There will be an extremely painful oil supply shortfall sometime between 2018 and 2020. It will be highly disruptive to our over-leveraged global financial system, given how saddled it is with record debts and unfunded IOUs.

Due to a massive reduction in capital spending in the global oil business over 2014-2016 and continuing into 2017, the world will soon find less oil coming out of the ground beginning somewhere between 2018-2020.

Because oil is the lifeblood of today's economy, if there’s less oil to go around, price shocks are inevitable. It's very likely we'll see prices climb back over $100 per barrel. Possibly well over.

The only way to avoid such a supply driven price-shock is if the world economy collapses first, dragging demand downwards.

Not exactly a great "solution" to hope for.

Pick Your Poison

This is why our view is that either

- the world economy outgrows available oil somewhere in the 2018 – 2020 timeframe, or

- the world economy collapses first, thus pushing off an oil price shock by a few years (or longer, given the severity of the collapse)

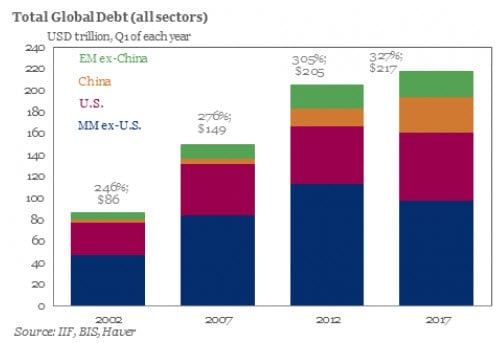

If (1) happens, the resulting oil price spike will kneecap a world economy already weighted down by the highest levels of debt ever recorded, currently totaling some 327% of GDP:

(Source)

Remember, in 2008, oil spiked to $147 a barrel. The rest is history -- a massive credit crisis ensued. While there was a mountain of dodgy debt centered around subprime loans in the US, what brought Greece to its knees wasn’t US housing debt, but its own unsustainable pile of debt coupled to a 100% dependence on imported oil -- which, figuratively and literally, broke the bank.

If (2) happens, then the price of oil declines, if not collapses. Demand withers away, the oil business cuts back on its exploration/extraction investments even further, so that much later, when the global economy is trying to recover, it then runs into an even more severe supply shortfall. It becomes extremely hard to get sustained GDP growth back online.

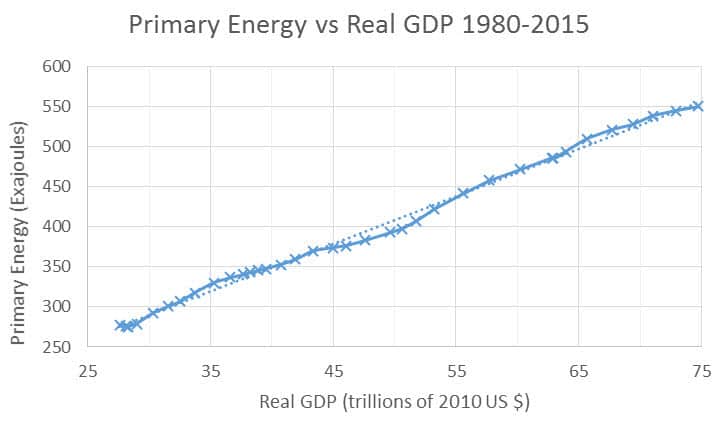

If you really want to understand why I hold these views, you need to fully understand and digest this next chart. It shows the amazingly tightly-coupled linear relationship between economic growth and energy consumption:

(Source)

This chart above says, if you want an extra incremental unit of economic growth you're going to need to have an extra incremental unit of energy. More growth means more energy consumed.

And today, oil is still THE most important source of energy. It's the dominant energy source for transportation, by far. A global economy, after all, is nothing more than things being made and then moved, often very far distances. Despite what you might read about developments in alternative and other forms of energy, our dependency on oil is still massive.

Plunging Investment

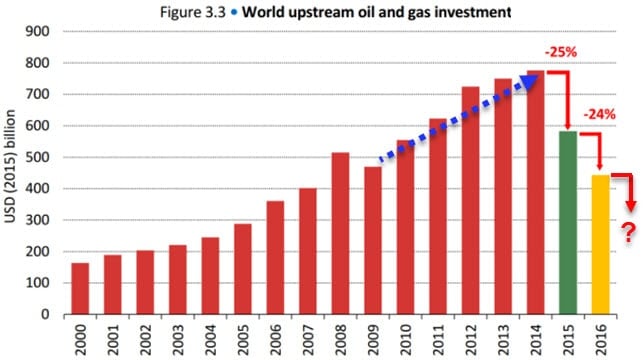

Resulting from the start of oil's price decline in 2014, the world saw a historic plunge in oil investments (exploration, development, CAPEX, etc) as companies the world over retracted, delayed or outright canceled oil projects:

(Source)

In the chart above, note the two successive drops in oil investment from 2014-2015 and then again into 2016. So far 2017 is shaping up for another successive decline, which will mark the only three-year decline in investment in oil's entire history. So what's happening here is actually quite unusual.

This isn’t just a slump. It’s an historic slump.

We don’t yet know by how much oil investment will decline in 2017, but it’s probably pretty close to the rates seen in the prior two years.

Next, take note of the dotted blue arrow in the chart. See how far oil investment climbed during the years from 2009-2014? Not quite a doubling, but not far off from one either. Remember those years, I’ll return to them in a moment.

The key question to ask about the 2009-2014 period is: How much new oil was discovered for all that spending?

Turns out: Not a lot.

Practically No Discoveries

There is one hard and fast rule in the oil business: Before you can pump it, you have to find it.

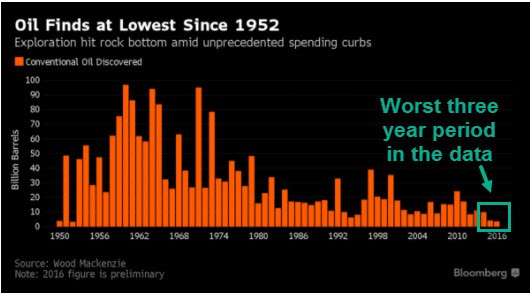

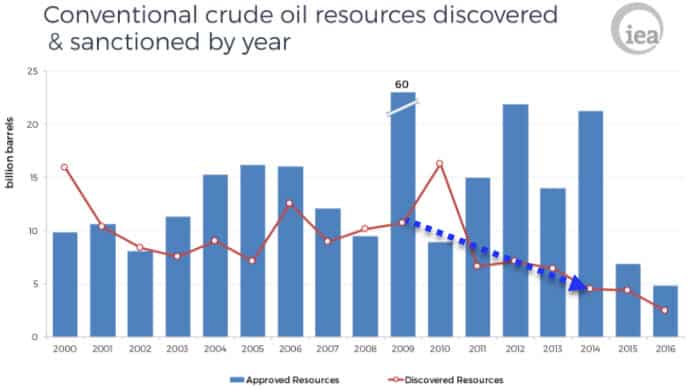

The growing problem here is that oil discoveries were horrible in 2016, really bad in 2015, and terrible in 2014. That recent three year stretch is the worst in the data series:

(Source)

Again: you have to find it before you can pump it. And around the world, oil companies are just not finding as much as they used to.

Remember that blue dotted line on the oil investment chart above? Here’s its counterpart, showing discoveries over the same time frame -- it’s just a straight slump downwards:

Global oil discoveries fell to a record low in 2016 as companies continued to cut spending and conventional oil projects sanctioned were at the lowest level in more than 70 years, according to the International Energy Agency, which warned that both trends could continue this year.

Oil discoveries declined to 2.4 billion barrels in 2016, compared with an average of 9 billion barrels per year over the past 15 years. Meanwhile, the volume of conventional resources sanctioned for development last year fell to 4.7 billion barrels, 30% lower than the previous year as the number of projects that received a final investment decision dropped to the lowest level since the 1940s.

(Source)

Now it's clear why the oil companies pulled back their investment dollars so rapidly when prices slumped: They were spending more and finding less throughout the 2009-2014 period, so they were already feeling the pain of diminishing returns. When the price of oil cracked below $100 a barrel, they wasted no time reining in their investment dollars.

Should we be concerned about this record lowest level of oil project funding in 70 years? Why, yes, we should. Everyone should:

"Our analysis shows we are entering a period of greater oil price volatility (partly) as a result of three years in a row of global oil investments in decline: in 2015, 2016 and most likely 2017," IEA director general Fatih Birol said, speaking at an energy conference in Tokyo.

"This is the first time in the history of oil that investments are declining three years in a row," he said, adding that this would cause "difficulties" in global oil markets in a few years.

(Source)

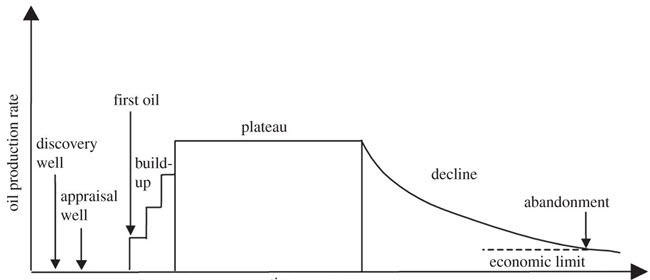

To give you a visual of the process, here’s a chart to help you understand why it takes years between making an initial find and maximum production:

(Source)

This bears repeating: Oil is the most important substance for our economy, we’re burning more of it on a yearly basis than ever before, and we just found the lowest amount since the world economy was several times smaller than it is now. And all this is happening while we're reducing our efforts to find more at an unprecedented rate.

There’s no way to speed up the process of oil discovery and extraction meaningfully, no matter how much money and manpower you throw at it. It simply requires many years to go from a positive test bore to a fully functioning extraction and distribution/transportation program operating at maximum.

In Part 2: Preparing For The Coming Shock we provide the evidence that shows why by 2019, or 2020, oil prices will have forced a new crisis upon the world.

More economic growth requires more energy. Always has and it always will. Oil is the most important form of energy of them all. But everyone assumes -- especially today when it appears as if we're "awash" in it given the current supply glut -- that we will always have access to as much as we need.

That's not going to be the case soon. And you are one of the few to understand why.

You get to use that awareness to make conscious decisions about your own life right here and right now. You can position yourself for safety, as well as to take advantage of what are likely to be once-in-a-lifetime investment opportunities.

But you also need to prepare for those in your life, like most other people today, who lack the ability, insight, or capability to join you at this early stage.

Click here to read the report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-looming-energy-shock/

And my personal favorite:

And my personal favorite: