Originally published at: https://peakprosperity.com/volatility-friend-or-foe/

After a short holiday break, we’re back! Happy New Year, everyone!

This week, Paul Kiker and I discussed a wide range of topics (See list of timestamps below).

The overarching theme was volatility. We’re seeing extraordinary moves in Japan’s bond and currency markets, enormous volatility in silver, and “decades happening in weeks” on the geopolitical front as evidenced by Trump’s move against Venezuela.

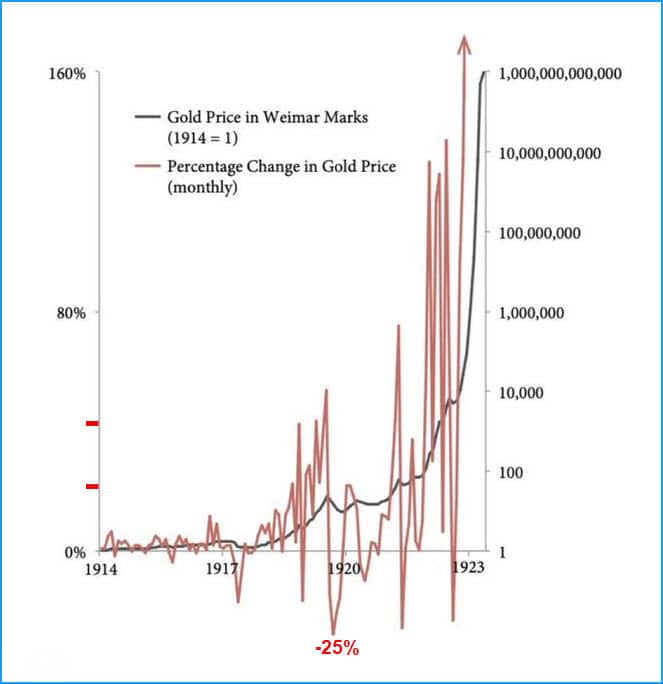

Perhaps these and many other items are unrelated events. Or perhaps they are connected by the spasms of the dying regime of debt-based fiat money. If so, then this chart of gold’s price during the death of the Weimar Republic’s mark might be instructive:

Could you, would you have hung on for every one of those gut-wrenching ~-25% drops in the price of gold along the way? Or would you have bailed, certain that gold had gone as far as it could and was due to collapse back down?

This speaks to the importance of knowing the underlying “why” of your investment and wealth protection strategies. Me? I am certain that the US government is thoroughly out of control on the spending front.

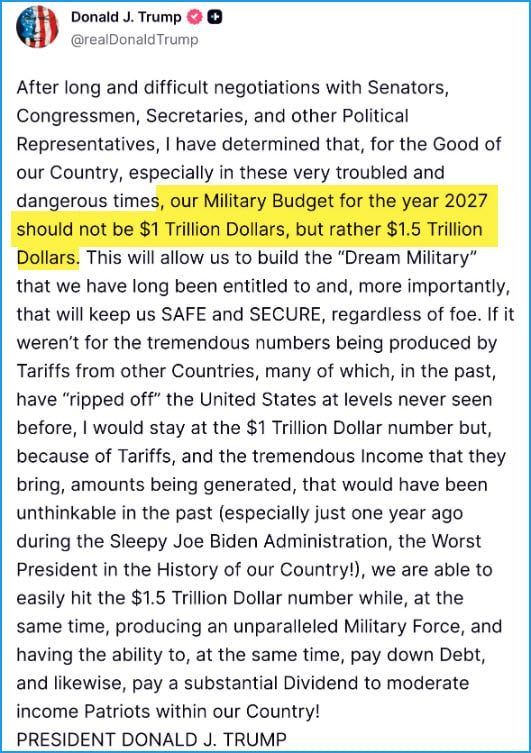

This recent tweet by Trump only added to that certainty:

Where’s that extra $500 billion going to come from? Easy, that’s going to be printed out of thin air by the Federal Reserve.

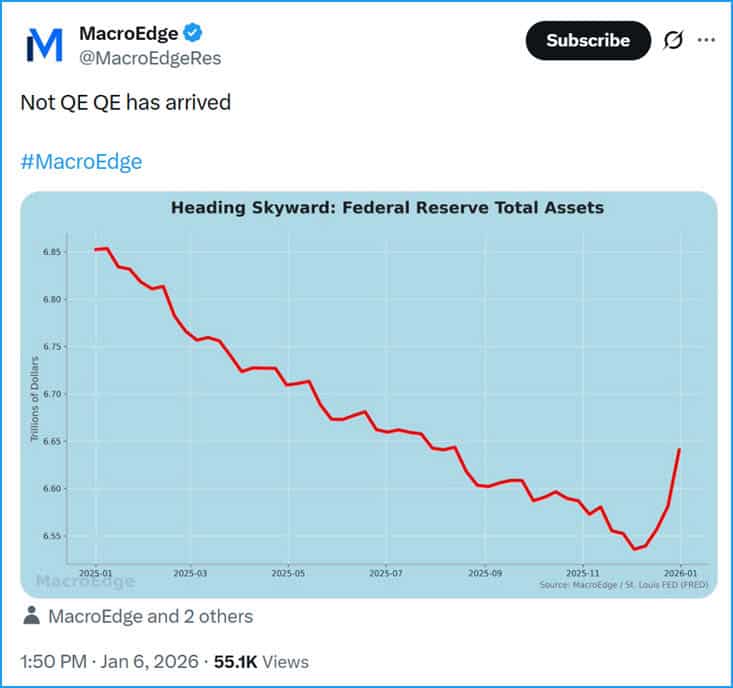

On that front, they have already begun.

To me, this signals “The End of Money” …well, not true money (which is gold) but corrupt fiat money managed by people who seem to have entirely lost the idea of the proper role of money in a society and economy.

The advice is to have a plan and be prepared to stick to it for what is certain to be a very bumpy ride.

Timestamps:

00:30 Introduction and Personal Updates

02:35 Market Shenanigans: Gold and Silver Prices

06:31 Market Manipulation and Trust Issues

10:39 Volatility in Precious Metals

12:31 The Role of Gold in Financial Markets

18:25 The Impact of AI on Information and Investment Decisions

21:38 The Global Silver Market Dynamics

29:24 Long-Term Thinking vs. Short-Term Gratification

31:46 The Dangers of Currency Debasement

33:31 U.S. Domestic Supply Chains and Independence

35:41 Japan’s Economic Push and Pull

39:32 The Impending Crisis in Japan

44:41 Venezuela’s Oil Industry and U.S. Interests

01:01:26 The Erosion of Trust in International Law

01:03:39 Emerging Alternatives to the US Dollar

01:05:15 Speculation vs. Investment: The Current Market Landscape

01:09:40 The Impact of Federal Reserve Policies

01:12:26 Generational Wealth and Responsibility

01:15:18 Navigating Rapid Change in a Complex World

01:18:25 The Future of Software and AI

01:22:37 Investment Strategies for an Uncertain Future

01:27:38 The Importance of Adaptability in Investing

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.