Originally published at: https://peakprosperity.com/when-the-ai-bubble-bursts-the-damage-will-be-severe/

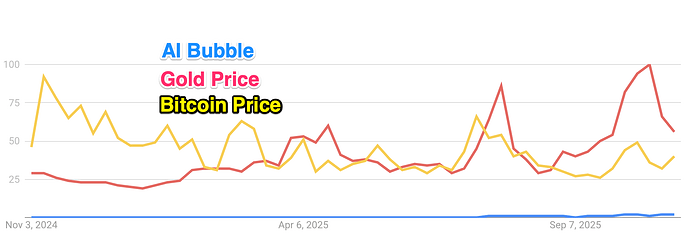

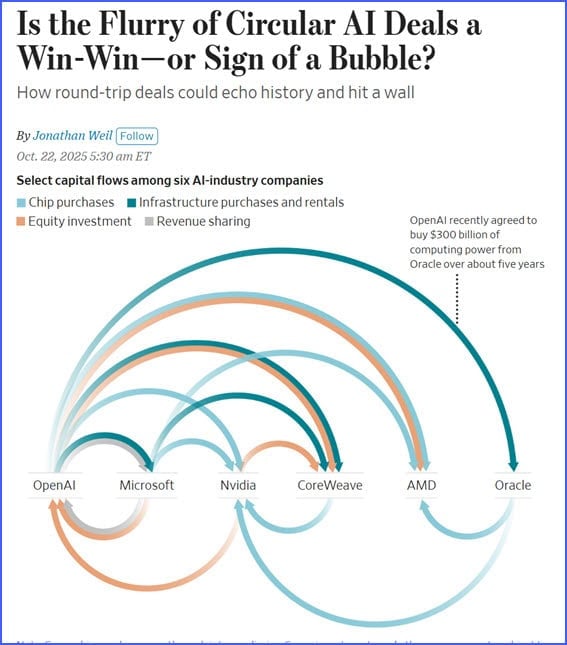

The AI bubble has gotten so massive and so complicated and so perversely organized that even the WSJ is having trouble figuring out how to describe the circular deals and money flows.

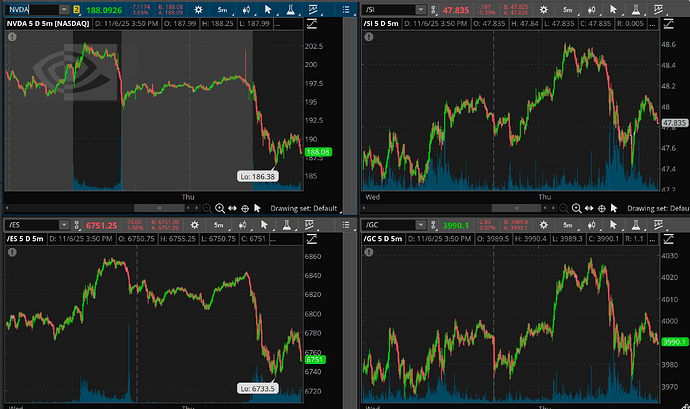

When this bubble bursts, it will be the most damaging in US history, by far. The amounts involved are truly staggering, measured in the supposed market valuations of the top 5 companies – Microsoft, Amazon, Apple, Nvidia, and Google. Together, they are ‘worth’ more than $19 trillion.

Nvidia alone is valued in the stock market at more than $5 trillion.

But let’s back up for a moment. What is a bubble? This is my favorite definition:

“A bubble exists when asset prices rise beyond what incomes can sustain.”

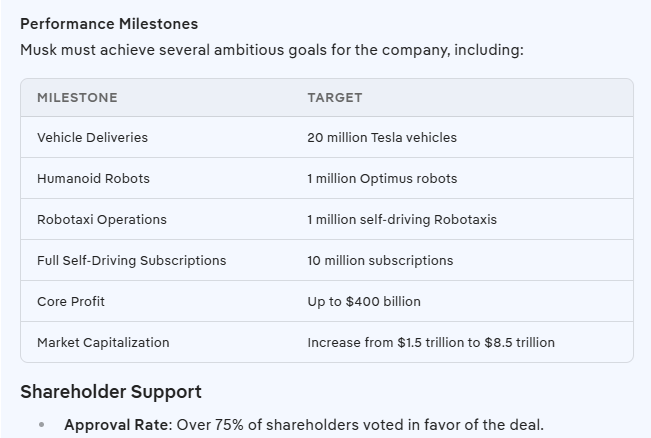

Using this definition, consider AI leader OpenAI, which has a purported $13 billion in yearly revenue, but which is losing billions more on top of that, having made capital spending commitments with other AI companies totaling $1.4 trillion.

The value of all the other involved companies has spiked on the news of the commitments, but where is that money going to come from? Nobody has yet said and OpenAI’s CEO, Sam Altman, refuses to answer:

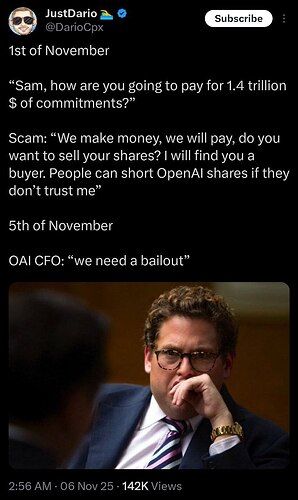

Sam Altman appears tired of having to justify how OpenAI will pay for its trillion-dollar-plus spending commitments as a startup bringing in a fraction of that in annual revenue.

In a testy moment during a recent podcast interview with investor Brad Gerstner on the “Bg2 Pod,” Altman was asked “the single biggest question” that is “hanging over the market.”

“How can a company with $13 billion in revenues make $1.4 trillion of spend commitments?” Gerstner asked the OpenAI CEO. “You’ve heard the criticism, Sam.”

OpenAI has invested heavily in infrastructure and compute, striking multi-billion-dollar deals to secure more Nvidia chips and energy to fuel its AI ambitions. The latest came Monday morning, when OpenAI announced a $38 billion partnership with AWS.

“If you want to sell your shares, I’ll find you a buyer,” Altman said in response to Gerstner’s question. “Enough.”

(Source)

It’s extremely weird for a CEO to refuse to answer the most basic of questions about their business model. Unless, of course, that CEO already knew there was no good answers to be given and was being evasive in an attempt to buy some time while they try to sort out a revenue model.

In other words, the asset price of his company has risen far beyond what incomes can sustain.

The day after recording this podcast with Paul Kiker, Sam Altman tipped his hand further by – I am not making this up – requesting that US taxpayers guarantee the gargantuan loans he needs in order to continue his money-losing project:

Sam Altman over at OpenAI wants the US government to provide and guarantee loans for its expansion.Up to a trillion.No, I’m not joking. pic.twitter.com/i4XRjpPPQn

— Peter B (@realpeteyb123) November 6, 2025

On top of that, we’ve also got the CEO of Nvidia now warning that China may ‘win’ the AI race (whatever that means).

JUST IN - Nvidia founder Jensen Huang says, "China is going to win the AI race." — Financial Times

— Disclose.tv (@disclosetv) November 5, 2025

The pattern is worryingly the same as we saw right before the internet bubble burst in 2000.

I see a pattern…Altman and Jenson smell the end of bubble (financing drying up) and are going to ask Daddy for taxpayer money citing national security issues. https://t.co/d8l30BRFSj pic.twitter.com/ASHRJZkcMu

— Edward Dowd (@DowdEdward) November 5, 2025

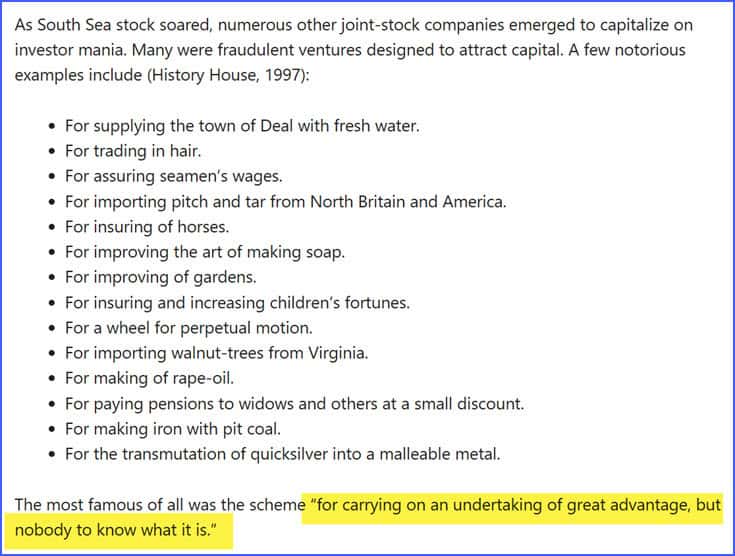

And this is the same behavior observed before the infamous South Sea Bubble of the 1700’s blew up. My favorite pitch for South Sea shares?

“The company is being formed for carrying on an undertaking of great advantage, but nobody to know what it is.”

(Source)

That, at least, was direct and honest. I’m getting the same vibes today from Sam Altman.

The Freight Recession

Meanwhile, the actual economy, the one based on real products being made, transported and sold to real people, is shredding at an alarming rate.

Freightwaves CEO: "Well, we should be worried. The goods economy, certain portions of the goods economy are collapsing right now. So, year over year trucking volumes, this is really predominance of freight that moves across the United States, is down 17%". "But when you look at… pic.twitter.com/DuCIgJNjWS

— StockMarket.News (@_Investinq) November 5, 2025

This is why, when the AI bubble bursts, the damage will be so severe. There’s no solid support beneath it. The real economy is suffering with job layoffs for October the highest since 2003:

Layoffs in October were the highest since 2003: pic.twitter.com/QnQ33KFyGZ

— unusual_whales (@unusual_whales) November 6, 2025

And that’s with $2+ trillion of government deficit spending, the Fed cutting rates, and financial conditions being extremely easy as M2 grows.

How much longer can this all continue? Nobody knows. Which is why having a risk-managed portfolio and a strategic plan are more important than ever.

Our endorsed financial advisors at Kiker Wealth Management treat every client as an individual and their process for determining if they can be a good fit for a client begins with an initial get-to-know-you phone call, followed by a financial review and planning session, and then finally a third recommendation session.

Every person or couple is unique in their family details, life stage, and resources, which is why Paul and his team spend so much time figuring each client out to ensure there’s a good fit (both ways). In a world of numbers, Paul seeks to ensure he and his team know the people.

To arrange an initial phone call, just go to Peak Financial Investing, fill out the simple form, and someone from Paul’s team will reach out within 48 business hours to arrange the meeting. It’s that simple.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.