Few people alive understand how Capitol Hill and Wall Street work better than former Congressman and financier David Stockman.

And he is deeply concerned that our current political, monetary and fiscal policies are setting the stage for an epic breakdown in the economy as well as the financial markets.

Risk is being grossly mispriced right now. Asset prices are being distorted into ridiculously dangerous territory by investors caught up in a flood of cheap liquidy as well as a widespread speculative mania.IMPORTANT REMINDER!

Before reading further, please take a moment to subscribe to the brand-new Wealthion.com YouTube channel:

Very soon, all of Adam's interviews with top experts on money & the markets will run exclusively on that channel.

Thanks!

Of the blizzard of warning signals that reflect this, here’s a gem – never before have so many money-losing companies been valued so richly:

<img class=“size-medium aligncenter” src=“https://peakprosperity.com/wp-content/uploads/2021/09/loss-making-market-cap.jpg” alt="“Total market cap of loss making companies” width=“500” height=“343” />

This, plus the gargantuan increase in deficit spending (along with its associated trillions in new debt), leads Stockman to warn that none of this is sustainable. And the farther the debt-binge and hot speculation continues before correcting, the more painful and permanent the reckoning will be

Which is why David agrees that now, more than ever, is the time to partner with a financial advisor who understands the nature of the market risks in play as well as the opportunities, can craft an appropriate portfolio strategy for you given your needs, and apply sound risk management protection where appropriate:

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical resilience preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/when-the-market-unravels-there-will-be-no-place-to-hide/

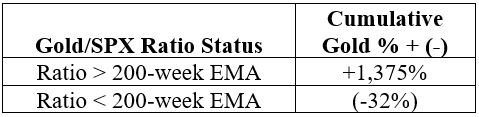

Does this mean that gold cannot and/or will not rally anytime soon? Not at all. It simply means that some improvement in the relationship between the performance of gold and the performance of the S&P 500 Index must occur BEFORE this particular indicator once again favors gold. This reversal of fortune could happen quickly if gold were to pop and/or if stocks were to swoon.

Does this mean that gold cannot and/or will not rally anytime soon? Not at all. It simply means that some improvement in the relationship between the performance of gold and the performance of the S&P 500 Index must occur BEFORE this particular indicator once again favors gold. This reversal of fortune could happen quickly if gold were to pop and/or if stocks were to swoon.