I have been wondering if Covid-19 hasn’t already been in the community for weeks? I had a respiratory virus 4 weeks ago that fits the description & lasted 3 weeks with a lot of productive coughing. I work in a public school & while I stayed home for 5 days or until I believed I was a symptomatic, this virus spread fast & furious through the school… also our small town nursing home reported 17 deaths in February… just wondering ?

For the first time in recent memory going back to the Global Credit Crisis I suspect we will soon conclude that there is no policy prescription to fix today’s damage. This one is going to be borne entirely by the markets alone this time and lets just admit that a good correction was long overdue as well as some cleansing of risky debt. The Federal Reserve, ECB and Bank of Japan along with their many smaller cohorts among the worlds important Central Banks have one thing and only one thing to stay focused on right now and that is the solvency of the banking sector. No bailouts for equity markets or suggestions of stick saves for the gamblers in the casino should even be contemplated. None of it matters now. This all gets down to the beating heart of the system itself which is the only place where the Central Banks should be looking. Ultimately, banking is their core business and this crazy idea so many investors have about the so-called Fed put is likely going to go the way of fairy tales and fantasy in short order. Like a person near drowning in a frozen lake, the blood must flow to the heart and organs even at the risk of a limb being being lost to the icy waters.

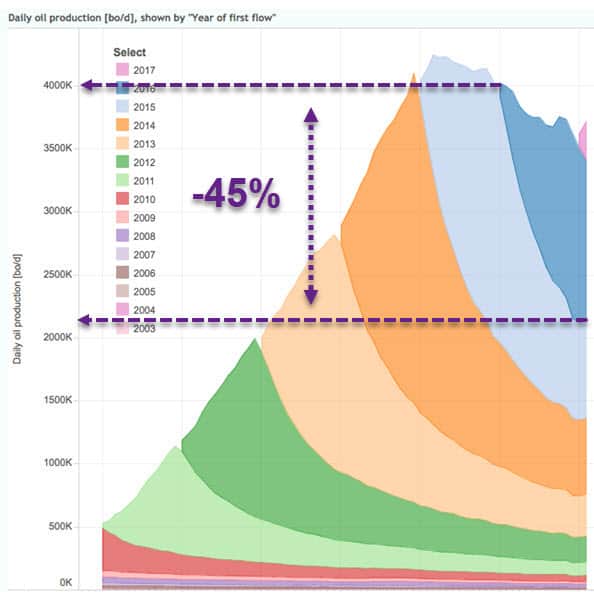

Re:Yep. Putin is a cagey player, and he bides his time. He's been waiting patiently since the US went after Russian interests in Ukraine and he's been playing chess ever since. In judo, you use your opponents own momentum against them. It's all about position and leverage. The US has been printing money like mad and much of that made it into the shale space...but US-style. Meaning a ton of debt. Already a staggering financial weakling, the US shale space was tottering near the top of a concrete stairwell. Putin just gave it a strategic shove in the lower back. Coupled to the obvious impairment of credit markets, the US shale space is about to see a ridiculous amount of bankruptcies and pain. It may never quite recover. Already some measure of discipline had begun to creep in, but after this? Well, the majors in the space had already learned that it is a great resource, but not at $50/bbl. If they have sharp pencils, they probably learned it's really not viable even in the Tier I acreage until $70 and up. So they will wait and bide their own time until oil is safely over that level. Maybe in a year or so? What happens between now and then? Oil production falls off sharply: With a ~45% decline yr/yr if drilling stops, I'm looking for ~20% decline in US shale production over the next year, as I am guessing that about half of all drilling and completion work simply stops. Just a guess. That would mean about a -1.5 mbd decline in US output. So Putin could either have agreed to cut -0.5 mbd of Russia's production, or give the US shale industry a strategic shove and cause 3x that decline (or more, possibly) without costing his country anything. So a shove it was. If you don't think somewhere in your reptilian brain that KSA was in on that thinking, and that the "knocked over Russian flag" at the "failed" OPEC meeting was pure theater, then you need to spend more time in the oil markets. Nothing personal. Just bare-knuckled business.Russia is behind crashing the oil market and it is NOT an accident

I can also appreciate that there are writers quick to blame the Russian OPEC negotiators for tilting us into this current energy price collapse as they were indeed the actors who broke the charts this week. We were going there anyway. That much could be forecast since lower prices were assured over time. It was really a matter of when it would happen though. So we won’t kid ourselves about the strategic purpose behind crashing oil. The Russians can read oil charts too and they KNEW where that breakdown trigger was going to come into play which suggests me that their lack of cooperation at OPECs meeting was a deliberate act to break America’s oil market. Fighting words? You better believe it.

I get your point - and part of me thinks there is a possibility that that is exactly what is going on.

And that it is quite possible that TPTB don’t actually require the disease to be all that bad - they may just require us all to react as if it is.

In which case we are playing nicely into their hands…

Rebel

Hi Nairobi,

I read your post with interest (oil price crashing - Russia behind - deliberate etc) and am curious what you would do, if you were in a similar position (just out of interest).

Each time (within the last few years) OPEC and OPEC+ have cut production to stop prices falling (or to bring prices back up), the cut in production has simply encouraged US shale operators to increase production, thus nullifying the efficacy of the cut to some extent. Each time, the reason given is that the shale players need to keep pumping as hard as they can to generate cash flow to survive…

What self-discipline is the world’s largest producer of oil (US) applying to its own total production? As far as I can see in the news, it always appears that the US is “celebrating its No 1 position…the biggest and the best…making America independent and great again…etc”.

Only when oil price is low, does it seem that US producers reduce rig count /production.

Surely, if there is to be a production discipline then the discipline should apply to all players and not just OPEC or OPEC+ members to constantly manage production to the marginal barrel…? If not, then OPEC members would be better described as the worlds patsy’s…no?

Or am I missing something really obvious and looking like a fool with this post? If I’m a fool - please be kind ![]()

![]() Thanks for cluing me up.

Thanks for cluing me up.

You are correct Chris (except for the part about my “reptilian brain”…lol), there is going to be serious damage to the domestic industry. Some of it will shut down immediately. Others cannot due to excessive debt and will try to ride it out until bankruptcy. A very few will buy up cheap interests, consolidate and expand for the day when prices return to normal. I am convinced we will see 10 dollar a barrel oil since that is the charts ultimate destination. And that means a great deal of pain is still to come. Not just for the drillers, explorers and services but for tens of thousands of employees who are about to be cut loose. The economy is going to take a bloody hit with all the bankruptcies and defaults. What Putin has not counted on though is that a war will send prices right back up. What he has done is put the administration in a very difficult position with his high stakes gambit whereby they can take this sitting down or they can launch against one of Russia’s allies to reduce supply. Venezuela does come to mind and I don’t think we need to think too hard about this. So does Iran. So watch for signs of war because something tells me we are not going to go broke silently. This is all really bad news. Putin has gone too far this time.

.

Note to Gedard: I would NOT have crashed oil. Since you asked me. That was a really foolish, risky mistake that was made.

Oh i know Nairobi i know, i read Michael Burry’s comments on it as well a few months ago:

https://www.cnbc.com/2019/09/04/the-big-shorts-michael-burry-says-he-has-found-the-next-market-bubble.html

I mean i’ve got tons of reasons why i’ve converted my life savings into gold and silver. Just to point out, i’m not a trader of any sorts. I could be, i’m smart/insightful enough for it, but i had… other worries until bout september last year.

So the silver/gold i bought represents pretty much 80% of my entire net worth. It’d be as if Jeff Bezos suddenly bought 100 billion of gold/silver (and kept a lil cash). I mean i virtually extracted myself from the banking system entirely (and in the process, costing my bank bout 10,000 worth of Tier 1 capital so with their leverage they need to recall in a ~70k loan to make up that difference).

I’m no trader. I’m a Saver. I know, rare to still see one in the wild, but we still exist ![]() But i did that pure survival reasons. This time not to make money, but to keep what little i have when so many will lose everything.

But i did that pure survival reasons. This time not to make money, but to keep what little i have when so many will lose everything.

In any case. Bubbles that will be imploding from today onwards (to my knowledge):

- The corperate "high yield" bubble: BBB rated debt will be downgraded 1 notch, gets booted out of Investment Grade, and loses access to funding markets. Many of these companies are zombie companies who will now lose access to their cheap funding. This is a $3+ trillion size market

- Student debt bubble: https://www.reddit.com/r/studentloandefaulters/comments/en68sf/the_death_of_for_profit_schools_and_bailing_out/ i wrote that back in december trying to find the next bubble starting point. I mean it's still valid, it's just now not where the whole thing started just one of the things that fell down with everything else. $1,6 trillion dollar problem.

- Tech bubble 2.0: The incredible overvaluation of supposed "disruptor stocks" like amazon, netflix, tesla, but as well as mature companies such as apple and microsoft that simply have been vastly overvalued. Not only is this bubble deflating, it's happening on top of Covid and the production shutdowns that arise from it. They won't go to 0, in fact i'm bullish on anything digital with so many people locked behind a screen while they're sick in a bed trying to take their mind off things. But alot of this *will* be reassessed and slimmed down. No size prediction here... this is one we'll tally after everything is said and done.

- Housing bubble: Yep it's our old friend Sub Prime that was happily reinflated. Maybe not to the same ludicrous valuations as last time. But just look at the price increases in many areas since the bottom in what, 2009? All artificial from "investors". Well now that it's public knowledge that nobody's going to buy anything at those prices (cause they can't when sick and unemployed), there will be write downs. Lord only knows how far this can go.

- Car loan bubble: Even before all of this length of loans was already getting ridiculous with reports of up to 84+ months payments or something? In any case it's clear that the car market never got the reset it really needed so, that'll happen now.

- Bond market bubble: Oh yes, the Europian Sovereign Debt Crisis is BACK baby! with a vengance this time because we fixed *nothing* after last time. Sure, bonds will go down now and this won't pop tonight - there's plenty of other carnage to be had. But, consider this: https://tradingeconomics.com/greece/government-debt-to-gdp Does that look fixed to you?

Everybody is focussed on the US treasuries but Greece has been pretty much imploding for a couple of weeks now! I guess nobody noticed because the rates are so historically low it doesn't register (as the 2nd graph shows) but something is 100% up. Just look at that daily chart!

Everybody is focussed on the US treasuries but Greece has been pretty much imploding for a couple of weeks now! I guess nobody noticed because the rates are so historically low it doesn't register (as the 2nd graph shows) but something is 100% up. Just look at that daily chart!

INSTANT 1600 dow drop! VIX at nearly 60, up 40%! Holy cow.

Edit: wow even had a timeout on investing.com. It went down for a few seconds. SSL secure connection error and everything.

Just gonna add to here to not spam with too many posts ![]() Russia says it can weather $25 oil prices for years:

Russia says it can weather $25 oil prices for years:

https://www.zerohedge.com/energy/russia-says-it-can-weather-25-oil-10-years

And they’re telling the truth. That sovereign wealth fund is no joke and just hit it’s target of 7% of GDP a few months ago. It was likely Putin would weaponize it but to do it so soon. Masterstroke. Shale is not prepared for this at all.

Meanwhile obvious bloodbath is obvious:

https://www.zerohedge.com/energy/here-are-energy-bonds-getting-crushed-morning

@Desogames

@RebelYell i agree that it’s problematic and makes no sense. That’s also exactly why it’s problematic, because that’s the way stuff is bid. It’s what happens when the yield curve inverts, and it is why people say the yield curve inverting is such a good indicator of recessions: Every time it inverts, people are expecting more trouble in the short term then long term.

Agree yield curve inversion implies anticipation of a problem. But you were implying more than yield curve inversion - you were implying broken treasury market / anticipation of default / eventual hyperinflation. Those are not the same things.

And anticipation of default and/or hyperinflation are not consistent with a bid for 30 year bonds.

That said I agree with a lot else of what you have written.

Anybody else notice outright hostility from people still calling this “just the flu”?

I was just called a “sheep” which is funny because I’ve been following this since back when the media refused to report it.

The BBC has this advice on prevention. Not bad.

No prep of course and the thing I think is missing is you do this to help protect the 20% who are at risk of complications.

https://www.bbc.com/news/health-51048366?fbclid=IwAR16BUmS7wJfWAwsrjmygoSeXq_jrysbYtucm6GcDJu9NEOKV3SCtzLsbEo

Alright i’ll yield on that one (pun intended :D). Still though. I expect things that have never happened before to happen.

For today though it matters little. So many strange things now. Oil dropping 33% then rallying up again to only 16% down… which now seems to have run out of steam so it’ll crater? maybe? Seems to be stuck at $34 a barrel now. But i’m seeing so many “glitches” in the tracking of the numbers where the price just swings violently within seconds. (whoop seems it’s over the hump and going down again).

I’ll still stick with my opinion of Saudi Arabia switching sides. It’s one thing to not get a cut from OPEC, but to immediately deeply discount oil AND announce a production increase? That’d be absolute budgetary suicide unless it was prepared for in advance. It’s an crazy strategy. Especially because they’re trying to bankrupt US shale. Not any other country - the US.

Every relationship counts both ways. The US is now an net exporter of oil. So it doesn’t need SA - and SA doesn’t have the US as a customer anymore.

Well. In any case i’ll be looking at the market charts all day. There has never been a better time to collect data on what actually happens during a crash ![]()

EDIT: I’ll take bailout for 500 alex.

https://www.zerohedge.com/economics/white-house-hold-meeting-discuss-economic-stimulus

Asher,

3 scenarios would be more representative than just taking 20% scenario. Since 1.125^6 = 2.03 , this scenario is representative of doubling the case #s in 6 days (widely accepted as spread of infections WW). If we assume that, then in US with 22 death cases, the # of predicted infections would be 22 x 1434 =~ 31,500. Quite realistic as of today. (I don’t understand how WHO came up with 3.4% mortality rate).

-Peter -

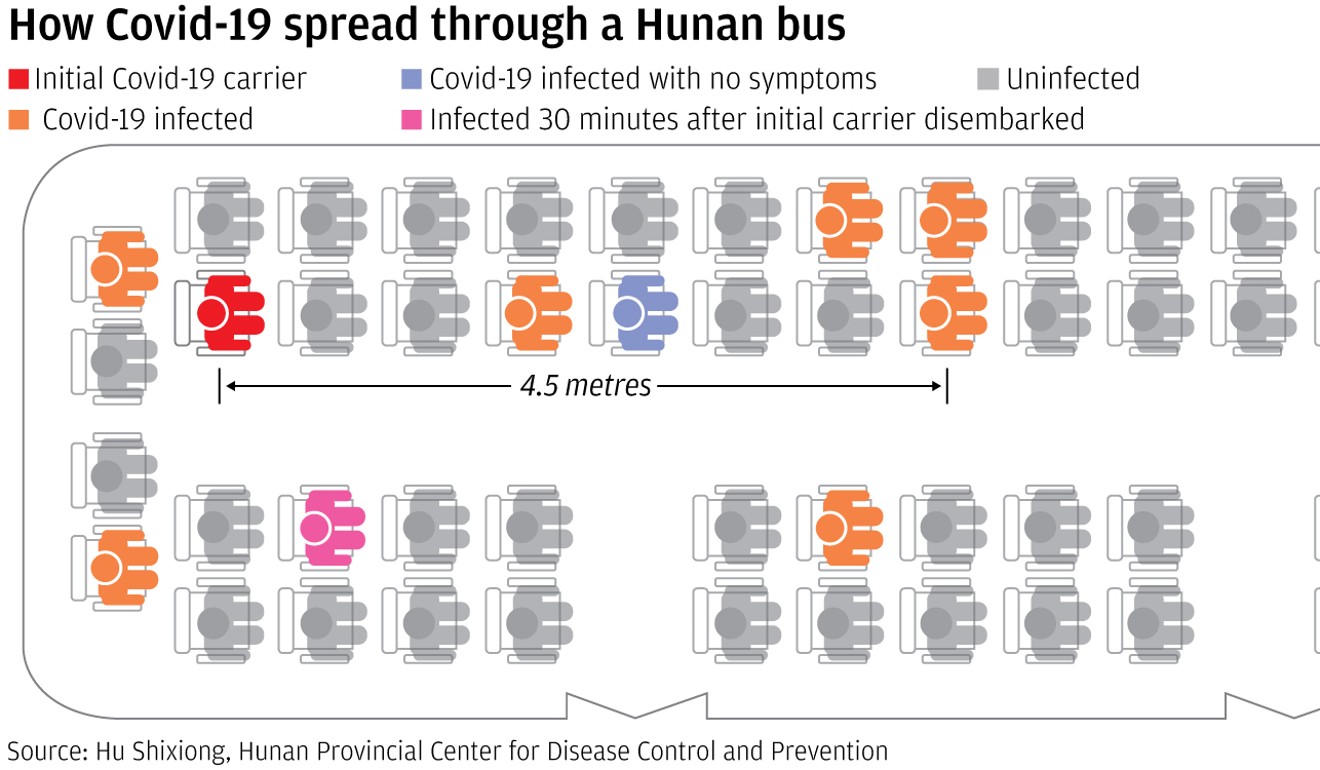

Coronavirus can travel twice as far as official ‘safe distance’ and stay in air for 30 minutes, Chinese study finds

- Health authorities advise people to stay one to two metres apart from other people, but researchers found that a bus passenger infected fellow travellers who were sitting 4.5 metres away

- The scientists behind the research said their investigation also highlighted the importance of wearing face masks because of the length of time it can linger

Published: 10:44pm, 9 Mar, 2020

The coronavirus that causes Covid-19 can linger in the air for at least 30 minutes and travel up to 4.5 metres – further than the “safe distance” advised by health authorities around the world, according to a study by a team of Chinese government epidemiologists.

The researchers also found that it can last for days on surfaces where respiratory droplets land, raising the risk of transmission if an unsuspecting person touches it and then rubs their face and hands.

The length of time it lasts on the surface depends on factors such as temperature and the type of surface, for example at around 37C (98F), it can survive for two to three days on glass, fabric, metal, plastic or paper.

These findings, from group of official researchers from Hunan province investigating a cluster case, challenge the advice from health authorities around the world that people should remain apart at a “safe distance” of one to two metres (three to six and a half feet).

“It can be confirmed that in a closed environment with air-conditioning, the transmission distance of the new coronavirus will exceed the commonly recognised safe distance,” the researchers wrote in a paper published in peer-review journal Practical Preventive Medicine last Friday.

Sunguy, here’s a better article breaking down the factors that contribute to your risk of illness or death from this virus

https://www.statnews.com/2020/03/03/who-is-getting-sick-and-how-sick-a-breakdown-of-coronavirus-risk-by-demographic-factors/

John Campbell says Vitamin D deficiency may worsen the respiratory effects.

https://www.youtube.com/watch?v=W5yVGmfivAk

Well, we’re up to 114 cases in California as of last night and one confirmed case in my county. Wish I could say it trips my personal red line, but I’m an RN and our clinic is the only source of health care in our community. As the nurse manager and the infection control nurse, I’ve had the advantage of information gleaned here and on other sites to avoid drinking the government Kool-Aid, and have been trying to prepare my colleagues and staff. We ordered extra supplies and meds early, I’ve taken a hard line about staff wearing masks if they’ve been traveling internationally or coming back from places with confirmed community spread. Some days I’ve felt like Cassandra making prophecies that nobody believes. I’d really rather have been wrong…

I saw data a day or two ago – from 24hourradar – that February 2020 flights worldwide were only off 4% or so from February 2019. Remarkable. I’m on the flight path in Spokane and if anything there seem to be more flights the last day or two. We seem hell bent on making sure this virus spreads as quickly as possible.