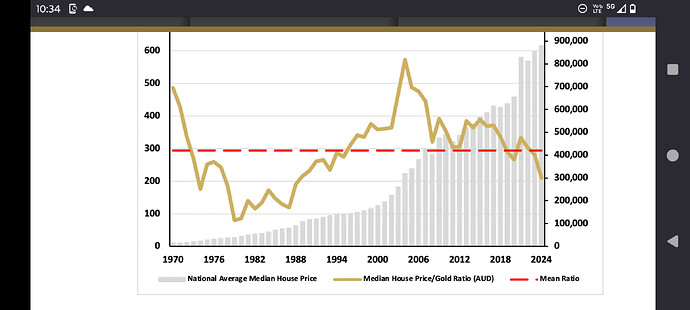

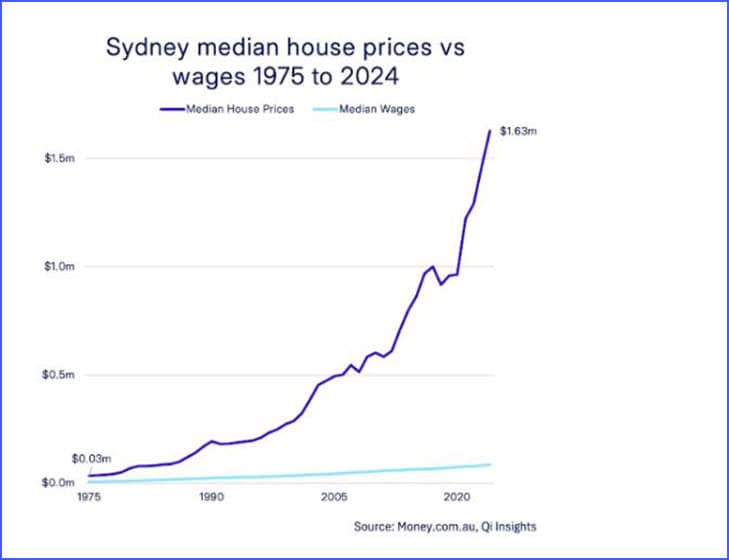

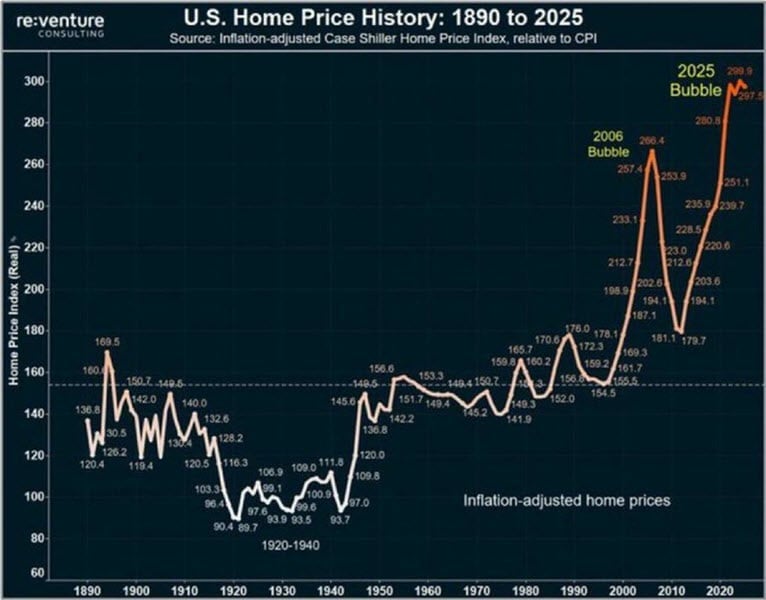

And then we’re supposed to also hold true that long-term sovereign bonds make sense in the 4% to 5% range even as real estate is at record levels of unaffordability in places like Australia, Canada and the US.

LOL!

Sorry Australia, you’re cooked!

But then again, of course, so is the US:

Yikes!

We sure do wish that someone in power would explain how a stock bubble, a bond bubble, and a housing bubble all resolve peacefully.

Obviously they can’t, which is why each of us must make other plans. I have yet to meet anyone as capable or as caring as Paul Kiker (and his well-curated team) to have those conversations.

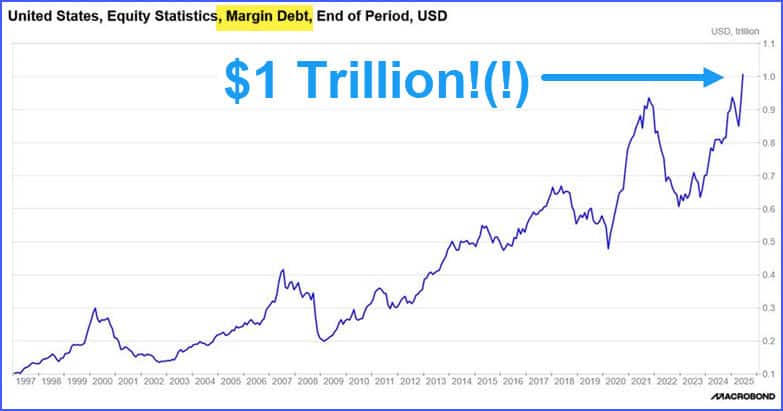

Speaking of stock bubbles, every bubble shares two common elements:

- A good story (e.g. “Tulip Bulbs…can’t lose!”)

- Ample credit.

On point #2, perhaps we should all carefully consider this chart:

Yes, that’s right, stock speculators are now more than $1 trillion in debt speculating on things always and steadily going higher. If they are right, they win. If they are wrong, we all lose.

The only way all this sorts itself out without a lot of economic and financial tears is if everything goes perfectly…in an imperfect world.

Trade safe, everyone.