Like an old vinyl record with a well-worn groove, the needle skipping merrily back to the same track over and over again, we repeat: Today's markets are dangerously overpriced.

Being market fundamentalists who don’t believe it’s possible to simply print prosperity out of thin air, we’ve been deeply skeptical of the financial markets ever since the central banks began their highly interventionist policies. Since 2009, they have unleashed over $12 Trillion in new money into the world, concentrating wealth into the hands of an elite few, while blowing asset price bubbles everywhere in the process (see our recent report The Mother Of All Financial Bubbles).

Our consistent view is that price bubbles always burst. Which is why we predict the world’s financial markets will implode spectacularly from today's heights -- destroying jobs, dreams, hopes, economies and political careers alike.

When this happens, it will frighten the central bankers enough (or merely embarrass them enough, being the egotists that they are) that they will respond with even more aggressive money printing -- and that will then cause the entire money system to blow up. Ka-Poom! First inwards in a compressed ball of deflation, then exploding outwards in a final hyperinflationary fireball (see our recent report When This All Blows Up...).

It really cannot end any other way. Money is not wealth; it is merely a claim on wealth. Debt is a claim on future money. The only way to have faith in our current monetary policies is if one believes that we can always grow our debts at roughly twice the rate of GDP -- forever. That is, compound the claims at twice the rate of income year after year from here on out.

This would be like having your credit card balance rolled over every month as the balance grows at 10% each year, while your income advances at only 5% per year. Eventually you simply have a math problem: your income becomes swamped by your debt service payment. First you are insolvent, then bankruptcy eventually follows.

At the national level, the US is already insolvent, meaning liabilities exceed assets. The US has been spending far above our means for decades and decades, amassing a tremendous amount of public and private debt (as well as entitlement promises) along the way. And, yes, even nations can go bankrupt.

But bankruptcy is a legal process, and it’s not possible for an entire economy to enter a legal process, so what do we mean when by talking of a looming bankruptcy? Simply put, all those the claims represented by all the debt and excess printed currency have to be destroyed, or reduced, to bring things back into balance.

The Austrian economist Ludwig von Mises said it best: “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Sadly, there’s been absolutely no demonstrated willingness on behalf of our national leadership for “voluntary abandonment of further credit expansion”. In fact, it’s been the exact opposite. With the Federal Reserve leading the way, the ‘plan’ has been the voluntary, increasingly desperate, attempt to expand credit even more aggressively than before.

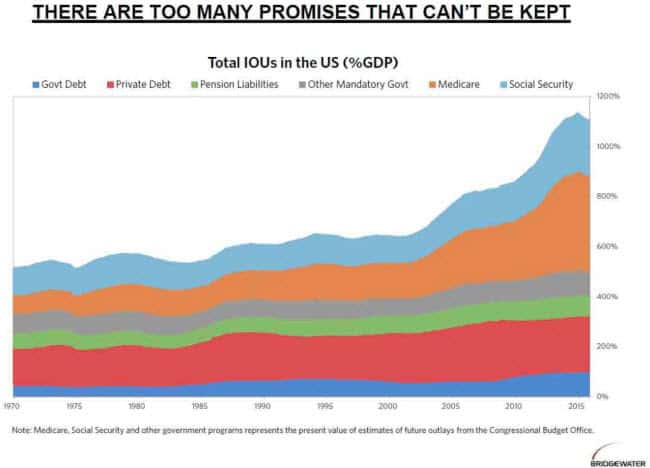

To understand just how dangerous this has become, we need look no further than this chart:

Our current debts and other national liabilities now total more than 1,000%(!) of the nation's annual income, a.k.a GDP.

US economic growth began slowing due to its accelerating ‘too much debt’ problem back around 2000. Instead of allowing natural market forces to clear out the excessive debts, the Federal Reserve chose to go into overdrive to ‘remedy’ the problem. It's remedy? Drive interest rates to 0% to reduce the service burden of those debts, and print trillions of fresh dollars that in turn can fund new borrowing.

Of course, no true ‘solution’ for having too much debt involves piling up even more of it. That's like treating cancer with more cancer. Or alcoholism with more alcohol. But such has been the twisted logic of our central bankers.

The only path that history has shown works involves fiscal austerity and reducing debt. Or, as von Mises put it, "a voluntary abandonment of the credit expansion". But, that requires real political courage and a willingness from society to endure actual ‘pain’ in the form of living below its means to make up for the prior periods of living too lavishly. Don't expect that to happen anytime soon? Nether do we...

Returning to the chart above, it’s sufficient to know that no country, ever, in all of history, has ever dug out from such a mountain of excess claims. Never. Not once.

The only possible way we're avoiding crisis is if the economy suddenly returns to extremely rapid economic growth for an extremely long time. And that’s if AND ONLY IF during such a period of rapid growth, we use that windfall to pay down the debts and other associated IOU’s -- rather than as an excuse to once again look the other way because, hey, everything's awesome now!

At any rate, what we can divine from all of this is that there’s been zero effort towards ‘voluntary abandonment’ of the credit cycle. And there's been every effort made towards extending it farther. We're simply climbing ever higher up an extension ladder from which we will someday fall. We passed the ‘moderately painful’ height a long time ago; now we're up at the ‘quite possibly lethal’ altitude.

But make no mistake, pushing us further up this credit ladder is exactly what 0% interest rates were meant to do. The openly-stated intent of the central banks in treading into the never-before-tried ZIRP and NIRP waters was to spark more borrowing (and spending).

The fact that savers and pension plans have been utterly decimated by these low (even negative rates in some parts of the world) is not even a passing concern to the Federal Reserve. Their only goal has been to get credit expanding again as fast as possible. Ditto for the European Central Bank, The Bank of England, and the Bank of Japan, as well as The People’s Bank of China.

All of them have the same plan: Expand!

But this ‘plan’ does not pencil out. It fails basic math both here in the short term, as evidenced by more than a decade of sub-par GDP growth, but especially later over the long term. Why? Because there’s no such thing as perpetual exponential expansion of anything. Even the universe itself is expected to one day stop expanding and eventually implode in a "big crunch".

Regrettably, though, that’s the ‘plan’ of every major central bank around the world right now.

Because it's mathematically guaranteed to fail, our only job as private individuals is to understand the situation accurately and to then take actions that are in alignment with the reality of living within such a broken system. If we can’t stop the lunatics, at least we can foresee the consequences of their actions and begin to unhitch ourselves as best as possible from their nutty trajectory.

Just how reality-detached are these bankers?

As Adam Taggart recently wrote:

Janet Yellen just poured more gasoline on the anti-bank fire smoldering in my heart...

Speaking today at the 10th Biennial Federal Reserve System Community Development Research Conference in Washington, D.C, she delivered a short speech titled "Strong Foundations: The Economic Futures of Kids and Communities". In it, she focuses on the difficulties of growing up poor and is clearly trying to present herself as an advocate for raising families out of poverty.

Really, Janet? Really???

What about the record-low interest rates you've presided over?

The ones that have destroyed all incentive to save?

The ones that have starved American households of savings income, especially for those on a fixed income?

The ones that have created asset bubbles everywhere, making it nearly impossible for young families to buy a house and sending the cost of rent and other living expenses skyrocketing?

The ones that have made it tremendously cheap for companies to borrow and invest in automation, gutting future demand for unskilled/low-skilled workers?

The ones that have led to the greatest wealth disparity in our country's history?

This is a classic example of the shameless pathological hypocrisy/evil of those running our monetary and financial systems. It's akin to a bloody-handed serial killer lecturing to his dying victims "You know, someone should really do something about the murder rate in this town")

Janet has a strong tradition of “blaming the victim” which she did a few years ago by lecturing poor and working class Americans that their own lack of advancement had nothing to do with Federal Reserve policies that literally hand money to big banks and wealthy insiders. Instead, she saw the root causes as shoddy early childhood education, a lack of entrepreneurship, and not having had wealthy parents who passed down a reasonable inheritance. I kid you not, she really said all that back in 2014.

Maddening? You bet. But only if you're of the mind that Janet Yellen cares about connecting the consequences of her actions to real people and their increasingly poor outcomes. Once you understand that Janet, et al., are psychologically unable to cross the chasm between their personal views of themselves and the consequences of their actions, it’s much less surprising. And much more sad and pathetic.

But also very human. All throughout history, oppressors and genocidal maniacs have always deployed elaborate psychological defenses to protect their fragile egos from the sort of crushing destruction that would result from a clear-eyed view of themselves and their actions. It’s hard to transition from one's self-inflated view of being a virtuous superhero to admitting you're actually the source of untold misery and heartbreak.

At Peak Prosperity, we hold out hope, dim though it may be, that the bankers and their bought-and-paid-for-politicians will be held accountable for the lives they are ruining, as well as the immoral and criminal acts they've committed in the process. Without accountability, nothing ever changes. You only get a repeat of the same bad behavior that got you into trouble in the first place.

That right there, in a nutshell, describes the systemic abuse by the banking elite that began under Greenspan when he bailed out Wall Street in 1998 (during the LTCM debacle). This was followed closely by the repeal of Glass-Steagall under Clinton in 1999. Since then, it has been an orgy of exploitation. And after a brief pause during the Great Recession (during which the banks paid themselves record bonuses while receiving taxpayer bailouts), it got worse than ever.

Conclusion (To Part 1)

All of the efforts to extend today's sky-high asset prices are drawing to a close. And the ending will be ugly. As prices correct, dazed investors will lose $trillions of market value, likely quite swiftly.

But how was it ever supposed to end any differently? The entire premise of what the Federal Reserve has been attempting to do is completely preposterous. They have ignored (or just as alarming, have been ignorant of) the risks of everything from moral hazard, to historical precedent, to the role of incentives on human behavior, to common sense.

And just as happened in 2008, the accumulating instabilities within the system will reach a tipping point where they can no longer be suppressed. The deflation monster will escape from the box the central banks have been desperate to confine him within, and he will very quickly set about making up for lost time. A lot of wealth will get destroyed very quickly.

Strange as it may sound, it's our opinion that the sooner this happens, the better. Crash now while there’s still chance of picking up the pieces afterwards and making something useful from them. The longer we push off the inevitable correction, the more destructive it will be and the more difficult it will be to recover from.

Why risk taking the overdrafts to such extreme levels that the future is ruined for generations? Or ends in the sort of global warfare that can result from economically-wounded nations lashing out instead of holding themselves to proper account?

The boomer generation in charge has a lot to answer for in this story; from their inability to lead boldly, to their selfish pushing-off of the repercussions of their own poor decisions onto future generations

More simply put: We not only need a market crash, but deserve one.

So, with that somber realization in mind, what to do? Well, for individuals like yourself, our strongest advice is to position yourself for crisis before crisis arrives.

In Part 2: Positioning Yourself For The Crash we detail out the steps a prudent individual should seriously consider taking now, while things are still relatively tranquil.

You want to make sure the bulk of your investment capital is positioned for safety, and you want to make your lifestyle as resilient as possible so that, no matter what jarring developments the future may bring, you and the ones you love are least impacted by them.

Click here to read the report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/why-this-market-needs-to-crash/