First Republic Bank failed on 5/1/23 and JP Morgan was selected (of course) by the US government for a sweetheart, can’t lose, make JPM billions deal.

Of course.

If it weren’t for overt corruption, the US government wouldn’t stand for anything at all.

Naturally, this is all wrapped up in the usual weak cover stories such as “This was the best outcome for a tricky situation” and “We’ve taken steps to strengthen the banking system to assure this doesn’t happen again.”

Those are really ignorant rationales because the true cause of these regional bank failures was the Fed’s policies.

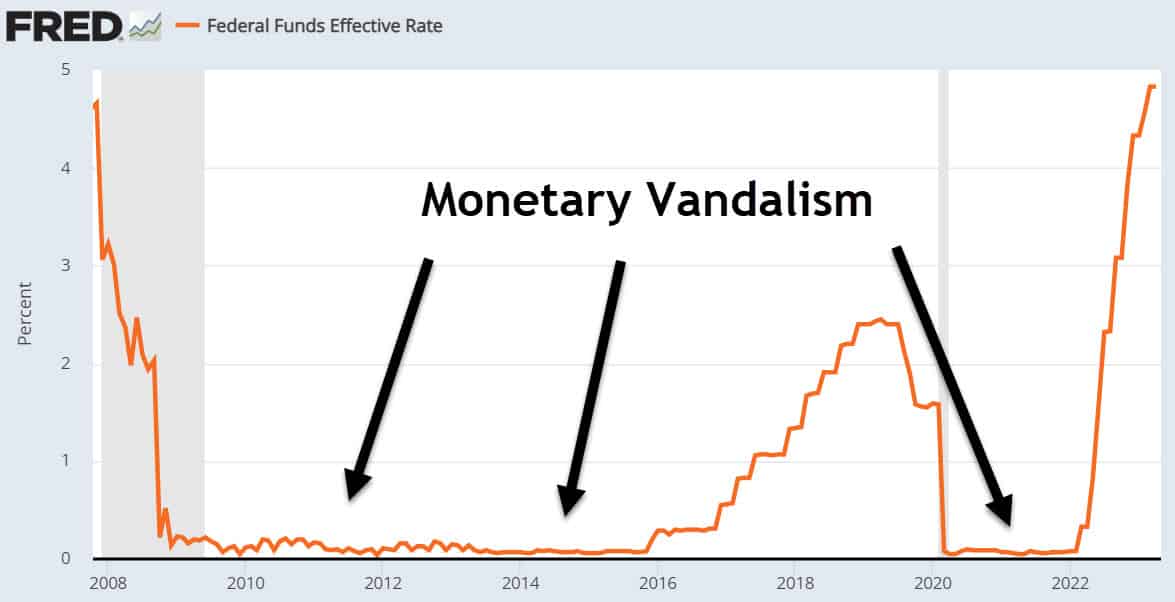

Because the Fed decided that it knew best, and because the Fed decided that what was best was money that was priced at zero (see chart below), various financial entities were forced into terrible binds where they had to hold their noses and buy overpriced debt and make underpriced loans that were guaranteed to lose value when the Fed raised interest rates.

Which means these regional bank failures were a matter of policy. Which means the forced acquisition by JP Morgan (against existing concentration rules, suspended or ignored because circumstances!, is a matter of Fed policy.

Welcome to the “you’ll own nothing and be happy” stage of the kleptocracy.

How else can you concentrate all the world’s wealth into a small handful of elites and institutions?

At any rate, this bank “failure” isn’t the last despite what Jamie Dimon said. The damage was done between 2009 and 2022.

Up next, more banks, pensions, endowments, and small and medium-sized businesses.

This is a companion discussion topic for the original entry at https://peakprosperity.com/what-does-the-latest-bank-failure-and-bailout-mean/