Originally published at: Why Passive Investing Is Dead: Navigating the New Financial Chaos – Peak Prosperity

In this episode of Finance University with Paul Kiker of Kiker Wealth Management, our endorsed financial advisor, we dove into the turbulent waters of today’s financial markets. The world is shifting rapidly, and the old rules of investing no longer apply. The complexity of the global financial system—derivatives, collateral settlement, OTC plumbing—is so vast that no single person can fully grasp it. Even the experts are struggling to keep up, and I’ve stopped relying on technical charts for gold, sensing manipulation beneath the surface. The system is too intricate, with emergent behaviors that defy prediction, demanding we stay humble, observant, and adaptable.

Paul and I discussed the stark contrast between retail and institutional investors. Retail investors are piling into the market, driven by FOMO and the “buy the dip” mantra peddled by mainstream media. They’re pouring billions into risky 3x leveraged ETFs like the NASDAQ, chasing past performance. Meanwhile, institutional investors and insiders are selling, battening down the hatches as they see danger ahead. This speculative frenzy, reminiscent of 2014, feels orchestrated, with retail investors set up as bag holders in a low-liquidity environment. Paul noted that professional investors are lowering risk, seizing opportunities like gold, which retail investors largely ignore despite its stellar performance.

Conversely, and as predicted, the dollar is doing poorly. That’s because the Fed has to make a choice here: save the US Treasury (bond) market or save the dollar. It can’t do both.

The Federal Reserve’s actions are raising red flags. Unlike past crises, where soothing words and rate cuts propped up markets, Fed Chair Jerome Powell is now warning of “challenging tariff impacts” and withholding rate cuts. This is, to say the least, unusual for a Fed that has gotten everybody used to always cooing market-supporting palliatives during every moment of equity market weakness.

Say wut?!? The Fed is openly threatening to delay interest rate cuts? What world is this?

This shift, post-election, suggests a deliberate move to talk markets down, possibly to drive demand for the $9 trillion in Treasury debt that needs refinancing. With Japan and China as net sellers of Treasuries, the U.S. faces a funding crunch. Paul and I suspect the Fed may be playing a deeper game, potentially letting markets falter to shift blame onto new policies or leadership.

We also explored the end of the 54-year fiat currency experiment, launched when Nixon decoupled the dollar from gold in 1971. Decades of unchecked debt expansion have led to a point where deficits do matter, and there are no easy fixes. The Fed’s bailouts have consistently thrown swaths of Americans – poor, middle class, now upper-middle class – under the economic bus. Passive investing, once a reliable strategy, is now a liability. Paul emphasized that its day in the sun has passed, as historical correlations break and algorithms fail to adapt. Investors chasing performance are at risk of catastrophic losses, especially those near retirement who can’t afford a 35% portfolio drop.

Gold, up 1,030% since 2000 compared to the S&P’s 258%, is a standout.

Yet, many financial advisors dismiss it, brainwashed by Wall Street’s fee-driven models. Paul shared how he left corporate finance in 2003 after discovering pay-to-play schemes, prioritizing independent thinking. The dollar’s weakening, down 10% this year, aligns with a surge in gold prices, signaling a potential shift in the global monetary order. A recent $11 billion gold purchase from COMEX and gold’s rapid rise from $3,000 to $3,310 in a week underscore big money’s move to safety.

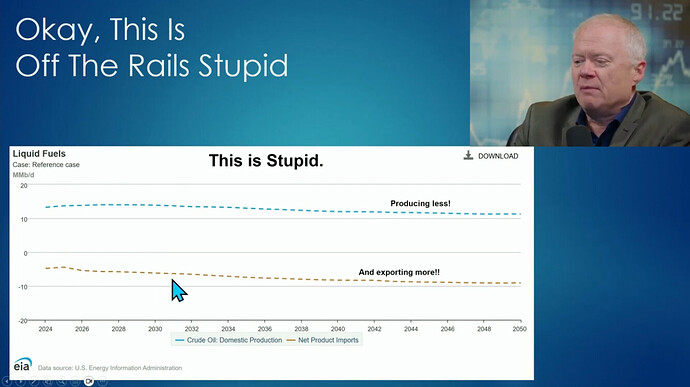

Energy markets are another critical focus. I’ve been warning about peak oil’s return, with U.S. shale production set to peak by 2027, according to the EIA. Their rosy projections of sustained exports are dubious, given declining production and political data fudging. Commodities, stagnant for 24 years, are poised for a breakout, offering protection against inflation that passive S&P 500 investors will miss. Corporate profits, propped up by globalization, face pressure from rising input costs, squeezing companies like Walmart in a trade war or inflationary spike.

The rise of AI, particularly Grok, is a game-changer. Its reasoning capabilities, acing complex tests, are transforming how we process information. I urged listeners to use Grok for its utility and to understand its world-altering potential. It’s already saving Paul hours weekly, distilling research efficiently. However, AI’s logic may challenge entrenched practices, from farming to finance, forcing us to confront uncomfortable truths.

As we face this tumultuous cycle, Paul and I advocate for active, prudent investing. It’s all about risk management, at which Paul and his team excel

At Peak Financial Investing, Paul’s team helps clients navigate these changes, offering tailored plans to assess risk tolerance. Our mission is to protect wealth by avoiding Wall Street’s passive traps. I invited listeners to visit PeakFinancialInvesting.com for a consultation, emphasizing the peace that comes from understanding your financial reality. In a world of rapid change, adaptability is survival.

In other words, passive investing is so yesterday. It won’t work going forward. Now we’re going to have to carefully spread our bets in targeted ways based on our experience and best efforts to predict where the puck is going to reappear on the ice once the dust settles.